ARMs ARE BACK BABY!

So, let’s break them down with a Q&A

What is an ARM?

An ARM or an Adjustable Rate Mortgage is a mortgage (typically 30 years) that begins with a fixed rate for a certain amount of time and then that rate adjusts with the market. The most common ARM is a 7/6. It is a 30-year loan that has a fixed rate for 7 years and then the rate adjusts every 6 months after.

Why would I want an ARM?

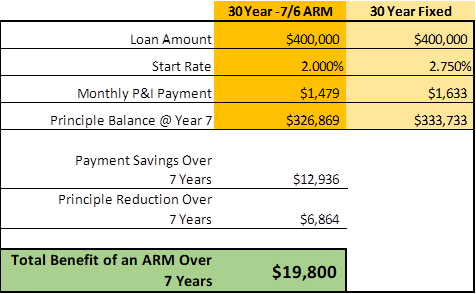

The fixed rate at the beginning of an ARM is lower than the rate of a mortgage with a fixed rate for the entire term of a loan. So, a 7/6 ARM would have a lower monthly payment for the first 7 years than a 30-year fixed mortgage. Given that most people get rid of their loans by selling their home, refinancing, or taking cash out every 3-5 years, most people won’t make it to the adjustment at year 7. So it is a great tool to create cash flow through a lower monthly payment for most families. And because you have a lower rate for the first part of the loan, you end up paying more money toward your principle instead of interest.

So, the total benefit of an ARM is the amount of money you save in your monthly payment + the lower principal balance your loan would have because of the lower rate. Total Benefit Example:

An ARM is something that everyone should consider but especially anyone who wants to make additional principal payments to pay off the loan faster! Why? Because if you make additional monthly payments, you get even more of a benefit during the amount of time the rate is fixed below the 30-year rate. This allows people to save both money and time.

You should consider an ARM if:

- You could use some cash flow

- You care about your budget

- You want a lower monthly payment

- You want to pay your home off faster