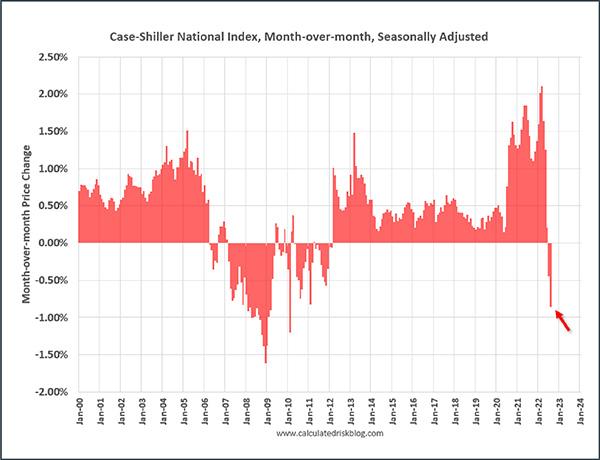

Housing Prices Showing Weakness

Dreadful news about the US Housing Market has helped improve mortgage interest rates in early morning trading.

The forceful deceleration in home values will be welcomed news to the Federal Reserve, which has violently raised the Fed Funds rate in an effort to put an end to the unsustainable growth the housing market has experienced over the past three years. As you can see from the image from calculatedriskblog.com, values are falling from their all-time high levels earlier this year.

Given that housing costs make up a large portion of the overall Core Consumer Price Index (CPI) inflation equation, we can expect this news to help soften the expectations for a 3/4% hike in December, especially given that today’s reported drop is for the month of August. It is almost certain that the September and October reports will show even greater damage has been inflicted on the housing market.

A second economic report we received this morning, this one from the Purchasers Manufacturing Index (PMI) showed a decline in October from 49.5 down to 47.3. This index measures the prevailing direction of economic trends in the manufacturing and service sectors. When you see this number drop below 50, it indicates a contraction.

Given that backlogs in manufacturing were partially to blame for the lack of inventory to meet consumer demands which added to inflationary pressures, we can assume that the current trend in manufacturing will be deflationary. Once again, this will be welcomed news to the Federal Reserve in its fight to get inflationary pressures under control.

Mortgage interest rates have dropped by ¼% from yesterday afternoon. Given the wild swings in the bond market, we could soon see this bond rally stall.

Unless you are able to stomach the risk, locking in the gains could prove to be a wise move in the near term.