Easiest rate quote out there!

You're just 30 seconds away.

- No personal information required

- No upfront deposit for appraisal or credit report required

- Expect to save money

Purchasing mortgage points is essentially prepaying interest to the lender, which allows you to secure a lower interest rate for the life of the loan.

Not sure if you should pay points? Don’t worry. You don’t have to decide until a few days before closing.

This is the interest rate applied to your home loan, and directly affects your monthly payment. Locking in a competitive rate can help you save on interest, and make homeownership more affordable.

The total cost of your mortgage, including interest, lender fees, and other charges. Since lenders can pick and choose what is included in this calculation, it’s not the best way to compare.

- Lower your blended interest rate

- Simplify your monthly payments

- Compare side-by-side-options

Purchasing a home?

Ask if you qualify for an even lower rate with our Purchase Special.

- No commitment

- No deposit for appraisal or credit report required

- Need a fast close? Ask for an express pass

City Creek Mortgage:

The Preferred Utah Mortgage Broker

We became a licensed mortgage brokerage in Draper, Utah, in 1998. We had one goal: make home loans in Utah more affordable and transparent for home buyers. We never hide our mortgage and refinance rates, and we try our best to have an online rate and fee quote experience as close as possible to the ones you receive at closing. We are constantly improving our mortgage experience and providing a higher value at a lower price.

The sole interest of our team is to help save our clients money when they buy or refinance a home. We do this by learning about each client’s specific goals and needs, then offer advice based on our experience and finance principles. We are the #3 mortgage broker in the US, and #1 Mortgage Broker in Utah according to Scotman’s Guide. We want to be the most trusted, respected, and loved mortgage company in Utah.

| City Creek Mortgage | Internet Mtg Co. | Typical Mtg Co. | |

| Access to instant rate & fee quotes with no personal info |

|

|

|

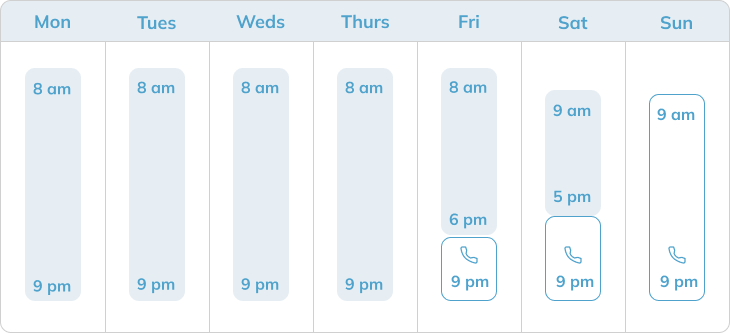

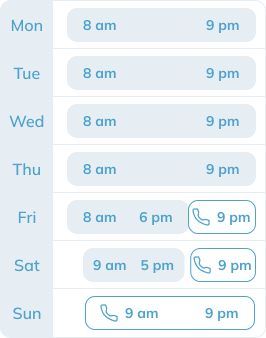

| Extended hours on weekdays & weekends |

|

|

|

| Local Market Expertise |

|

|

|

| Access to generate fee sheet, online, 24/7 |

|

||

| No upfront appraisal or credit report fees |

|

||

| Salary-based loan officers |

|

||

| Custom rate & closing cost analysis that saves you the most money |

|

||

| ⭐️⭐️⭐️⭐️⭐️ Google rating with thousands of reviews |

|

||

| Close Happy Guarantee (when refinancing) |

|

Have a quote from another lender? Let's see how much Mortgage Mike can save you.

Both mortgage brokers and credit unions can be good options for refinancing or purchasing a home.

Credit unions are nonprofit organizations that are owned and controlled by their members. If you have an account at a local credit union, you're likely a member. Although credit unions offer the best auto loan rates, they often have mortgage rates that are not as competitive. In some cases, they may provide personalized service and flexible underwriting criteria. Additionally, credit unions offer additional financial products and services that can be beneficial to their members.

Mortgage brokers, on the other hand, specialize in mortgage loans. They often do not offer other financial products. Brokers find lenders with great rates and help borrowers choose the option that meets their needs best. At City Creek Mortgage, we have access to a wider range of mortgage products with low rates, from different lenders and can help you find the best mortgage to meet your needs. For most borrowers, their best loan will be a 30 year fixed mortgage. Additionally, we can help you navigate the mortgage process from submitting your application all the way through funding.

In general, if you're looking for a wide range of mortgage options and personalized advice in Utah, a mortgage broker may be a better option for you.

- Conventional mortgage: A conventional mortgage is the most common mortgage type there is. It’s a loan that is not insured or guaranteed by the government. Conventional loans (sometimes called conforming loans) are an ideal loan for borrowers with good credit and a stable income. Conventional mortgages usually require a higher down payment and have strict underwriting criteria. Conforming mortgage limits do apply.

- Federal Housing Administration (FHA) loan: An FHA loan is a government-backed loan that is designed to help lower-income and first-time homebuyers purchase a home. FHA loans have more lenient credit and income requirements, and they require a lower down payment. In 2023, Utah's FHA loan limits range from $472,030 to $1,089,300 for a single-family home.

- Veterans Affairs (VA) loan: A VA loan is a government-backed loan that is available to eligible active-duty military personnel and veterans. VA loans have more lenient credit and income requirements and require no down payment. There are limits on VA loans in Utah, and they vary by county.

- Non-Conforming or Jumbo Loan: These loans are designed for high-income borrowers looking to purchase a high-value property with a loan amount higher than conforming loan limits. You can get a Jumbo adjustable-rate mortgage (ARM) or a Jumbo fixed-rate mortgage. They are not insured or guaranteed by the government. They are the main mortgage option for high loan amounts. Jumbo loans usually require 10% down.

- Adjustable-rate mortgage (ARM): An adjustable-rate mortgage is a type of mortgage where the interest rate changes over a predetermined schedule. ARMs usually start with a lower initial interest rate, and the rate adjusts over time, usually making the monthly mortgage payment more expensive.

- Fixed-rate mortgage: A fixed-rate mortgage is a type of mortgage where the interest rate remains the same over the entire term of the loan. This can make budgeting for your monthly mortgage payment easier, as the payment remains the same over time.

A mortgage broker and a bank are both options for obtaining a mortgage loan, and each has its own advantages and disadvantages.

Using a mortgage broker like City Creek Mortgage can be beneficial because brokers have access to a wide range of mortgage products from different lenders. This means that we can help you find the best mortgage for your needs and circumstances, saving you time by shopping around and comparing offers from multiple lenders for you.

Additionally, we can help you navigate the mortgage process, offering guidance and advice. We can also help you understand the different types of mortgages available, explain the terms and conditions of each one, and help you choose the best option.

On the other hand, some people prefer to use their own bank as a lender because they already have a relationship with the bank and trust the institution. Banks may also offer special deals or discounts to their existing customers, and you may be able to take advantage of these if you have an account with the bank. The tradeoff is, because banks have to spread risk across their lending products (including auto, and other loans), bank mortgage rates are typically higher than rates that mortgage brokers have access to.

Ultimately, the choice between using a mortgage broker or your bank as a lender depends on your individual needs and circumstances. You should consider factors such as your credit score, financial situation, and the type of mortgage you need before making a decision.

Yes, we are licensed in nine states and growing with lenders that cover them all! Outside of Utah, we are currently licensed to do loans in Colorado, California, Florida, Illinois, Michigan, Idaho, Kansas, and Oregon. If you're not in any of those states, we can put you in touch with a trusted City Creek partner that is licensed in the state you’re looking at.

Your credit score is one of the key factors that lenders consider when determining the interest rate they are willing to offer you on a mortgage. In general, the higher your credit score, the lower your mortgage rate will be. This is because borrowers with high credit scores are considered less risky to lenders. As a result, lenders are willing to offer them lower interest rates to purchase their home.

A credit score of 740 or higher is considered excellent and can qualify you for the best mortgage rates. A score between 700 and 739 is considered good and may result in a slightly higher interest rate. A score between 580 and 699 may result in an even higher interest rate. Scores below 580 are considered poor and can result in difficulty getting approved for a mortgage or, if you are approved, a significantly higher interest rate.

Keep in mind that your credit score is just one factor that lenders consider when determining your mortgage rate. Other factors, such as your income, employment history, and debt-to-income ratio, are also important. Additionally, mortgage rates can change frequently, so it's a good idea to shop around and compare offers from different lenders to find the best deal.

- No Cost Loans: This is a mortgage strategy where you take a higher interest rate in exchange for a credit that covers some of the loan costs.

- Portfolio loans: Portfolio loans are mortgage loans that are held and serviced by the lender instead of being sold on the secondary market. These loans may offer more flexible underwriting criteria and loan terms for borrowers with unique financial circumstances. These can be a great alternative if you're seeking alternative financing.

- Investment property loans: Investment property loans are designed for borrowers looking to purchase a property for investment purposes. These loans may have higher interest rates and fees, and they may have different underwriting criteria than other types of mortgage loans.

We'll work around your schedule.