Today is an Important Day for Mortgage Rates

Today’s release of the Federal Reserve Meeting Minutes from October’s meeting could show just how high some Fed members believe the peak Fed Funds Rate will need to be before the Fed can officially “pause.”

The relationship between the levels of inflation expected in the months to come and the peak Fed Funds Rate is critical in projecting mortgage interest rates in both the near and long term. After the October statement from Fed President Jerome Powell that we can expect to see more Fed rate hikes than previously anticipated, we have only a vague view of what certain members are expecting as a peak rate. We may learn today that the idea of higher rates may not be shared by all Fed.

We are certainly hoping for a reasonable increase in the peak rate projection, which would be in the 5% – 5.25% range. Any surprise above 5.25% could cause a quick upward move in mortgage rates.

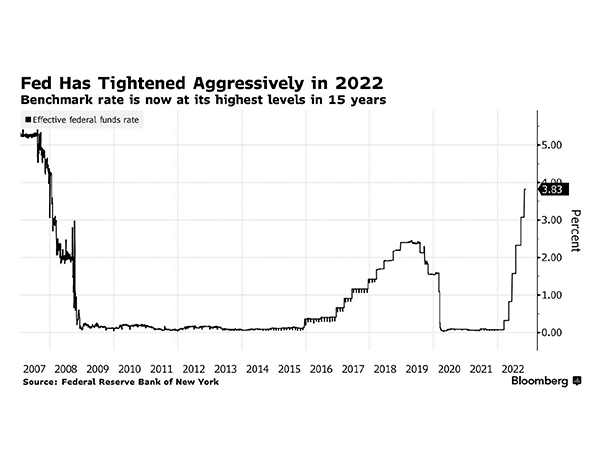

A look a the chart shows just how aggressive the Fed has been so far during this tightening cycle. From March ‘22 to October ‘22 we have seen the Fed Funds Rate move up nearly 4%. The goal of this unprecedented move has been to “front load” the brunt of the hikes to quickly tame inflation.

Although we clearly see many areas of the US economy this has slow growth (take the housing market as a prime example), there is still reasonable fear that large parts of the US economy will continue to show high levels of ongoing inflation.

One of the greatest risks to inflation that is rarely discussed is the Globalization Movement, where jobs that are currently or recently have been performed overseas are brought back to the US. This adds more demand for US labor, which is already in short supply. Further, it drives the costs of production higher, as US employees demand higher pay than the labor in the countries from which the jobs were displaced.

A peaceful, global economy is the best environment to help keep inflation under control. The US consumers’ demands are greater than the nation can fulfill. Bringing too many jobs back to the US creates an environment that is highly inflationary and could put us on a long-term cycle of higher rates to force a deep recession to slow demand.

Hopefully, our leaders recognize the need for peaceful relationships with nations that can help us produce goods at a reasonable cost sufficient to keep up with the US consumer. Maintaining the American standard of living needs to be a priority, even if this means we purchase some goods from abroad.

Fed Minute release days are generally not friendly to the mortgage market. The risk of floating is elevated. Be careful.