Home Affordability Slowing Existing Home Sales

After just six very hard weeks in office, UK Prime Minister Liz Truss has resigned.

This came after significant pressure for her resignation from both the opposition as well as her conservative party.

After her budget and tax cut plan nearly destroyed their financial system, she lost the confidence of almost every person in the UK. At this time, she holds the title of being Britain’s shortest-serving prime minister in history.

This morning’s Existing Home Sales report, which tracks closings on Existing Homes, decreased by 1.5% in the month of September. This is not a surprise to many given the impact the massive jump in mortgage interest rates has had to potential homebuyers.

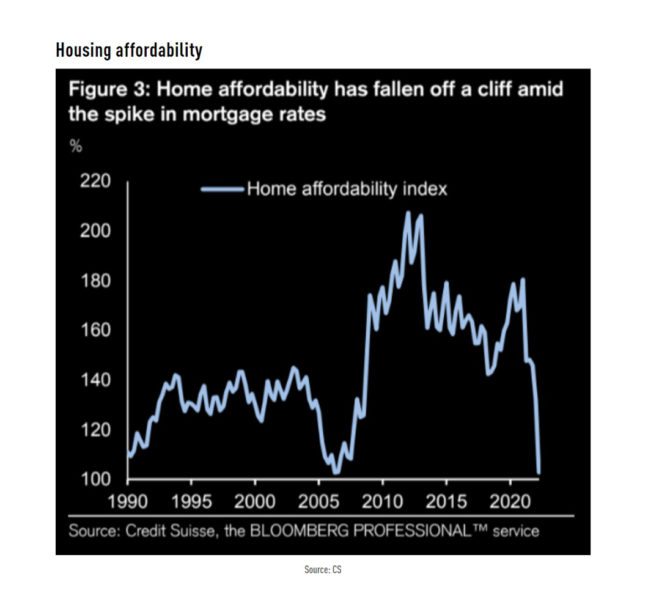

Home affordability has fallen off a cliff amid spike in mortgage rates

As you can see from the image, home affordability has not been this low since 2007. We are in an unsustainable situation, where we will need to see mortgage interest rates and/or home values decline in order to find a more healthy balance in the housing market.

The last time we were in this position it took a combination of lower mortgage rates and lower home values to solve the problem.

The labor market once again showed continued strength, with only 214,000 new unemployment claims being reported for last week. The stubbornness we are seeing is heavily a result of inflated balance sheets from companies that thrived during the pandemic and stimulus waves of money from both the US Treasury and the Federal Reserve.

As we witnessed in tracking billionaire net worth growth, money ends up flowing to the top. That money is being used to delay layoffs. As the reality of imminent recession sets in, we will see the job market stumble and unemployment claims begin to rise.

Since there is no real reason to float, locking is prudent.