It’s election day, and voters are coming out strong to support their candidates. The key issue driving many Americans’ vote is, of course, inflation. Although polling numbers can change as the day progresses, www.FiveThirtyEight.com is predicting an 84% of the…

`

`

`

The markets are constantly moving! Get Mortgage Mike's daily market updates

Additional Articles

Midterm Mayhem

Midterm elections are giving bond investors something to look forward to. According to...

Read More

Job Report Confusion

The labor market showed mixed results after the Bureau of Labor Statistics (BLS)...

Read More

I Volunteer *HOUSING* as Tribute

The Federal Reserve’s rate hike and policy announcement yesterday shows that the housing...

Read More

The Fed Keeps Hammering

Today’s announcement from the Federal Reserve confirmed the 3/4% rate hike that the...

Read More

The Labor Market Flexin’

Talk regarding one of the Fed’s favorite historical leading indicators of an impending...

Read More

Waiting On the Fed

Interest rates have moved a bit higher in early morning trading as investors...

Read More

Initial GDP Shows Growth

This morning’s Gross Domestic Product (GDP) report showed an initial reading of a...

Read More

Purchase Applications Take Another Hit

This morning’s mortgage application data showed that last week’s purchase applications are now...

Read More

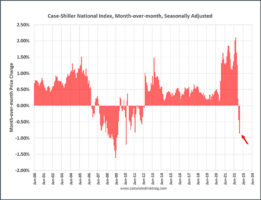

Housing Prices Showing Weakness

Dreadful news about the US Housing Market has helped improve mortgage interest rates...

Read More

Still Need Help?