Hot House Summer

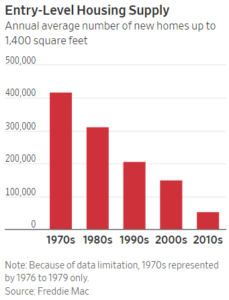

If you’re a first-time buyer looking to kick off your ‘Hot Girl Summer’ with a starter home, your summer probably wasn’t that hot. A decade long trend of entry level home building falling is further contributing to the inventory shortage, especially on the more affordable end.

Freddie Mac defines a ‘entry-level’ house as having 1,400 sqft or less. The consistent downward trajectory of entry level builds is frightening for younger generations who do not have the ability to build equity at a younger age like the generations before them. The Urban Institute estimated that people who become homeowners between the age of 25 and 34 build a median of $150,000 in housing wealth. On the other hand, those who do not buy until 35-44 build $72,000.

Well, That Was Fast…

Recession

re·ces·sion

noun

1. 2 consecutive quarters of declining GDP

The US government got a bit of déjà vu of the 2008 Great Recession at the beginning of 2020 and immediately put their foot on the stimulus pedal. The government put out trillions of dollars in business loans, stimulus checks, security purchases, etc. and it seems to have worked… for now. Most of the stimulus implemented during the covid shutdown are set to expire by September of this year. And according to those who know what they are talking about (The National Bureau of Economic Research’s (NBER) Business Cycle Dating Committee), the US just recovered from its shortest recession ever.

Essentially, covid put a damper on the longest bull run in history which lasted from 2009-2020. We will see how long this next one lasts.

On to the rates:

Mortgage rates had a nice downward fall over the past week – especially refinances due to the elimination of the Adverse Market Fee. However, this morning, mortgage-backed securities are tumbling. They bounced off their 200 DMA yesterday and have more room to fall. We are holding a strong locking bias in the short term.