Utah USDA Rural Housing Home Loans – Apply Today

If you are wanting to buy a home in Utah in a rural area one option you might consider is a USDA loan. This is a type of mortgage that is backed by the U.S. Department of Agriculture and has less stringent qualifying terms than a conventional mortgage, so people with lower to moderate income can have an easier time qualifying. Here is some information about USDA loans from the mortgage experts at City Creek Mortgage to help you understand whether this might be a good option for you.

Speak with a USDA Loan Officer – 801-501-7950

What are USDA or Rural Loans and Their Advantages?

A USDA or rural home loan is a type of mortgage that is backed by the U.S. Department of Agriculture. This type of mortgage is only available in qualifying rural areas for applicants who meet income eligibility requirements.

For single-family housing, the USDA offers two different programs, including the single-family direct loan program and the single-family guaranteed loan program.

The USDA Section 502 guaranteed single-housing loan program provides a guarantee to lenders that the borrower will pay the mortgage. The direct loan program is available for low to moderate income buyers and provides a home purchasing option to qualifying buyers to help them obtain sanitary and safe housing in rural areas.

To qualify for a USDA mortgage through the single-family direct loan program, your income must meet the criteria for the area in which you want to purchase a home. For the single-family guaranteed loan program, your income must be considered moderate and can’t exceed 115% of the median household income for your area.

As long as you are fine with living in a qualifying rural or suburban area and only are looking for single-family housing, a USDA loan might be a good option. This type of mortgage offers the following advantages:

- Option for 100% financing with zero down

- No cash reserve requirements

- Low, fixed-interest rate

- Seller can pay the closing costs

- Easier qualifying credit guidelines

- Can use the mortgage to build or renovate a home

- Can roll repairs and renovations into the mortgage

- No pre-payment penalties

↓ Try Our Utah USDA Mortgage Calculator ↓

How Can I Find a Utah Home That Qualifies for a USDA Loan?

You can start by going to the property eligibility lookup tool on the USDA website. This tool lets you enter the address of a home you are considering to make sure it is in an eligible area.

You can also use the zoom feature on the U.S. map to zoom in and see the general areas of Utah that qualify. Ineligible areas are those that are highlighted in a beige color.

Which Utah Areas Qualify?

Much of Utah is located in eligible areas. The ineligible areas of Utah largely stretch along U.S. 89, I-15, and I-84 as these highways go through the various cities located along them. Here is some more information about specific regions of Utah and where might qualify.

Large swaths of Utah fall into eligible areas for USDA-backed home loans, except for a large region stretching roughly along U.S. 89, I-15, and I-84 and including Provo, Salt Lake City, Ogden, and Layton. These cities have metropolitan areas with population sizes exceeding the limits and are not considered rural.

However, moving into suburban or rural areas outside of these major population centers might allow you to find a home that qualifies for a USDA-backed loan.

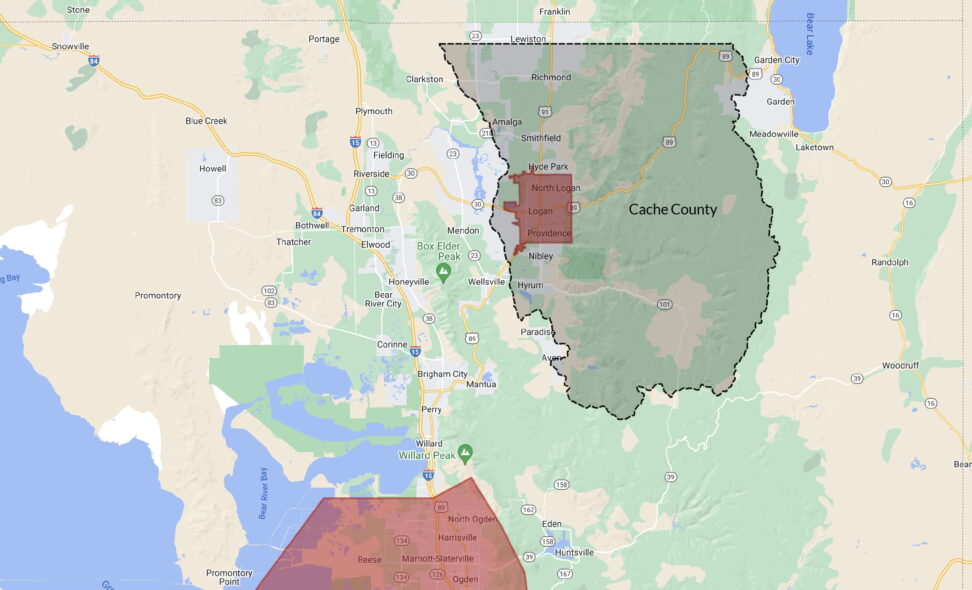

USDA Loan Boundaries of Cache County (Logan Area)

In Cache County, the ineligible areas include the cities of Providence, Logan, and North Logan. The remainder of the county is eligible, however, including Hyrum, Smithfield, Hyde Park, and Richmond to the county line and below Providence to the county line near Brigham City.

If the property you want to purchase is east of Logan in the mountains along U.S. 89 or anywhere in the county that is north, south, west, or east of the ineligible areas, you might qualify for a USDA rural loan.

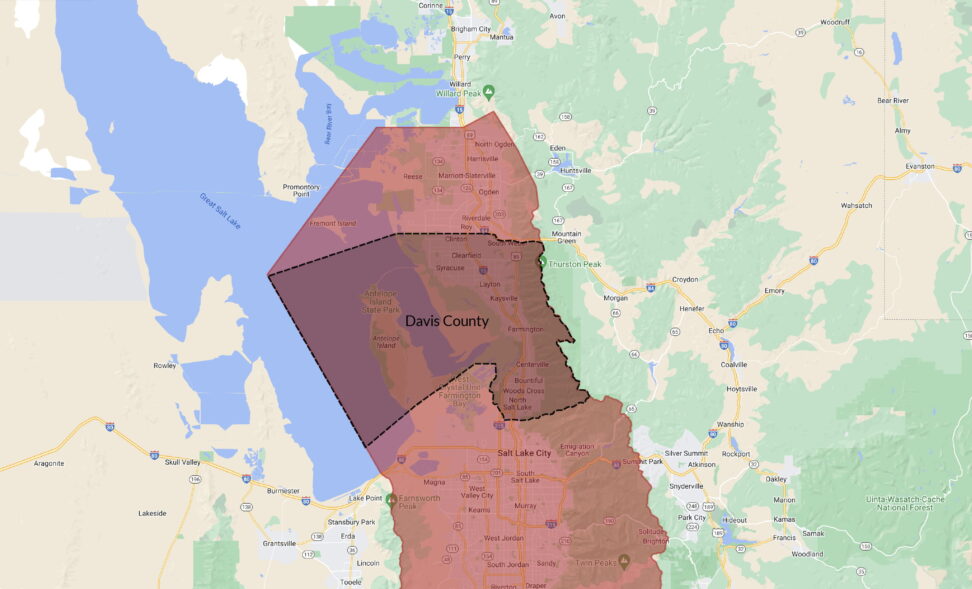

USDA Loan Boundaries of Davis County (Farmington & Kaysville)

Much of Davis County is an ineligible area, including the cities of Bountiful, West Bountiful, Centerville, Farmington, Kaysville, Layton, and Clearfield along I-15. The ineligible area stretches to the Great Salt Lake, which bounds the western edge of Davis County, and west of U.S. 89 to the mountains.

If you want to buy a home in Davis County with a USDA loan, you’ll need to find one in the mountainous area west of U.S. 89.

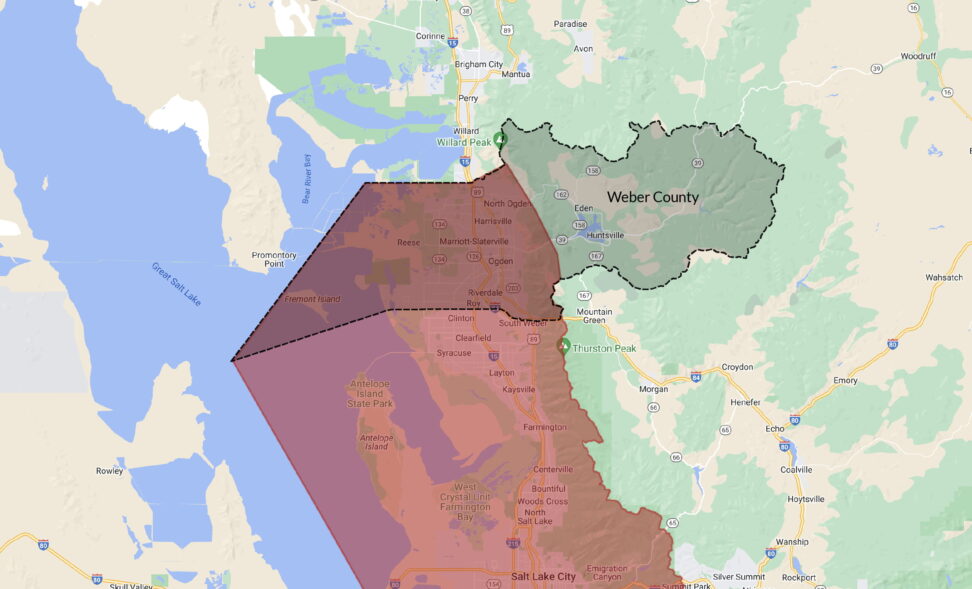

USDA Loan Boundaries of Weber County (Ogden, North Ogden, Eden, & Huntsville)

In Weber County, the ineligible areas include everything east of I-15 to the Great Salt Lake and west to the other side of U.S. 89 along the mountains. However, eligible properties include the mountainous areas west of U.S. 89, including the towns of Eden and Huntsville and the surrounding rural landscape.

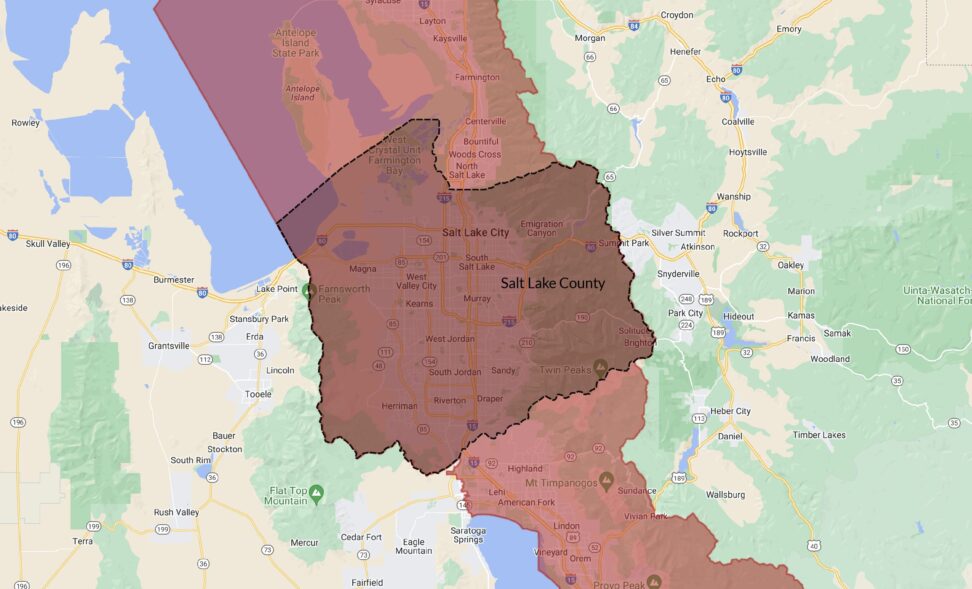

USDA Loan Boundaries of Salt Lake County (Salt Lake, West Valley, South Jordan)

Salt Lake City, South Jordan, West Valley, and Draper are all located in ineligible areas. The mountainous areas of Salt Lake County are all in eligible regions, so you can look there to find eligible properties for USDA home loans.

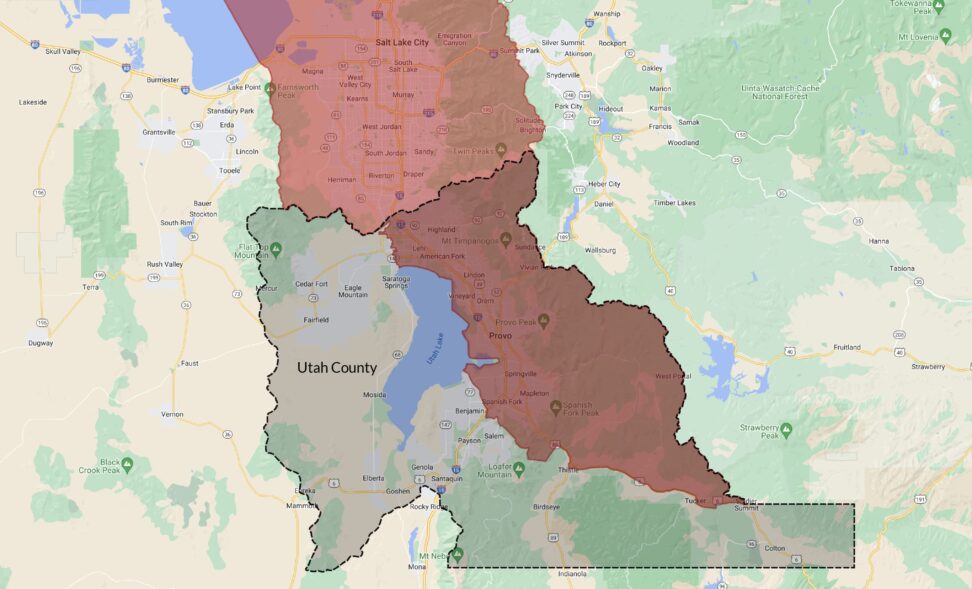

USDA Loan Boundaries of Utah County (Provo, Orem, Highland, Alpine)

In Utah County, the corridor formed by Highway 6, I-15, and U.S. 89 is surrounded by ineligible regions for USDA loans. The following cities are not eligible for rural loans from the USDA:

- Provo

- Orem

- Lindon

The ineligible swath extends to the western boundary of Utah Lake. Properties located in Utah County on the eastern side of Utah Lake are eligible. The ineligible region also extends to the west to Uintah National Forest.

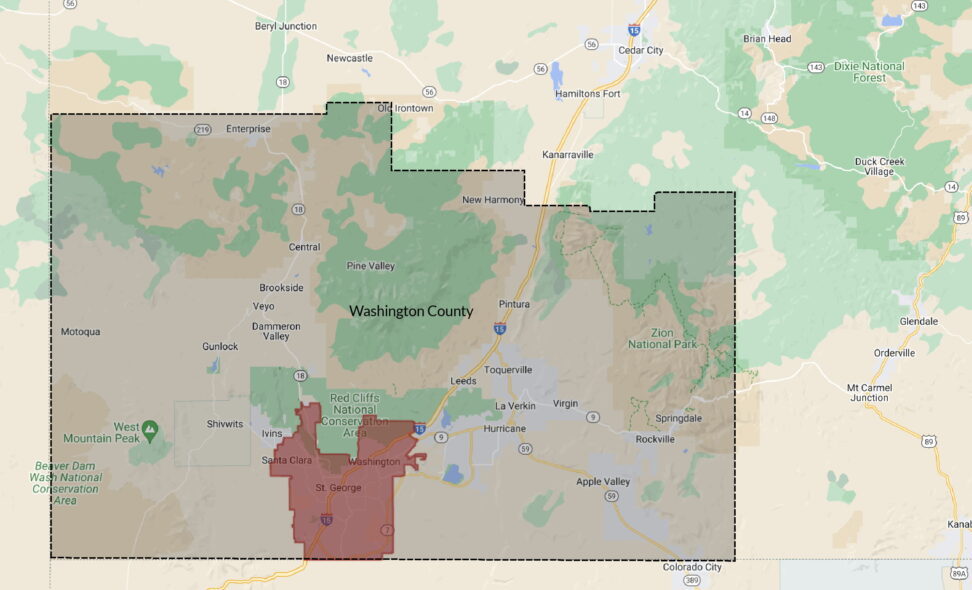

USDA Loan Boundaries of Washington County (St.George)

In Washington County, the St. George metropolitan area is ineligible as is the I-15 corridor as it runs from the south county line north until after Washington. Areas along I-15 slightly north of Washington to the northern count line are eligible.

The ineligible region extends through Santa Clara but does not include Ivins or anything west of it in the county. Areas north and west of St. George are eligible areas, including the towns of Hurricane and La Verkin and all of the surrounding rural regions.

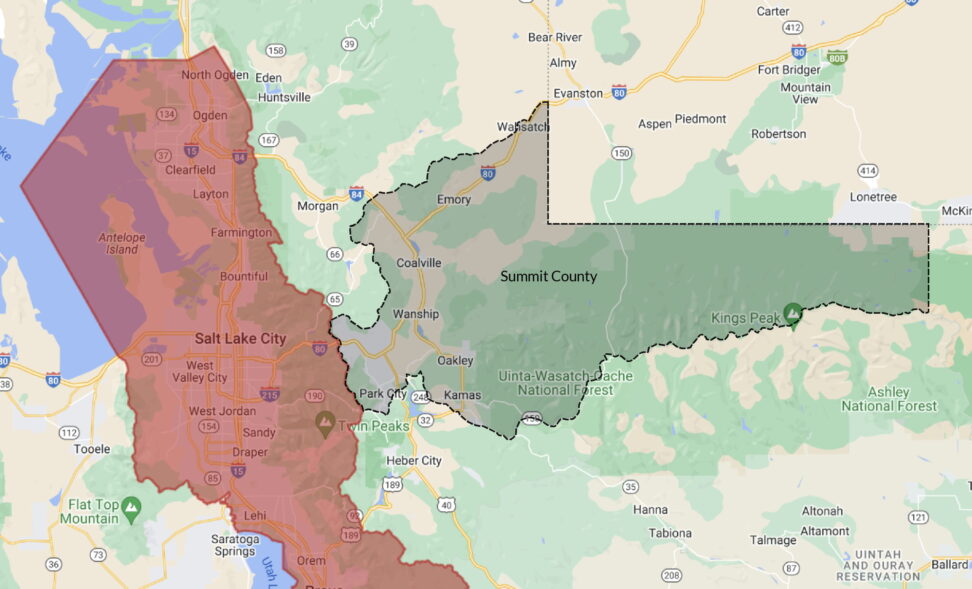

USDA Loan Boundaries of Summit County (Park City, Heber)

Summit County USDA Loan Qualifying Area Map

Nearly all of Summit County, including Heber and Park City, are eligible areas for USDA home loans. The only area in the county that is ineligible is along I-215 around Emigration Canyon. Summit County can be a great place to buy a home with skiing and plenty of other outdoor activities in the mountains.

How Do USDA Loans Work?

The USDA guarantees USDA home loans issued by private lenders. The agency also issues USDA home loans directly to eligible individuals with low to moderate incomes that can’t otherwise qualify through a private lender.

As the guaranteeing agency, the USDA assumes the risks of the mortgage, which makes it easier for people to qualify. These loans do not require you to pay any money down, and they also do not require traditional private mortgage insurance (PMI). However, there is an upfront fee of 1% of the mortgage amount, but it can be rolled into the mortgage. Mortgage insurance for a USDA loan is then 0.35% of the loan amount each year.

USDA loans also typically have lower fixed interest rates than conventional mortgages. For example, as of May 1, 2023, the current interest rate for single-family homes through the USDA’s direct home loan program for low-income and very low-income borrowers was set at 4.125%. By contrast, the average interest rate for a 30-year fixed-rate conventional mortgage on May 1, 2023, was 7.26%.

Borrowers also have the option of longer payment terms for USDA loans. Through the guaranteed loan program, borrowers can choose a 33-year fixed-rate term. The term can be stretched to 38 years for very low-income borrowers going through the USDA’s direct loan program who can’t afford the payments of a 33-year mortgage loan.

To qualify for a direct 502 home loan, a property must meet the following criteria:

- Must be less than 2,000 square feet

- Must be a single-family residence that will be the buyer’s primary home

- Must be located in an eligible rural area

- Must have a value of less than the applicable conforming loan limit for the area

- Can’t be an income-producing property

- Can’t have an inground swimming pool

For a guaranteed USDA loan, the borrower must meet the income and other eligibility requirements. The home must be located in a qualifying rural area, not be an income-producing property, and must be the homebuyer’s primary residence.

Who in Utah Qualifies for a USDA Loan?

To qualify for a guaranteed USDA home loan, you must meet the following requirements:

- Have an income that does not exceed 115% of the median income for the area

- Must agree to use the home as your primary residence

- Must be a U.S. citizen, U.S. resident, or qualified alien

To qualify for a USDA direct home loan, a borrower must meet the following requirements:

- Income at or below the low-income limit for the area

- Not have safe, decent, and sanitary housing

- Not be able to obtain a mortgage from other sources with terms and conditions that the borrower can meet

- Agree to live in the home as a primary residence

- Have the legal capacity to enter a loan contract

- Be a U.S. citizen or U.S. resident

- Not be debarred from participating in federal programs

For guaranteed approval, you must have a credit score of 640 or above. If your credit score is between 600 and 639, you might qualify through manual underwriting.

When to Go with a USDA Loan over a Conventional or FHA

If you are eligible and want to purchase a home in a qualifying rural area in Utah, a USDA loan might be the best option.

This type of loan offers a no downpayment option, has a lower fixed interest rate than FHA or conventional mortgages, and does not have a prepayment penalty. However, you must use it to purchase a single-family home that meets the requirements and live in it as your primary residence.

Would It Make Sense To Get a Different Loan Type Even if I Qualify for USDA?

If you qualify for a USDA loan, it might still make sense to choose a different type of mortgage in certain situations.

If you qualify for a VA loan, it might be more flexible than a USDA loan and allow you to purchase a home in nearly any area with a low rate of interest and easier credit qualifying requirements.

An FHA loan is more flexible with its credit requirements, location, and income than USDA loans.

Getting a USDA mortgage might be a good option if you want to buy a home in a rural area to use as your primary residence and meet the income and credit requirements. To learn more about whether a USDA loan or a different type of mortgage will best meet your needs, contact the experts at City Creek Mortgage to schedule an appointment by calling us at 801-501-7950.