Utah Bad Credit Mortgage Loan

Poor credit can limit home buying options, but it does not disqualify you from home ownership.

Having poor credit can make the idea of homeownership seem like a dream you’ll never realize, but it is not an automatic disqualifier. Here’s some need-to-know information from the mortgage experts at City Creek Mortgage about buying a home in Utah when you have poor credit.

Credit Scores and Their Impact on Your Mortgage Approval

The first thing to understand is what a credit score is and how your score might affect your ability to be approved for a mortgage.

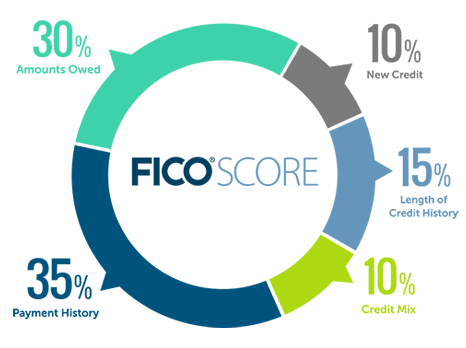

Your credit score is a number that reflects the risk lenders might face when loaning money to you. It is a three-digit number that ranges from 300 to 850. Credit scores are based on multiple factors, including:

- Your payment history – 35% (FICO)

- Total amounts owed – 30% (FICO)

- How long you have had credit accounts with different lenders – 15% (FICO)

- Mix of credit (having different types of credit) – 10% (FICO)

- New credit – 10% (FICO)

Many different factors in your credit history are taken into account and grouped into these categories. However, lenders also look at other things beyond your credit score, including how long you have been at your job and your income when deciding whether to approve your mortgage application.

Types of Credit Scores

One thing that can be a little confusing is that you have more than one credit score. There are three major credit reporting agencies (CRAs), including TransUnion, Equifax, and Experian.

Each of these agencies has a separate credit scoring model it uses, so you might have slightly different scores reported by each one. Differences also exist because lenders might vary in how they report information about you to the agencies. For example, one of your creditors might only report information about your payment history to Experian but not to the other two nationwide CRAs. Others might report information to all three, and still others might not report any information about you at all.

The Fair Isaacs Corporation (FICO) calculates the most commonly used credit scores. FICO scores are what many people think of when they think about their credit score. However, FICO also publishes a few different types of scores based on its proprietary models, including FICO 8, & FICO 2.

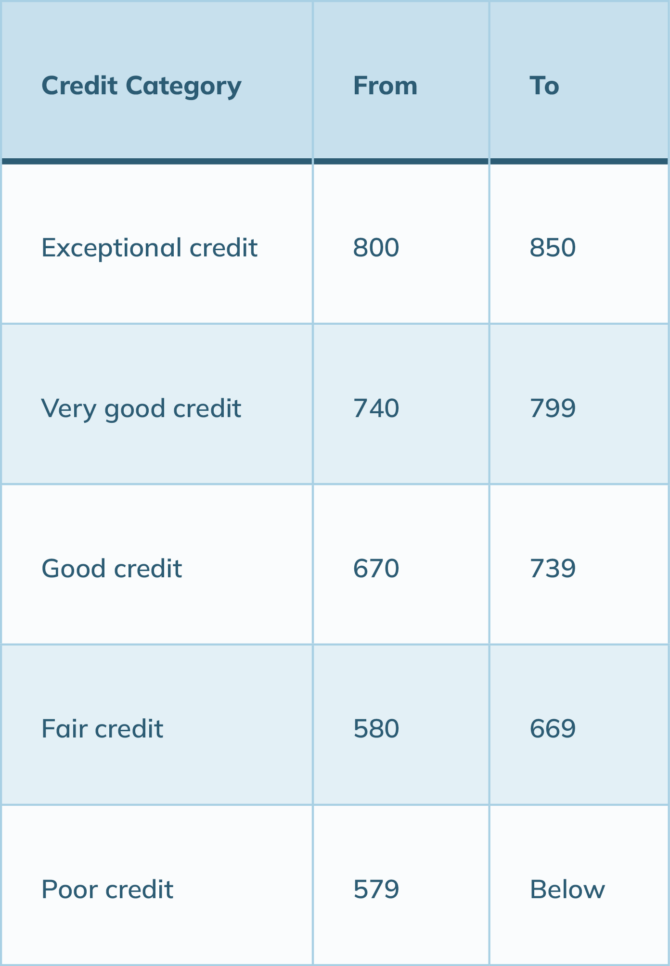

The FICO credit score ranges include the following:

FICO scores have been around since 1989, and MyFICO reports that 90% of lenders rely on FICO scores.

The second major credit scoring model used by lenders is the VantageScore. This score was created collaboratively by the three major CRAs in 2006 as an alternative to FICO. While many of the previously listed factors are also used to calculate your VantageScore, the factors might be weighted differently under the VantageScore model.

For example, under the VantageScore model, the percentage of available credit you are using is given more weight than your payment history. This means that if you are using more than 30% of your available credit card balances, that could hurt your score.

Theinclude the following:

While Equifax has created its own scoring model with scores ranging from 280 to 850, Experian and TransUnion’s scores are based on the VantageScore model.

Which Credit Score Do Mortgage Lenders Use?

With the large number of different types of credit scores, you might be confused about which one potential lenders might use.

Most mortgage lenders check FICO scores when evaluating creditworthiness. FICO has created different models for different credit purposes. For example, mortgage lenders have different needs than auto lenders.

FICO has also tailored models for each of the three nationwide CRAs as follows:

- Experian – FICO 2

- Equifax – FICO 5

- TransUnion – FICO 4

When you apply for a mortgage, the lender will check your credit with each of the three major CRAs and your FICO score and will receive the information in a single report. If the credit scores from the three CRAs are different, the lender might go with the middle one or the lowest one.

Having a higher score provides you with access to lower rates of interest. If your credit is poor, your application could be denied. However, you might be able to get a mortgage with poor credit at a higher interest rate.

Before you get to the point of applying for a mortgage, you first need to figure out what your score is to get an idea of your credit standing.

Is My Credit Actually “Bad”?

Your first step is to check your credit by getting copies of your credit reports from each of the three nationwide CRAs. You can get a free copy once per year from each CRA at annualcreditreport.com.

You can also get your FICO scores at myFICO.com. However, you will have to pay a small fee to obtain your FICO scores directly from MyFICO. Other places you can ask for your score include your bank or credit union or online sources such as Credit Karma.

If you obtain your credit score from a source other than the three major CRAs or myFICO, take a look at the fine print to determine which scoring model they use.

Statistics to Know

Based on data using the VantageScore Model, Equifax reports that the average credit score in Utah is 708. The average VantageScore in the U.S. was 698.

The states with the three highest scores include:

- Minnesota (724)

- Vermont (721)

- Massachusetts (720)

The three states with the lowest average VantageScores include:

- Mississippi (662)

- Louisiana (669)

- Alabama (671)

Overall, 15.5% (39.28 million) of Americans have credit rated as poor or very poor. Another 54.99 million (21.7%) have fair credit, and 159.15 million (62.8%) have good credit.

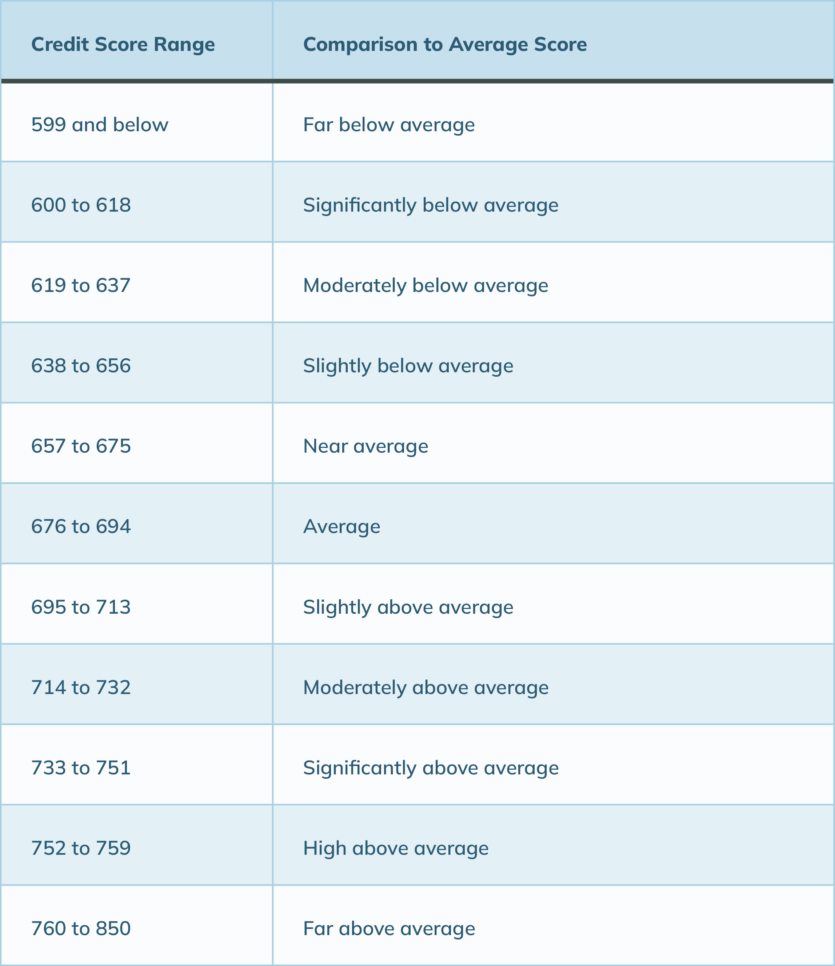

Once you have your score, you can compare it with the average VantageScore in Utah of 708 and the information in the following table to determine how prospective mortgage lenders might evaluate your credit risk:

After getting your score and comparing it to the various credit ranges, average VantageScores, and the information in the table above, you should be able to determine whether your credit score is bad.

If your credit is below average, you might still be able to qualify for a mortgage. Check the rates you might receive based on your credit score using the calculator below:

See What You Can Qualify For: Use Our Mortgage Calculator That Factors Your Credit Score

Now that you have an idea about where your credit stands, here’s a look at six common myths about bad credit mortgages.

6 Downright Myths About Bad Credit Mortgages

1. “Bad credit means no mortgage.”

Many people believe that if you have bad credit, you won’t be able to get a mortgage. In reality, while having bad credit can make it more challenging to secure a mortgage, it doesn’t make it impossible. Many lenders and programs cater specifically to individuals with less-than-perfect credit.

2. “You’ll always pay an exorbitant interest rate.”

If you have bad credit, you might receive higher interest rates than someone with stellar credit. However, shopping around and leveraging federal programs can help secure more favorable rates.

3. “A high down payment can’t help if you have bad credit.”

A larger down payment can significantly increase your chances of mortgage approval even if you have bad credit. A sizable down payment reduces the lender’s risk and shows financial responsibility.

4. “FHA loans are the only option for bad credit borrowers.”

While FHA loans are a popular choice for those with lower credit scores, they aren’t the only option. There are other government-backed and private lender programs available.

5. “Bad credit mortgages are filled with hidden fees.”

While there may be additional fees associated with certain bad credit mortgage programs, working with a transparent and reputable lender can ensure you’re fully aware of all costs upfront.

6. “Improving your credit score a little bit doesn’t help.”

Even small improvements in your credit score can make a difference in your mortgage terms. Moving up even one credit tier can potentially save thousands of dollars over the life of a loan.

When You Have Bad Credit, A Cosigner Can Sometimes Make All the Difference

If your credit is much lower than average, getting someone to cosign with you could make the difference in whether you could be approved for a mortgage.

A cosigner is someone with good credit who signs the mortgage application with you. Since their credit will also be taken into account, this can boost your chances and could help you obtain a lower rate of interest.

The reason why a cosigner could help is the lender could collect from your cosigner if you default on your mortgage. As a result, having a cosigner with excellent credit lowers the lender’s risk.

My Credit Score is in the 500s, What are my options?

If your credit score is in the 500s, it will be much more difficult to get approved for a mortgage. However, there are a couple of different ways you might still be able to get approved, including:

- Have someone cosign with you.

- Apply for an FHA loan (minimum credit score is 580, but you’ll need to find a lender who will approve you).

- Apply for a VA loan if you’re eligible (no set minimum for VA loans, but most lenders will require a score of 580 or 620).

- Take steps to improve your score and apply in a few months.

- Save up a larger down payment.

My Credit Score is in the 600s, What are my options?

If your credit score is in the 600s, you’ll have more options than if it is in the 500s. Government-backed mortgages can be a good source for people with credit scores in the 600s. If your score is in the upper half of the 600s, your choices will be less limited than if your score is in the lower half.

5 Ways to Raise Your Credit Score

Here are five ways to raise your credit score before you apply for a mortgage:

- 1. Challenge all inaccurate information on your credit reports with each of the nationwide CRAs.

- 2. Work with a credit repair company (we have one we recommend, contact us)

- 3. Pay down your credit card balances to a 30% or under credit utilization percentage.

- 4. Avoid applying for too many new credit sources when you’re preparing to get a mortgage.

- 5. Don’t close old accounts when they’re paid off because the length of your credit history positively affects your score.

Your credit score should be thought of as a marathon and not a sprint. It takes time to increase your credit score, but you can do so by establishing a good payment history with each of your creditors going forward. Make arrangements with any collection account holders to pay them off in exchange for having the derogatory information removed, and monitor your credit regularly so that you can promptly address any inaccuracies.

Aren’t There Utah Programs For Low-Income or First-Time Home Buyers?

If you have less than perfect credit and have a lower income, there are a few different programs to consider in Utah. These programs are geared to assist first-time homebuyers and those with lower incomes.

1. Utah Housing Corporation First-Time Homebuyer Assistance Program

The First-Time Homebuyer Assistance Program was created by Utah S.B. 240 to help people become homeowners by providing assistance to them. This program is brand new and began accepting applications on July 25, 2023.

The program provides up to $20,000 in funds that can be used towards the purchase of a newly constructed, uninhabited home with a maximum purchase price of $450,000.

To qualify for assistance, you must first be approved for a Utah Housing Mortgage. Check with City Creek Mortgage about this new program by calling us at 801-501-7950 or using our website’s online chat function.

2. Utah Housing Corporation Home Loan

The Utah Housing Corporation offers a variety of resources for people wanting to purchase homes in Utah, including home loans.

In general, you’ll need to have a credit score of 620 or above and meet other qualifying factors. A mortgage expert at City Creek Mortgage can provide you with more information. You can call 801-501-7950 or use our website’s chat function to learn more.

3. Down Payment Assistance Grant

You might be eligible for a down payment assistance grant of up to $4,000. A mortgage expert at City Creek Mortgage can apply on your behalf.

These grants do not have to be repaid and are offered through United Wholesale Mortgage. If you would like to learn more about this program, contact City Creek Mortgage by using the website chat function or by calling 801-501-7950.

How Do I Apply for a Utah Mortgage With Bad Credit?

If you have bad credit but would like to buy a home, you should start by calling City Creek Mortgage at 801-501-7950. You can also use the chat function on our site. We can explain the various programs you might be eligible for and help you understand your best options and next steps.

Which Lender Should I Work With To Get Approved?

City Creek Mortgage is a mortgage broker, which means we work with thousands of lenders. We search through a database of all the available loans for you and simply present you with the best options. Call us to get started at 801-501-7950.

Utah First Time Home Buyer Grants & Programs

Utah First Time Home Buyer Grants & Programs