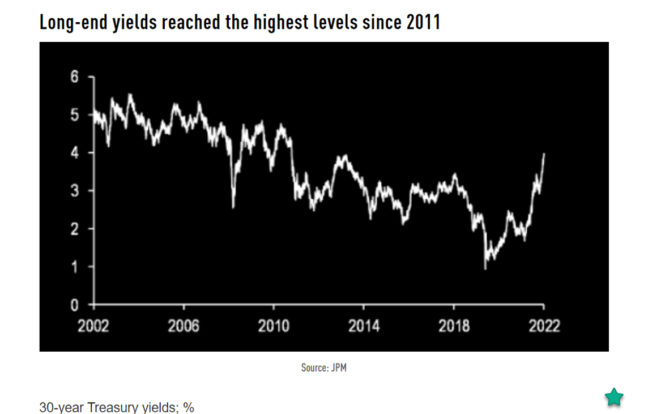

Yields at 11-Year High

If there is one thing the past eleven weeks have taught us, it’s that bad news for mortgage interest rates is sticky and good news is quickly forgotten.

Mortgage rates just can’t seem to catch a break. Every time we see improvement, it is short-lived. In fact, mortgage rates are at it again, moving sharply higher in morning trading.

This comes in advance of a 20-Year bond auction that could cause the upward momentum of mortgage rates to gain speed. Until we see mortgage interest rates stabilize, we should plan on rates continuing to move higher.

As shown in the graph, long-term yields have now reached their highest point since 2011. This has sucked the wind out of the mortgage industry and is now flowing into the housing market.

As we know, there remains a housing shortage, with many estimating we are 4,000,000 homes shy of what is needed to support the current population.

However, affordability has become an overwhelming challenge, with many builders reporting upwards of a 30% cancelation rate as homebuyers are not able to afford the homes at today’s interest rates (overall the new home cancellation rate is around 16%).

Home values and/or interest rates need to fall in order for potential home buyers and builders to achieve equilibrium in the market. Until this happens, we will continue to feel deep pain in all industries tied to mortgage, real estate, and new construction.

As bad as things are, things could get even worse as the day wears on. Locking is the safe play.