The “Locked In Effect” is Destroying Home Inventory

After a seemingly coordinated effort to push the “tighten regardless of consequences to the economy” rhetoric,

on Friday we heard a couple of Fed members expressed concern that continued rate hikes may soon pause as the Fed waits to access the impact rate hikes will have on future economic reports.

Since it can take up to six months to see the results, we agree that it will be prudent to “pause” soon, likely before 2023. The news of at least two members expressing concern was enough to help reverse some of Friday morning’s losses, which was good news for mortgage rates as the day wore on.

However, since good news in the mortgage market has been very short-lived, we must be on guard today. Although markets are trading near flat so far this morning, we must be mindful that we could see that change as the day wears on.

Let’s hope the Fed will continue to soften its rhetoric in the weeks to come so we can see some real softening to the quickly upward-trending mortgage interest rate environment we are now in.

The “Locked In” effect continues to restrict the supply of homes for sale on the market. When you consider the reality of home affordability at multi-decade lows, you must consider who is actually impacted by this. It heavily impacts the first-time buyer market as well as those whose life situations require them to sell their existing home and buy another. The mass number of current homeowners who are locked in at a mortgage rate near 3% will be hesitant to make a move.

Knowing they would have a 50% increase in their monthly payment just to make a lateral move at current interest rates will hold many back who would otherwise love to relocate. This will limit available homes hitting the market and will also prevent a situation similar to what we faced in the 2008 housing market meltdown. Further, it will help support home values from falling dramatically.

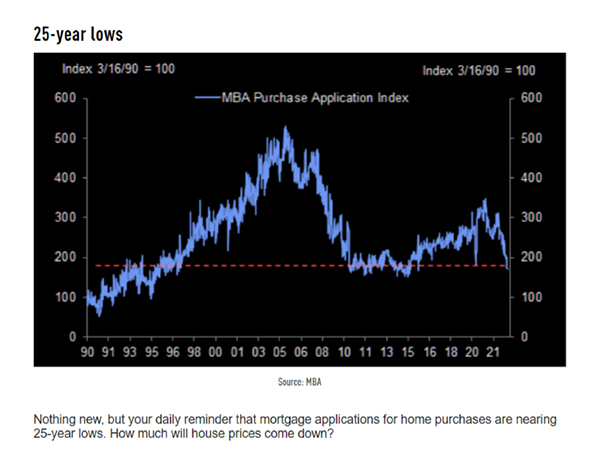

The attached chart shows how all the headwinds facing the mortgage and real estate markets have caused mortgage applications to purchase a home to hit a 25-year low. With last week reporting even higher mortgage rates than the week before, it is probable that purchase applications have declined even further since what is outlined on the graph.

Most economists predict the slowing to continue throughout 2023, likely leading to a severe thinning in the number of mortgage and real estate agents throughout the country. Let’s hope inflation numbers fall more quickly than anticipated, as that would lead to lower mortgage rates, likely triggering a strong comeback in the housing market.

With markets showing slight improvement, many will be tempted to float. Keep in mind, rates have been in a strong upward trading channel. Until we see a clear breakout, we need to assume the worse.

In light of this, the safe play will be to lock. If you choose to float, do so only if you are able to closely watch the bond market.

Mortgage applications and home purchases are nearing 25-year lows.