It’s Getting Hot in Here

Last year it was toilet paper but this year’s shortage is of a slightly more necessary resource, WATER.

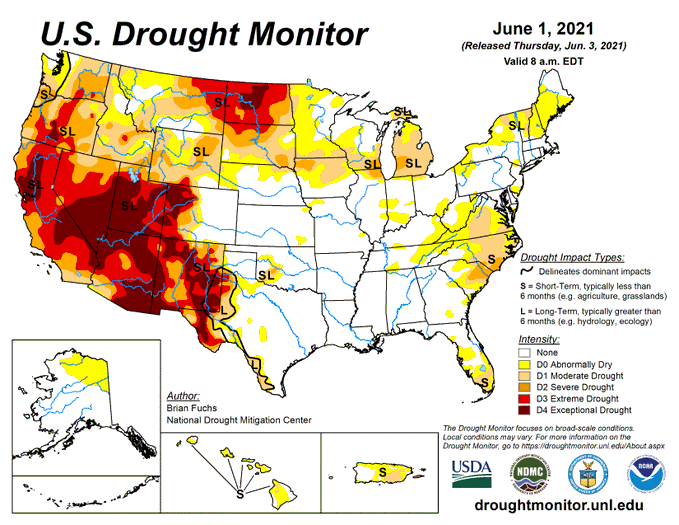

As you may have seen, Utah’s Governor Cox has asked all Utahns to pray for rain. Stating that the state needs divine intervention to get us out of this drought. But it’s not just Utah that is facing this problem. A massive amount of the country is experiencing an abnormally dry start to the Summer.

California for example has placed 41 counties in a state of emergency as it is worried about recreating last years wild fires. As many of you know, California was in a similar water shortage last year where they had 5 of the 6 largest wildfires in modern state history.

Bottom line, a large portion of the country is going to be in some trouble if we don’t get some rain.

Rates – We Didn’t Learn Our Lesson

If there’s one thing that we learned in the craziness that was the 2020-2021 economy, it’s that technical indicators mean nothing in the face of intervention from the government (or massive groups of online day traders). There are a lot of inflationary things happening. The jobs report came in this morning slightly under expectations but still strong, unemployment fell from 6.1-5.8% and the big one is that wages have increased by over 1.5% in the past 2 months. If you think about the Fed’s 2% inflation target, the US seems to be the fast track. In addition, early next week we will be getting inflation numbers and like last month, it’s coming in hot. Last May’s inflation reading was negative due to the economic shutdown. So when you look at a year over year number, it looks a lot higher than it “actually” is.

All of these inflationary things should clearly drive mortgage rates up, right? WRONG.

All of this is overlooked by the fact that the NY Fed Chairman talked about how far away the US is from sustaining itself without massive Fed intervention in this mornings Fed meeting. This means more Fed stimulus and MBS purchases which is good for mortgage rates. MBS’ are up 28 bps so far this morning. We are recommending locking in those massive gains as we approach next week’s inflation reading.