Take Care of Y’all Chicken

| In an interview 2 years ago, Marshawn Lynch hit his younger teammates who just joined the NFL with some timeless advice. “Take care of y’all bodies. Take care of y’all mental. Take care of y’all chicken.” So today, let’s take care of our chicken!

And by chicken, he means chedda.

The Question Is it better to make extra payments on my house to pay my loan off faster or take that money and invest it?

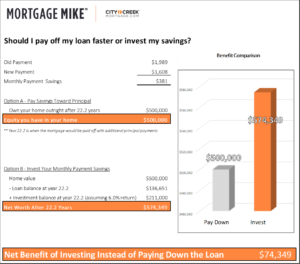

Well, the answer depends on your risk tolerance but let’s look at this strictly financially – what option gets me the most chicken? And I’m not looking at this as a Wall Street Bets enthusiast demanding a 450% return. I’m looking at this as the boring, conservative investor that I am who will take 6%. Now, here is an example of one of our clients who was dropping her rate from 3.375% to 2.600%, saving $381/ month, and wanted to know which was a smarter decision:

Option A) Take her new monthly savings and apply it as a principal reduction every month to pay off her loan early Option B) Invest the monthly savings into a boring investment that produces 6% per year

Now, if you do not need the additional monthly cash flow to keep your household running, both options are a better financial decision than letting your new monthly savings sit in a bank being eaten away by inflation. Option A will reduce the amount of interest you pay over the life of the loan because there is less principal to pay interest on. Option B will result in paying higher interest over the life of the loan, but you will also be building wealth at a 6% annual average (a conservative number).

*SPOILER ALERT* – Option B is going to be a better financial decision every time. But, how much better? |

| $74,349… now that’s a lotta chicken. Let’s break it down.

In option A, we need to remember that the return on your home equity is 0%; however, the loan would be paid off 7.8 years early. Now, to compare apples to apples, we need to look at Option B over the same time frame (22.2 years). At the end of 22.2 years, if you chose Option A, you would own your home free and clear – your net worth would be whatever your home is worth. In option B, your net worth is whatever your home is worth, minus the balance of your mortgage plus your investment balance. If you take the difference of Option A and Option B, you get the net benefit of how much wealthier you could be by using Option B. In this client’s case, it was $74k.

Moral of the story If you are looking for the smartest financial decision, don’t pay more money toward your mortgage. Invest the same amount and over the life of the loan, you will build much more wealth. |