Is it a Good Time to Buy? You May Be Surprised

With Fed members continuing to push the inflationary threat rhetoric, investors could start to panic.

Once again, we believe the Fed has a little more to go in the fight against inflation. However, some members are going way too far in their statements of how high peak rates may need to reach before the Fed stops hiking. One member stated last Thursday that the Fed may need to drive the Fed Funds Rate as high as 7%, which is 3% above current levels.

This is not at all probable and is viewed by many as outright irresponsible to say. We expect to see The Fed pause after an additional .75% – 1% increase, which means the true “pause” could be as soon as February 1st.

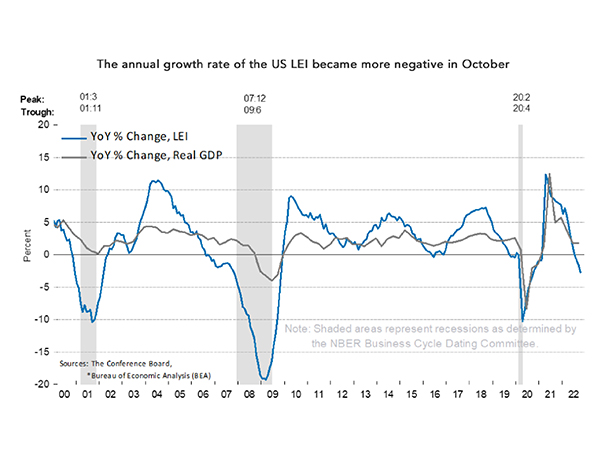

The Confidence Board Leading Economic Index fell by .8% in the month of October, following a .5% decrease in the month of September. As you can see from the image, this is trending significantly lower, following a huge uptick that started in 2020.

This is a forward indicator of what we expect our economy to look like in the months to come. The current trend supports a weakening economy as we head into 2023, which is also deflationary.

As inflation moderates to a more reasonable rate (between 2-3%) in 2023, we can expect to see mortgage interest rates fall below 5%.

The 10-Year Treasury Note yield is battling an important ceiling of resistance. If this level is broken, it will add significant upward pressure to mortgage interest rates. We could see mortgage rates climb 1/8% – 1/4% in a short time frame. This level has held for the past four days, which is a great sign for mortgage interest rates.

You can float if you are able to closely watch the markets. Be prepared to lock should sentiment change.