Utah Mortgage Calculator

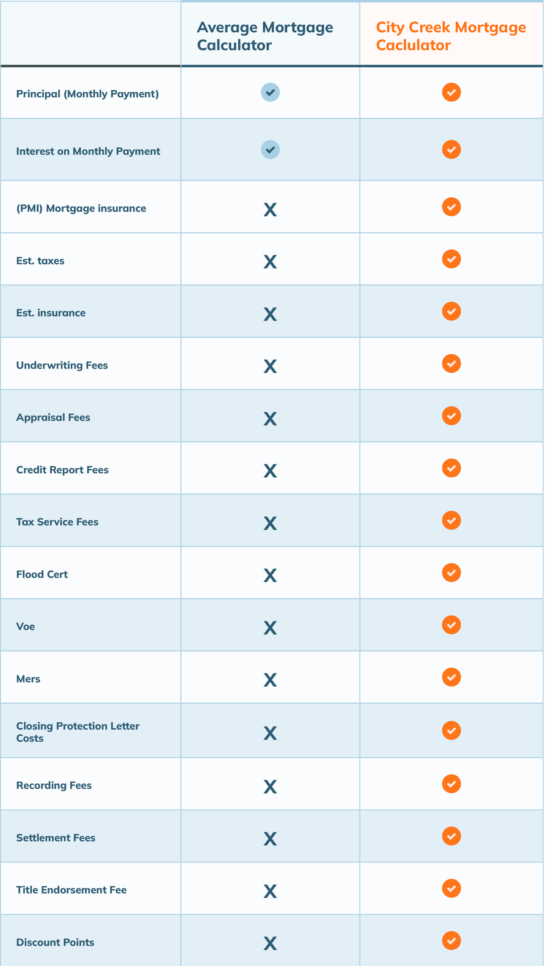

We calculate every cost, fee, and expense down to the penny.

Using our calculator, you may see costs or fees with names you’re not familiar with. If so, call us and we’ll talk you through your mortgage calculation.

We’d rather be 100% transparent with your quote than give you an oversimplistic answer to something as complex as your mortgage.

The Most Comprehensive Utah Mortgage Calculator (PMI + Taxes & More)

What to Expect

When you use the mortgage calculator tool, you can review a fee summary sheet, which serves as a one-stop method of understanding everything you should know about a potential mortgage offer.

Our calculator calculates estimated fees and costs for all of the following:

- Principal & Interest – The fee sheet will provide an estimate of the principal and interest you’ll pay with each mortgage payment. Your total monthly payment will include the monthly amounts of your principal and interest, homeowner’s insurance, any mortgage insurance that might be required, and property taxes.

- Mortgage Insurance – If you are applying for a conventional mortgage and plan to make a down payment of less than 20%, you’ll be required to carry private mortgage insurance (PMI).If you are applying for an FHA-backed loan, you’ll be required to carry FHA mortgage insurance. The mortgage insurance estimate shows you how much of each mortgage payment will be comprised of your mortgage insurance payment.

- Estimated Taxes – The estimated taxes are the property taxes that will be included in your monthly mortgage payment. This estimate is based on the value of the home and the property tax rates in the county and city where it is located. The actual monthly tax amount could be lower or higher.

- Estimated Insurance – The calculator will return an estimate for the monthly cost of your homeowner’s insurance that will be included in your mortgage payment. Since this is an estimate, the actual monthly cost of your homeowner’s insurance might be lower or higher.

- Underwriting Fees – The underwriting fees are typically set amounts charged by a lender to cover the costs of evaluating risk and originating the mortgage. These fees are typically included as a part of the closing costs.

- Appraisal Fees – When you apply for a mortgage to finance a home, your lender will appraise the home to confirm its value and ensure you meet the required loan-to-value ratio for your mortgage. The appraisal fees are the costs involved with hiring the appraiser and securing the appraisal.

- Credit Report Fees – The credit report fees are the costs your lender has to pay to get copies of your credit reports from all three credit reporting bureaus, including Experian, Equifax, and Transunion. It also includes the fee for obtaining your credit score and evaluating your credit.

- Tax Service Fees – Tax service fees are closing costs lenders charge to ensure that borrowers will pay their property taxes and avoid default on their mortgages. These fees represent the costs lenders have for hiring tax service agencies to research properties and the property taxes that are typically associated with them.

- Flood Certification – A flood certification fee is a fee charged to certify whether your property is located in a flood zone. This document is issued by the Environmental Protection Agency (EPA), and the cost is typically passed to the borrower as a closing cost.Lenders want flood certification for properties to verify they aren’t located in flood zones and avoid damage that could reduce the value of the property and increase the risk of default and foreclosure. If the flood certification reveals that a home is located in a flood zone, the borrower might be required to purchase and carry flood insurance since it is not included in regular homeowners’ insurance policies.

- VOE – When you see this on your fee details sheet, it stands for the verification of employment (VOE). This is a step your lender must complete during the underwriting process to confirm your employment and ensure all income sources have been accounted for.Your current or former employer will complete this form as a written document to validate your reported employment and income sources. The VOE fee is a charge for the cost of completing the employment verification.

- MERS – MERS stands for the Mortgage Electronic Registration System. When a lender sells a mortgage loan, the information is entered into MERS. This allows the loan to be tracked if it is sold or transferred to a new lender.You can look up your current mortgage loan on MERS to see the financial institution that currently owns it by entering the 18-digit mortgage identification number that appears on your loan paperwork. The MERS fee is the cost of entering your mortgage into the system so that it can be tracked.

- Closing Protection Letter Costs – Closing protection letters are issued by title insurance companies and protect buyers, sellers, and lenders against mistakes and misconduct by the title agent.This letter also protects against theft of settlement funds and other problems. The typical fee charged for a closing protection letter is $25.

- Recording Fees – The recording fees are fees charged by a government agency to record a mortgage, deed, and other documents related to a mortgage. These fees might either be paid by the buyer or seller.

- Settlement Fees – Settlement fees are paid to the escrow holder or settlement agent. The seller and buyer can negotiate who will be responsible for paying the settlement fees.

- Title Endorsement Fee – Title endorsements offer additional coverage beyond what is provided by title insurance, deletions, or limitations. Lenders might choose to get certain endorsements to protect their interest in a property. Most lenders follow the endorsements listed by the American Land Title Association.Homebuyers can also choose to add title endorsements to protect them against potential losses caused by title issues, including:

- Encroachments

- Easements

- Others’ interests in minerals or subsurface materials such as oil on the property

- Access and entry

- Contiguity

- Zoning

Many other types of endorsements are available based on the particular attributes of a property. Title endorsement fees are charged per endorsement.

- Discount Points– Discount points are costs for reducing the interest rate you will pay on a mortgage that must be paid upfront at closing.

Understand Your Mortgage Calculation

When you use the free mortgage calculator tool with City Creek Mortgage, you’ll be asked to input some basic information about the home you are considering, whether it is your first home purchase, whether you are looking for a refinance or home purchase loan, your credit, the purchase price, your down payment, and others.

Once you submit the requested information, the calculator will return a list of potential mortgages and interest rates. You can click on the loan details for a particular mortgage loan to get a list of fees and costs you might expect to pay if you apply for it.

Below, you can see a sample scenario of what you might expect when you input information into this mortgage calculator. This information will provide you with a highly accurate estimate of all of the costs that might be involved with closing your loan.

Sample Input:

Home Sales price: $400,000

Down Payment: $50,000 (12.5%)

Rate: 6.875%

Credit Score: 660 -679

Sample Output:

Est. Monthly Payment – $2,890.25

Principal & Interest – $2,299.00

Mortgage insurance – $262.50

Est. taxes – $250.00

Est. insurance – $78.75

Total Est. Monthly Payment – $2,890.25

Underwriting fee – $1,055.00

Appraisal fee – $535.00

Credit report fee – $62.00

Tax service fee – $85.00

Flood cert. – $8.00

Voe – $54.95

Mers – $24.95

Closing protection letter – $25.00

Recording fee – $80.00

Settlement fee – $240.00

Title endorsement fee – $85.00

Cost for buying down to chosen rate

Discount Points: $6,954.00

Total Est. Closing Costs: $9,209.00

You will also see a section that provides a brief explanation of the various fees and why they are required.

As a prospective homebuyer, it’s important to know what you might have to pay so that you can determine the value you will receive in exchange for your money. This section provides a high-level explanation of the value you will be getting when you pay various fees.

Beware of Lenders That Tell You That You Won’t Have to Pay Certain Fees

Some lenders tell prospective buyers that they will pay certain fees for them. However, they then turn around and move the costs into different categories to make it look like they are paying when they aren’t.

You should always ask any potential lender if it will truly pay for those fees or will instead simply combine them with other fees or place them in a different category.

Ask a lender that claims to pay for certain fees how it will remain profitable on the transaction if it does.

It’s important to critically evaluate the fees and costs associated with any loan you consider. This is why we provide detailed information about the fees charged by different lenders so that you can understand what you would be paying and receive an accurate estimate of the total costs associated with obtaining a mortgage.

We Work With Multiple Lenders to Get You the BEST Loan

At City Creek Mortgage, we strive to help you get the best mortgage loan for your circumstances. We are a mortgage broker and do not have a hidden agenda. We focus on helping you get the best loan by working with multiple lenders. This is a prime advantage of working with City Creek Mortgage.

Our more than 2,500 five-star reviews on Google demonstrate that we have established ourselves as a trusted partner for homebuyers across Utah. To learn more about what you might expect when buying a home in Utah, try out our mortgage rate calculator and reach out to us today to schedule a consultation.