Utah Town-Home Mortgage Loans

- No personal information required

- No upfront deposit for appraisal or credit report required

- Expect to save money

Delve into the financial perks and practical advantages of town-home ownership in Utah, as we decode the real value of choosing a townhouse over a single-family home.

The Advantages of Buying a Town-Home in Utah

#1 They are objectively less expensive Home buyers often feel they’re making slight concessions when opting for a townhome instead of a single-family residence. However, the data shows making that compromise pays dividends. So, exactly how much cheaper is it to buy a townhome in Utah compared to a single-family home? Let’s look at the data…

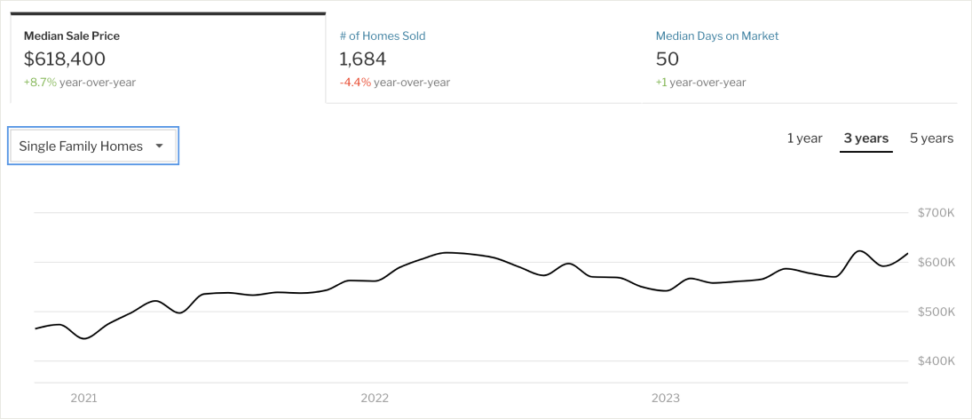

Previous 5 years of median single-family home sale price

Single-family homes in Utah have a median sale price of $588,600 according to sales data from the previous 5 years.

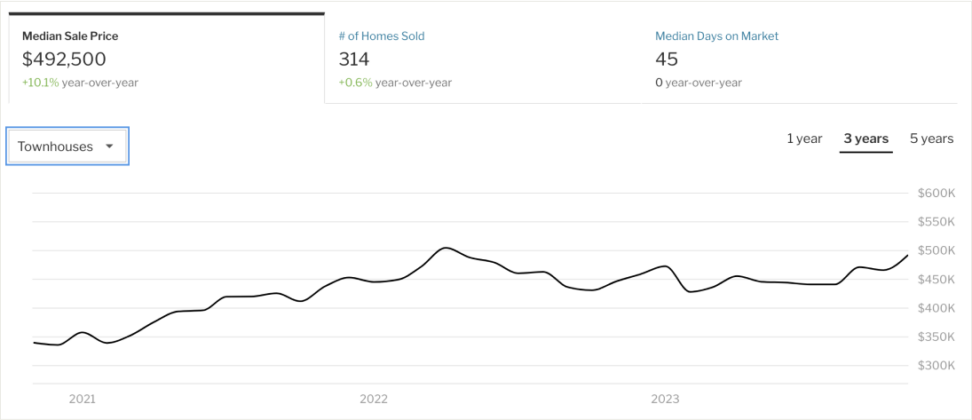

Previous 5 years of median townhouse sale price

Townhouses in Utah, according to sales data over the last 5 years, have a median sale price of $445,900.

This means the average Utah town-home buyer saved approximately $142,700 by purchasing a townhouse over a single-family home. That’s an average of 24% less expensive.

#2 The Appraisal Process Is Almost Always More Smooth

One of the benefits of opting for a townhome in Utah over a single-family home is the notably smoother appraisal process. When you consider a townhome, particularly within planned developments or communities, the appraisal procedure tends to be streamlined, predictable and drama-free.

Here are the main reasons why:

Predictable Comparables: Townhomes within planned communities often share similar layouts, sizes, and features, simplifying appraisals by providing clear comparable properties.

Community Maintenance: Townhome developments with homeowner’s associations (HOAs) ensure regular upkeep, enhancing the community’s aesthetics and this typically leads to more favorable appraisals.

Resale Value Confidence: Planned townhome communities offer predictable resale values due to controlled environments, benefiting both lenders and appraisers with accurate historical data.

#3 They’re One of the Lowest Barriers to Entry into the Real Estate Market

When you’re setting your sights on owning your eventual dream home, the journey often begins with that very first step onto the property ladder. Choosing a townhouse can be an amazing strategic move towards not just a house, but a future that aligns with your aspirations.

Here’s why opting for a townhouse is a smart decision that lays the foundation for your real estate dreams:

Accessible Homeownership: Townhouses provide an accessible entry into homeownership with a notably lower barrier to entry, enabling you to begin your homeownership journey earlier than anticipated and start building equity sooner.

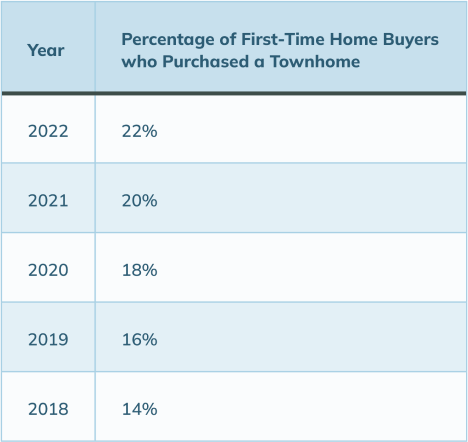

According to the 2022 NAR Profile of Home Buyers and Sellers, the number of American first-time home buyers who start home ownership in a townhome is rapidly increasing.

Equity without the Hassle: Embrace the perks of owning a property that appreciates in value over time. Plus, you’ll sidestep the numerous responsibilities that can come with a single-family home, such as the ongoing upkeep of lawns, sprinklers, handling maintenance issues, and managing exterior or roofing repairs.

Are Town Home Loans Different Than Single-Family Home Loans?

Let’s set the record straight: the type of loan you get isn’t determined by whether you’re buying a townhome or a single-family home. Instead, it’s all about the financing terms and who’s backing the loan.

With that said, for most townhome buyers, it’s nearly a guarantee you’ll go with one of these loan types (unless you or a spouse has served in the military): an FHA loan or a conventional loan.

FHA Loans (typical for buyers with lower credit scores)

- What they are: These are loans insured by the Federal Housing Administration.

- For first-time buyers: FHA loans often appeal to first-time homebuyers because of their lenient credit requirements and smaller down payment demands.

- Flexible credit scores: They typically allow for lower credit scores than conventional loans.

- Down payment: As low as 3.5% with a 580 or higher credit score.

Conventional Loans (typical for buyers with higher credit scores)

- What they are: These are mortgage loans not insured by any government agency.

- For established borrowers: Ideal for those with a stable credit history and the ability to make a larger down payment.

- Credit demands: They generally require higher credit scores than FHA loans.

- Down payment: Can range, but 20% is common to avoid Private Mortgage Insurance (PMI).

- Remember, while the home’s structure doesn’t dictate your loan type, your financial situation and goals do. Consult with a mortgage professional to determine the best fit for you.

Navigating the Townhome Purchase Journey: What To Expect

Once you’ve found a townhome you’re smitten with and are ready to make an offer, you’re about to embark on an exciting journey. Let’s break down the steps so you know what’s coming next:

Making the Offer

- After determining the value and what you’re willing to pay, you’ll submit an offer to the seller, often through your real estate agent.

- This offer will detail the price you’re willing to pay, any contingencies (like a home inspection), and your desired closing date, among other specifics.

Negotiation Phase

- The seller might accept your offer, reject it, or counter with a different proposal.

- This is a dance, and it might require a few rounds of back-and-forth until both parties agree on terms.

Inspection and Appraisal

- Once your offer is accepted, it’s typical to have the property inspected for any issues or potential repairs.

- The bank or lender will also schedule an appraisal to ensure the property’s value matches the loan amount.

Finalizing Your Mortgage

- At this stage, City Creek Mortgage will help you gather the necessary documentation and finalize the details of your home loan.

- It’s crucial to keep all financials stable during this time – big purchases or credit changes can impact your loan approval.

Closing

- This is the final step! You’ll meet with a title company to sign all the necessary paperwork, finalize the mortgage, and receive the keys to your new townhome.

Moving In

- With keys in hand, you’re now ready to move into your new space and make it your own!

Most Townhome Owners Have to Pay a PMI (Private Mortgage Insurance)

If you’re like most folks, you’re shopping for townhomes because you’re trying to be cost-conscious. You’re looking to reduce your homeownership costs, not increase them. However, one of the cruel ironies of home buying is this: The less you pay up front, the more you may pay throughout the life of your loan (unless of course you refinance when rates drop, which is part of our no-cost loan strategy).

PMI or Private Mortgage Insurance is why you pay more when you have a lower downpayment.

Most homeowners are left shrugging in disappointment, “But why?!”

In a nutshell, PMI is the lender’s way of ensuring that they stay profitable even if you default on your loan. If you put down a smaller initial payment, lenders see it as a higher risk. PMI is their safety net.

This is exactly why your down payment is so important. It’s because the amount will determine whether you’ll need to pay Private Mortgage Insurance (PMI) and how much over time.

Let’s run through some scenarios of what your PMI costs might look like depending on your down payment. Let’s also assume your townhome cost the median amount over the last 5 years in Utah: $445,900.

0% Down Payment

- Down Payment Amount: $0

- Loan Amount: $445,900

- PMI Implication: With no down payment, PMI will definitely be a part of your monthly mortgage payments. The average PMI rate for a 0% down payment mortgage in Utah in 2023 is between 0.8% and 1.2% of the loan amount annually. This means that for a $445,900 mortgage, you could expect to pay approximately $4,459 in PMI a year.

3% Down Payment

- Down Payment Amount: $13,377 (3% of $445,900)

- Loan Amount: $432,523

- PMI Implication: The average PMI rate in Utah for someone with a 3% downpayment is between 0.7% and 0.9% of the loan amount annually. This means you could expect to pay approximately $3460.19 in PMI costs.

10% Down Payment:

- Down Payment Amount: $44,590 (10% of $445,900)

- Loan Amount: $401,310

- PMI Implication: With a 10% down payment, your PMI will be less than in the previous scenarios. In Utah in 2023, the average PMI rate in Utah for a mortgage with a 10% down payment is between 0.5% and 0.6% of the loan amount annually. This means that for a $401,310 mortgage, you could expect to pay between $183.93 in monthly PMI costs.

20% Down Payment

- Down Payment Amount: $89,180 (20% of $445,900)

- Loan Amount: $356,720

- PMI Implication: Here’s the sweet spot! With a 20% down payment, you typically avoid PMI altogether. This can lead to substantial savings over the life of your loan.

From this, you can see how having a decent down payment can lead to significant savings over time. Many lenders are hesitant to offer a 0% down payment loan. This is because it’s rare to find scenarios where someone can manage the higher PMI payments without being able to afford at least a modest down payment.

Let City Creek Mortgage Be Your Partners in the Journey of Townhome Ownership

At City Creek Mortgage, we’ve become synonymous with expertise in guiding townhome buyers. Drawing upon our vast experience and tailored loan options, we aim to make your journey to homeownership both seamless and economical. Here’s what sets us apart:

- Two Decades in the Field: With over 20 years of mastering the mortgage terrain, our insight ensures a smooth loan process for our clients.

- Diverse Loan Products: Our portfolio, spanning from conventional to FHA to VA loans, ensures there’s a perfect fit for every buyer.

- Special Programs & Discounts: Leverage unique opportunities like our first-time homebuyer program, potentially trimming up to $5,000 from your closing costs.

- Dedicated Loan Officers: Our team is passionate about demystifying mortgages, providing you with personalized counsel every step of the way.

Considering a townhome purchase? Reach out to City Creek Mortgage. We’re here to make the path to your new home clear and cost-effective.

FAQ

1. Why do some lenders not offer a 0% down payment option?

Lenders view a 0% down payment as a higher risk. The absence of an upfront investment by the buyer increases the chances of loan default. To protect their investment, lenders might require PMI or avoid offering 0% down options altogether.

2. If I can’t afford a 20% down payment now, can I get rid of PMI later?

Yes! Once you’ve built enough equity in your home, typically when the loan-to-value ratio reaches 78%, you can request the lender to remove PMI from your mortgage.

3. Are townhomes always cheaper than single-family homes?

While townhomes are often more affordable due to shared walls and reduced property size, prices can vary based on location, community amenities, and the current real estate market. It’s essential to compare specific properties in your desired area.

4. What kind of mortgage is best for a townhome purchase?

The best mortgage for a townhome purchase is going to depend largely on your financial situation, long-term goals, and current market conditions. Typically, conventional loans are the most common for townhouses. However, FHA, VA, and USDA loans can also be options if qualifying criteria are met. To answer this question appropriately, It’s essential to compare interest rates, down payment requirements, loan terms, and whether the loan has a fixed or adjustable rate.