Volatility Remains High for Mortgage Rates

Markets continue to digest the Consumer Price Index (CPI) report released yesterday.

In the late afternoon, we saw the mortgage bond market rally hard, bringing mortgage interest rates back to the 6.5% rate we started with yesterday morning. So far this morning, a great amount of volatility has led to mortgage interest rates moving back up to 6.625%.

Hopefully, the markets can soon price in the likelihood that the Fed will stick to their guns and continue to drive rates higher until they see the annualized rate of inflation get back to the 2% rate on the Core level. This would basically remove any hopes of a rate cut in early or mid-2023. Based on these criteria, we would likely not see a rate cut in 2023 at all.

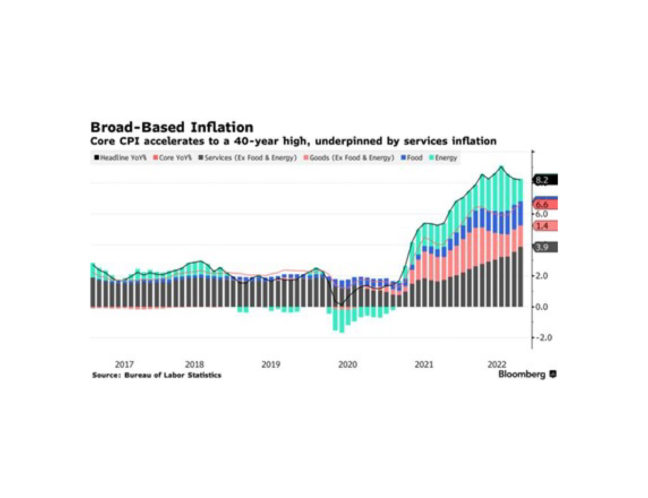

Bloomberg released a great chart yesterday showing the key areas of inflation, where they are, and where they have been. There is hope that we have seen the peak in headline inflation. However, there are many factors that could cause inflation to spike. Most notably, the price of oil.

The recent announcement by OPEC that they plan to reduce their daily output by 2,000,000 comes at a time when we will also be forced to stop adding 1,000,000 barrels a day from the US strategic reserves, as well as just before heading into winter where demand increases as people need to heat their homes.

This is highly inflationary and could lead to oil prices getting back into the mid $90 per barrel range or even higher.

Volatility remains high. With the negative sentiment overwhelming the markets, locking is a safe play.