Utah No-Down Payment Home Loan Lender

Homeownership Is Possible With City Creek Mortgage's No Down Payment Options

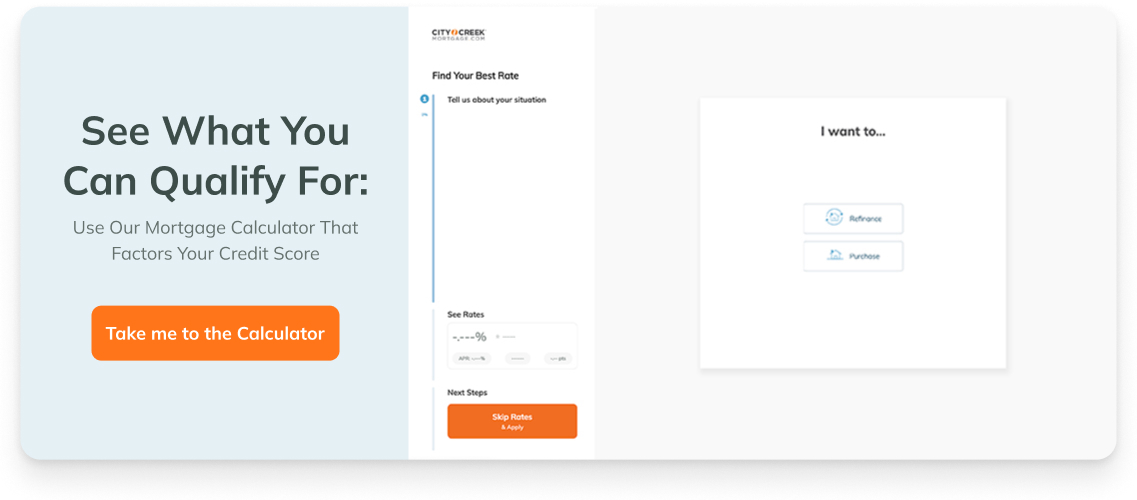

- No personal information required

- No upfront deposit for appraisal or credit report required

- Expect to save money

When you’re dreaming about buying a home, saving enough money to make a sizable down payment could be an obstacle to realizing your goal. It is possible to get a mortgage without having to make a down payment, but it’s important to understand the benefits and drawbacks of no-down mortgages. Here’s what you need to know about no-down home loans in Utah from the trusted mortgage experts at City Creek Mortgage.

Exploring No Down Payment Home Loans in Utah

It is possible to purchase a home with a no down payment mortgage in Utah. However, it’s important to understand the potential drawbacks of no-down home loans before you move forward.

You should consider the following factors if you’re thinking about trying to get a mortgage without making a down payment:

- Hidden catches in zero-down mortgage loans -Lenders that advertise zero-down promotions often don’t explain hidden catches in their mortgage products. You must carefully review the fine print to understand what you might be getting into if you apply.

- Impact of your credit score – Your credit score could be a major factor in whether you might qualify for a mortgage without a down payment. If you have a high credit score, it will be much easier than if your credit score is lower.

- Effect of private mortgage insurance (PMI) – Without a sizable down payment, you will have to purchase private mortgage insurance (PMI). This insurance cost can greatly add to your monthly payment amounts.

There are several potential pitfalls to watch for before you purchase a home without making a down payment. You must make sure you understand them so that you can make an informed decision.

Some people who have moved forward with no-down mortgages without conducting due diligence have found themselves trapped with 30-year mortgages with payments they can’t afford. With this guide, our goal is to help you understand the ins and outs of no-down mortgages so you won’t end up in this type of situation.

Pros and Cons of No-Down Mortgages

Mortgages with no required down payments are not as common today as they once were. During the early to mid-2000s, subprime, no-down mortgages were fairly easy to get. However, the collapse of the subprime housing market led to the great recession of the mid-2000s, and many no-down and other sub-prime mortgage options went away.

Sub-prime mortgages were loans that were extended to people with poor credit, little to no savings, limited work history, etc. These were people who couldn’t qualify for traditional mortgages. When the housing bubble collapsed, many people could no longer afford to make their payments on these riskier loans, leading to the recession.

Because of this history, there are fewer options for no-down mortgages today. Today’s no-down mortgages are also not geared to subprime borrowers with poor credit.

Before you try to get a mortgage without a down payment, you should understand the pros and cons.

Pros of a No-Down Home Loan:

- Being able to buy a home sooner – If you don’t have to take time to save enough money for a down payment, you’ll be able to purchase a home sooner. This might be good when the home prices in your desired area are spiking or when there is a transitory dip in the market that you’d like to take advantage of before area prices rebound.

- Keeping money on hand for other needs – If you do have money set aside for a down payment, getting a no-down home loan might allow you to spend that money on other things. For example, maybe you want to pay for renovations, your teenager’s college, or other important expenses.

Cons of a No-Down Home Loan:

- Seller might choose a different offer – If you make an offer on a home with a pre-approval for a no-down mortgage while another buyer makes an offer that includes 20% down, the seller might find the other buyer’s offer more attractive because they might believe they are less likely to encounter headaches during the transaction process.

- Higher interest rates – No-down mortgages tend to have higher interest rates to make up for the lack of a down payment. A higher interest rate means that your payments will be larger, and you’ll end up paying much more over the life of the loan.

- Having no equity – If you buy a home without making a down payment, you won’t have any equity in your home. This can be an issue if you experience an emergency because you won’t be able to access your home’s equity to cover unexpected expenses.

- Private mortgage insurance (PMI) – If you buy a home with zero down, you’ll have to carry private mortgage insurance until you have a minimum of 20% equity in your home. When you’re starting at zero equity, this could take years. PMI is added to your mortgage payments, and can greatly increase their amounts.

Important Insights From Recent Housing Studies

We strive to help our customers make buying decisions that are tailored to their unique situations and are based on objective data. This helps to ensure our customers are fully informed and understand their options before they apply for mortgages.

To help, we’ve reviewed data from the following two studies to provide you with some information about housing affordability and no-down mortgages:

- The State of the Nations Housing 2022 – Harvard University

- Barriers to Accessing Homeownership – Urban Institute

Here’s what to know from these two studies:

Important Findings That Concern Home Buyers

1. Housing Costs Are Still Climbing

Both studies emphasize that housing prices are on a relentless rise. According to the Harvard study, home price appreciation nationwide touched 20.6% in March 2022, a significant leap from prior years. This increase is not an isolated incident, as 67 out of the top 100 housing markets have also experienced record-high appreciation rates.

2. The Barrier of Downpayments: You’re Not Alone

It’s not just the increasing price of homes; it’s the barriers they pose for prospective homeowners. The Harvard study mentions that for a median-priced home in April 2022, the downpayment, typically 7.0% of the sales price, would amount to $27,400. Now, let’s contextualize this: 92% of renters have median savings of just $1,500. The math is straightforward; traditional downpayments are simply out of reach for many.

3. Millennials & Gen Z are still Interested in Home Ownership

Even in the face of financial hurdles, the aspiration for homeownership hasn’t changed. The Urban Institute’s study provides compelling evidence, noting that homeownership rates among those under 35 rose from 36.5% in 1994 to 40.2% in 2021. This positive trajectory among younger buyers is also corroborated by the Harvard report. The data makes it pretty clear: owning a home remains a cherished goal for countless individuals.

What Does This Mean for Utah Home Buyers Without A Downpayment?

1. No Downpayment Doesn’t Mean No Ownership.

First and foremost, Utah residents should understand that not having a hefty downpayment doesn’t exclude them from homeownership. With 92% of renters having median savings of just $1,500, you’re certainly not alone in this predicament. The key is to explore alternative mortgage options and programs that cater to those without a traditional downpayment. Programs such as USDA loans, VA loans, and certain FHA loans can make homeownership possible with little to no downpayment.

2. Utah’s Unique Housing Landscape

While nationwide trends provide a helpful backdrop, Utah has unique housing market dynamics. Utah has seen a surge in its population and a booming tech industry, leading to increased demand for homes. This might translate to steeper prices, but it also means there’s a stronger push for more inclusive financing options to cater to the state’s diverse population.

3. Research and Expert Guidance is Key

Now, more than ever, potential homeowners should be proactive in understanding the different mortgage options available to them. Partnering with a knowledgeable mortgage broker, like City Creek Mortgage, can provide clarity on the array of mortgage products suited for those without a traditional downpayment. We’re equipped with the expertise and tools to navigate this evolving landscape and find a solution that aligns with your homeownership dreams.

4. Community and State-Specific Programs

Utah offers a variety of state and community-driven programs designed to assist potential homeowners. For instance, City Creek Mortgage is helping lower-income home buyers get a $4,000 grant through UWM.

Pathways to Homeownership Without Traditional Mortgage Loans

There are several programs through which you might be able to access mortgages without making a down payment, including the following:

1. VA Home Loans

If you or your spouse are a military service member or a veteran, you might qualify for a VA loan. These home loans are backed by the U.S. Department of Veterans Affairs but are offered through approved lenders instead of the VA directly. If you are eligible, you can purchase a home without a down payment if the sales price is not higher than the home’s appraised value. You’ll also need to meet specific eligibility criteria.

2. USDA Home Loans

If you want to buy a home in a rural area in Utah and have a moderate to low income, you might qualify for a USDA home loan. These mortgages are guaranteed by the U.S. Department of Agriculture. You must meet the income and credit guidelines, and there are limits on the purchase price of the home.

3. Down Payment Assistance Programs

Some down payment assistance programs might allow you to purchase a home without making a down payment. City Creek Mortgage partners with UVM to provide $4,000 in down payment assistance. For this program, City Creek Mortgage applies on behalf of the borrower.

There are also down payment assistance programs available through the Utah Housing Corporation. We can help you review the various programs and see if one might meet your unique needs.

![]()

5 Most Important Factors to Consider (When Buying With No Downpayment)

# 1 – The Health of Your Credit Score

Your credit score is like your passport to financial opportunities. A good score can unlock favorable terms, while a poor score can place considerable limits on your loan options.

How Lenders View Your Score

Lenders rely on credit scores to gauge the risk of lending. A higher score usually means lower risk for the lender, and a lower score equals higher risk for the lender. This means if your credit score is in the poor or fair range, it will be more difficult to get approved for a mortgage because of the perceived risk.

Ways to Boost Your Score Before Applying

Consider checking your report for errors, paying off outstanding debt, or refraining from opening new credit accounts in the months leading up to your application.

Get copies of your credit reports from each of the three major credit reporting bureaus around six months before you intend to apply for a mortgage.

Review your reports and look for any inaccuracies. Challenge inaccurate information with the credit reporting agencies so it can be removed.

You can get a free copy of your reports once each year from annualcreditreport.com.

#2 – Understanding Private Mortgage Insurance (PMI)

Private Mortgage Insurance (PMI) becomes a key player when you’re not making a down payment. It’s important to understand PMI and how it works to understand the true cost of a no-down mortgage.

What Is PMI?

If you put down less than 20% when buying a home using a traditional mortgage, your lender will require you to purchase private mortgage insurance (PMI).

If you instead buy a home with a government-backed mortgage, such as an FHA loan, and do not put 20% down, you’ll have mortgage insurance premiums added to your monthly payment and will also have an upfront mortgage insurance premium to pay.

The Purpose of PMI

PMI protects lenders if a borrower defaults. When you’re not putting money down, lenders see the loan as riskier, which is why PMI is typically required.

Impact on Monthly Payments

Though it safeguards lenders, PMI means higher monthly payments for you. Ensure you understand how much and for how long you’ll be paying.

#3 – The State of the Housing Market

The market’s health can influence your no-down-payment purchase decision in terms of available interest rates and the demand in your area.

Current Interest Rates

Low interest rates can make buying now more attractive, but always consider future rates and market shifts.

If the interest rates are low at the time you buy a home, it makes sense to lock in the rate and choose a fixed-rate mortgage instead of an adjustable-rate mortgage (ARM).

Housing Demand in Your Desired Area

In high-demand areas, sellers might choose buyers with down payments over those who do not have money to put down. Make sure you understand the local dynamics.

#4 – Your Long-Term Financial Strategy

How does buying with no down payment fit into your broader financial goals?

Future Equity Building

Without an initial down payment, building equity in your home might take longer. If it takes longer to build equity in your home, you might not be able to sell your home and move when you want to. Consider how this affects your future financial plans.

Flexibility for Other Investments

Saving on the initial down payment can free up funds for other investments. Determine if this aligns with your financial strategy.

#5 – Loan Terms and Conditions

Beyond the interest rate, dive deep into the terms and conditions of your no-down payment loan. It’s important to understand whether there might be pre-payment penalties, additional closing costs, or other fees that might affect the total cost of your mortgage.

Loan Duration

Understand the difference between, for example, a 15-year and a 30-year loan and the financial implications of each.

If you can afford the payments on a 15-year mortgage, you’ll save on interest over the length of your mortgage and own your home free and clear much faster. If you instead choose a 30-year loan, your monthly payments will be lower. However, you will pay more in interest over the life of the loan.

Potential Penalties

Some loans come with penalties for early repayment or refinancing. It’s essential to be aware of any such conditions.

Contact City Creek Mortgage

There’s a lot to think about when you’re getting ready to buy a home. In some cases, getting a no-down mortgage can be a good option and can help you realize your dream of becoming a homeowner. Make sure to understand the implications of a no-down mortgage by speaking with the mortgage experts at City Creek Mortgage. Contact us today for a consultation by calling (801) 501-7950.