Today’s Mortgage Rates in May 2023

May 26, 2023

While rates continue their climb, we will maintain a locking bias.

Less Spending / More Taxes

The Fed’s preferred gauge of consumer inflation was released today, revealing that prices are continuing to rise at a pace more than double the Fed’s comfort level – 4.7%.

Two tools that could be used to cool inflation are reducing federal spending and increasing income tax rates… These are exactly the issues in the current debt ceiling debate.

Consumers Are Not Slowing Down

Consumers are continuing to spend money, with a 0.8% increase in spending last month alone. However, this notable increase is primarily concentrated in gasoline and car prices. Such a strong upsurge is not helpful when the Fed is working to slow down the overall economy.

Inflation Spiral

The Fed is facing challenges in pausing interest rate hikes while the labor market remains strong, inflation persists, and consumer spending remains robust. These factors have contributed to the recent climb in mortgage interest rates over the past few weeks.

Currently, rates are 1.25% higher than they were just seven weeks ago, further straining the housing market. If economic activity continues to strengthen, we can anticipate more rate hikes from the Fed in the coming months.

May 25, 2023

There remain no signs as to when the rise in rates will stop. We are now 1% higher than we were a few short weeks ago. We will maintain a locking bias.

25% Chance Of A Default???

JP Morgan Chase reports that the odds of the US defaulting are currently at 25% and increasing daily. The deadline for reaching an agreement is projected to be within the next 6-20 days. Unfortunately, Democrats and Republicans are still far from reaching a mutually acceptable agreement.

Both parties are urging their leaders to stand firm and not give in to the opposing side’s demands. While it’s unlikely that our leaders will let the country go over the cliff, there is a possibility of prolonged uncertainty. As we wait for a resolution, expect interest rates to continue rising.

Income Limit of $4k Down Payment Grant Lifted

Qualifying for our $4,000 grant has become easier, opening up eligibility to a larger pool of prospective homebuyers. This is great news for the real estate market, especially for those facing challenges with down payments. We anticipate high demand for this limited-time offer. If you know someone who could benefit from an additional $4,000 towards their down payment, please share this message with them.

Home Sales Down

The number of Pending Home Sales, which measures signed contracts on existing homes, did not show any month-over-month improvement from March to April. This indicates a significant weakness in our housing market, especially considering the usual increase in home-buying activity during the spring season. Compared to this time last year, pending home sales have declined by 20.3%. With mortgage rates climbing back up, with the national average now above 7%, housing sales will face even stronger headwinds.

May 23, 2023

Mortgage rates have moved 5/8% higher in the most recent three weeks. There is no indication as to when the rapid climb will stop. We will maintain a locking bias.

Let’s Hope For A Compromise

Inflation happens when there’s too much money chasing too few goods. One of the reasons inflation peaked at nearly 9% is due to the massive cash flow from the US Treasury Department through Covid Relief payments. This was funded by tax dollars and extensive government borrowing. To tackle inflation, we can take the opposite approach: raising taxes, which would have a deflationary effect, and cutting federal spending.

The challenge lies in the differing views between Democrats and Republicans, with disagreements over spending cuts and tax rate increases. This is causing a stalemate over the debt limit. Both spending cuts and increased taxes are necessary to curb inflation. Let’s hope for a compromise soon.

Stocks Are Doing Well

The stock market is currently at a critical juncture. Apart from a brief period in August 2022, the S&P is near its highest levels in over a year. The current situation suggests that the next move for the market might be a decline. However, once a debt limit agreement is reached, it could fuel significant gains in stock prices as we enter the second half of 2023. It’s important to note that conflicting data points are making it challenging to make investment decisions, let alone predict future mortgage interest rates.

A $4,000 Down Payment Grant

With mortgage interest rates on the rise, it’s crucial to explore creative solutions to help homebuyers enter the market. One option is the 2/1 buydown, which temporarily lowers monthly payments to a more comfortable level. Additionally, we have a $4,000 grant available for qualified first-time buyers, and the best part is it doesn’t need to be repaid. If you’d like more information on either of these options, reach out to one of our salary-based mortgage planners.

May 22, 2023

There are no positive changes regarding mortgage interest rates. We expect to see rates continue to climb at least until we have assurance the US will avoid a default. We maintain our locking bias.

Last Week Was A Roller Coaster

Last week was tough for the housing market. Mortgage rates went up, leading to a decline in mortgage applications. Additionally, there were fewer new listings, but more properties available for sale. This isn’t great news, especially during the busy spring buying season.

Unfortunately, the housing market’s health is closely tied to mortgage rates, and if they continue to rise, we can expect to see more weaknesses in housing statistics. To make matters worse, the ongoing debt ceiling situation doesn’t give us much hope for immediate improvement.

Volatility From The Debt Ceiling

Both the stock and bond markets are preparing for a highly volatile week due to news about the debt ceiling negotiations. Recent developments indicate that there may be moments of hope followed by times when congressional leaders abandon talks, blaming the other side for irrational behavior. Brace yourself for potential ups and downs.

Additionally, as we approach a possible default, mortgage interest rates are likely to keep increasing. The Treasury Secretary has extended the projected dates of default from June 1, 2023, to June 15, 2023. It would be great if our leaders could reach an agreement soon to prevent further harm to Americans.

Cheap Gas Is a Weakness

Oil prices have dropped significantly and have remained around $70 per barrel for several weeks. While this may seem like good news for consumers at the gas pumps, it can also indicate weakness in the economy. During the COVID-19 pandemic, when demand for travel and commuting plummeted, oil prices hit rock bottom. Suppliers were even paying manufacturers to take the oil off their hands. With the recent massive cuts in oil supply by OPEC, the low demand levels raise concerns about a potential recession.

May 19, 2023

Rates have taken a beating the past couple of weeks. If a debt deal is not made soon, things will get much worse. We maintain our locking bias.

40/60 For A Rate Hike

The Federal Reserve is currently divided on whether to continue raising interest rates or maintain the current levels. Several Fed members have advocated for further hikes, causing mortgage rates to rise once again. The likelihood of a rate hike at the next Fed meeting has increased to around 40%, a significant rise from near 0% a few weeks ago. We are awaiting remarks from Fed Chairman Jerome Powell later today, which may sway the odds in one direction or the other. Powell has shown more openness to the idea of a pause recently, recognizing the prudence of such a move.

The Dalio Effect

Ray Dalio has expressed concerns about the US debt ceiling, adding fear to the markets. He believes that Congress will eventually reach an agreement to raise the ceiling. However, without meaningful limits on federal spending, the US financial system could collapse in the future. Dalio’s research and insights from his authored books highlight the historical cycle followed by superpower countries, which eventually face an end to their dynasties. Given our trajectory, we should not assume exemption from this cycle.

Prep With A HELOC

As the likelihood of a recession continues to rise, it is crucial to protect your finances. One way to do this is by having a home equity line of credit ready to use in the event of a job loss or to seize investment opportunities. Building a cash reserve and consolidating debt are the two most important steps to take during this economic cycle. Our team is here to assist you. Please call us for more details.

May 17, 2023

Unless a debt limit deal is reached, rates will continue to climb. Further, even after a deal is done, massive amounts of treasuries will need to be sold to replenish the funds needed to pay coming bills. This will also add upward pressure on interest rates. We will maintain a locking bias.

An Inventory Recession

Our housing market remains in an inventory recession, with low active inventory and limited new listings. The current spring purchase season indicates a higher number of potential homebuyers than available homes for sale. We hope that many homeowners are waiting for the end of the school year before listing their homes to avoid disruptions for families. If this doesn’t happen, it could be a challenging season for hopeful homebuyers. However, a longer-term view of active inventory suggests that we are likely at the bottom, and charts indicate better times ahead.

The Treasury Crisis

Leaders of both political parties have confirmed that the US will not default and that a debt ceiling agreement will be reached. While the stock market has responded positively, bond investors remain skeptical. Banks and financial institutions are reducing exposure to interest rate-sensitive investments as a defensive measure. Once an agreement is reached, bond investors are likely to re-enter the market, leading to lower interest rates.

Treasury Secretary Janet Yellen’s statements indicate that we will have clarity within two weeks. Depending on the outcome, interest rates may significantly rise or fall. Banks will continue to sell Treasuries until a deal is sealed, and the longer it takes, the more panicked the bond market will become.

Jobs Are Still Too Strong For The Fed

The latest data reveals 242,000 new jobless claims, which is below the approximately 325,000 weekly average needed for the Fed to consider the labor market adequately slowed. The Fed has made it clear that it will not cut rates until they see a significant improvement in the labor market. Currently, there are limited signs of softening.

May 16, 2023

The same song and dance with mortgage rates continuing to move higher. What we need to see if an agreement that will prevent our government from defaulting. In the meantime, we will maintain our locking bias.

A Rise In Financial Hardships

Total consumer debt has reached a new record high, surpassing $17 trillion for the first time ever. As the Federal Reserve has raised short-term interest rates by 5% since last March, many consumers are burdened with high monthly debt payments. Consequently, they are reluctant to give up their low mortgage rates to consolidate their debts for a lower monthly payment. With increasing consumer delinquencies, we may see a rise in divorce rates and other financial stress-related issues.

Hopefully, people will divorce their low mortgage rate over divorcing their spouse.

Some Optimism

Billionaire hedge fund manager Paul Tudor Jones predicts that the Federal Reserve has finished raising interest rates in its fight against inflation. He also anticipates the stock market to climb higher as the year progresses. Given his influence and credibility among investors, this could boost confidence for those who have been hesitant to bet against the Fed’s continued rate hikes.

The next Fed policy meeting is scheduled for June 10th, when we will receive confirmation regarding a potential rate hike pause. While some Fed members suggest the possibility of more hikes, betting on a pause carries risks. The Fed’s credibility has been eroded, and aligning bets with Paul Jones seems more prudent.

A Treasury Selloff Is Raising Rates

Banks are selling substantial amounts of US Treasuries to meet the demands of depositors seeking withdrawals. This increased supply of bonds in the market is driving down the value of US Treasuries. As a result, interest rates have been rising over the past few weeks. It appears that the situation may worsen before any improvements are seen.

May 15, 2023

Mortgage bonds remain under pressure. We will continue our locking bias.

A Utah Bubble? Nah.

The housing market in Utah has experienced a downturn, with fewer homes being sold at lower prices. This is mainly due to higher mortgage rates and buyer concerns about future price drops. However, the market has stabilized, and in some local markets, home values are holding steady or even strengthening. With limited inventory, it would take a significant increase in mortgage rates to be concerned about a housing bubble.

So long as the US Treasury avoids default, home values are likely to strengthen in 2023.

A Delayed Buying Season

Typically, the second week of May sees a decrease in home purchase mortgage applications as we enter the summer season. However, if mortgage interest rates start to fall, we may see a delayed surge in homebuyers. Due to low levels of seasonal purchase applications, we expect a slower buying season in 2023. Many potential buyers are considering renting out their current homes instead.

Lower rates would encourage current homeowners to sell, which would support buyer demand.

Praying for An Agreement

There is hope for an agreement to raise the US Treasury debt limit and avoid default. It’s crucial for every voter to closely monitor this situation, given the catastrophic consequences of a default. If a deal is reached soon, we can expect US stock prices to rise, and there’s a possibility of interest rates falling. We should have more information following the meeting between President Biden and House Leader Kevin McCarthy.

May 12, 2023

Mortgage bond prices have not been able to break the current ceiling that has been in place since last fall. As a result, we will maintain our locking bias.

If The US Defaults… Rate Are Going Up

If lawmakers fail to reach an agreement to keep the US government funded, the US Treasury may default on its obligations, causing mortgage interest rates to increase to 8.4%. This would be catastrophic for our housing market and could force many households into bankruptcy. A default could happen in as little as three weeks.

Is Another Bank Failing?

While the Fed continues to assure us that banking is fine… another bank is crashing. PacWest Bank’s deposits have dropped over 9% in the last week and is a frontrunner for the next failed bank. The Federal Reserve may have to quickly reverse course to try to stabilize the situation.

Now Is The Time For a 2/1 Buydown

As the Spring Buying season brings more and more demand, a lot of people believe seller concessions will again be a thing of the past. With, the average number of offers on homes rising, sellers have less and less incentive to give credit.

So, if you’re buying, make sure you ask for a concession ASAP in case they are right.

May 11, 2023

Unless the bond yields can break below the floor, we will maintain a locking bias. However, once this floor is broken, we will see a nice improvement to mortgage rates. It will eventually happen.

How Long Until The Fed Says Something?

The yields on the 10-Year Treasury note have fallen sharply since Wednesday’s CPI report. Although we have tested this level several times since we have not been able to break below it. Unfortunately, I fear the Fed will step in once again to prevent a move lower in mortgage interest rates. This could happen before the US economy sees an uptick in the unemployment rate.

Mortgage Rates Have A Fever

The spread between mortgage interest rates and the yield on the 10-Year Treasury note is an indication of the mortgage industry’s health. In a normal market, the spread is about 2%, but currently, it is over 3%… so the industry is sick. However, if we can see the mortgage market stabilize, there is room for mortgage rates to fall.

Will We See Jobs Go Down?

New unemployment claims rose by 22,000 last week to 264,000. This indicates that we are now at an inflection point in the labor market, and we will likely see the beginning of the job loss recession that the Fed has been hoping for. However, we still have more room to go to hit the Fed’s target rate of unemployment.

May 10, 2023

Mortgage bonds are in a tough battle with their 200-day moving average. Until bond prices have made a decisive move to avoid this critical level, the safe play is to lock.

We’re Below 5%

This morning’s Consumer Price Index (CPI) report showed that consumer inflation is coming down, just not as quickly as the Fed would like to see. In the month of April, prices rose by .37%. This is nearly double the pace the Fed targets as an acceptable monthly increase.

A deeper look into the data shows that some of the pricing pressure came from segments that are temporarily higher than normal, so we should see overall inflation numbers fall more dramatically in the months to come. The most encouraging news is that the annualized rate of inflation is now beneath 5%, which is a big drop from the high point in this inflationary cycle of approximately 9%.

Some Confidence is Coming Back

Mortgage applications in the US climbed sharply last week, likely fueled by hopes of lower rates making home purchases more affordable. Lower rates should also help increase active inventory levels, providing more inventory for potential homebuyers to choose from. Let’s hope this hits in time to meet the elevated seasonal summer buyer demand.

Less Fees For Buyers

We finally had good news for mortgage borrowers today! After the mortgage industry fought a hard and bloody battle with the FHFA (which sets guidelines and pricing for conventional mortgage loans), a planned fee increase for borrowers who have a debt-to-income ratio greater than 40% has been rescinded.

This is especially helpful for first-time buyers who are already pushing their payment limits with current home values and interest rates. This will help save them money by having a lower mortgage rate.

Now is not the time to be charging anyone more money to get a mortgage. This was a good move and one the mortgage and real estate industries should be celebrating.

May 9, 2023

Mortgage rates have been trending higher for weeks. We need a downward surprise in tomorrow’s CPI report to help rates fall. Given the risks associated with tomorrow’s report, the safe play remains to maintain a locking bias.

Compromise Isn’t Easy

President Joe Biden is sitting down for the first time in three months with House Speaker Kevin McCarthy to discuss how to make progress on the debt ceiling. Although this is a step in the right direction, hopes for a resolution are low. McCarthy is committed to requiring spending cuts in return for pushing through a rise in the debt ceiling, while Biden wants the increase.

The key point to this is that a potential default would have dire consequences. This is a battle that will more than likely be resolved prior to a US default. However, if it is not, we can expect to see short-term treasury prices rise in response, which will be good news for interest rates.

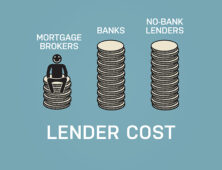

Brokers Save Consumers Money

Research conducted by the CFPB shows that mortgage brokers are cheaper than both banks and non-bank lenders, saving consumers thousands of dollars on each loan they close. Pricing competitiveness is one of the many reasons why brokers are gaining market share at an astonishing rate. This is good news for real estate agents who are looking for ways to help their clients qualify for higher home prices as the rate savings is reducing monthly payment burdens on their buyers.

Lower Rates This Year

Although it has been a long road of higher rates for the past 17 months, it is widely believed that we will see mortgage rates fall as we move into the second half of 2023. In a nutshell, mortgage rates will rise or fall based on inflation. If we see inflation numbers fall, that will trigger mortgage rates to follow. Although it may not happen with tomorrow’s CPI report, it could be another 30, 60, or 90 days, but it will happen. Lower rates will drive active inventory levels higher, which will help thaw out our frozen housing market.

May 7, 2023

In the meantime, we will maintain a locking bias.

The Debt Ceiling Chaos

According to US Treasury Secretary, Janet Yellen, we can expect to soon see “Economic Chaos” unless the debt limit is raised. Current estimates show that without a deal between the Republican House of Representatives and the Democratic-led Senate is made, the US government will be forced to default on its obligations by early June.

Even if the two legislative branches agree, it will also need to be approved by President Biden, who has also shown an unwillingness to negotiate on spending priorities. With odds strongly favoring a recession, this could be the final straw that triggers the significant economic downturn that most economists are already anticipating.

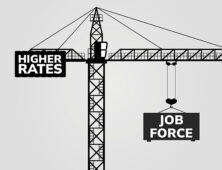

Jobs are Still Strong

Mortgage bonds are still suffering from Friday’s Bureau of Labor Statistics (BLS) report that showed the US labor market remains far too strong for the Fed to consider cutting rates any time soon. It seems that even under the intense pressure of higher interest rates, the labor market is not backing down. Higher interest rates are the counterbalance to an overheating job force.

However, the current rate hiking cycle is challenging this conventional belief. Unless we see an unforeseen event such as Congress allowing the US Treasury to default on its obligations, it is unclear what event will rapidly slow the pace of new hires. It could take higher rates to remain in place for an extended period before we see employers slow their hiring enough to make the Fed feel comfortable cutting rates.

Slowly But Surely

Wednesday’s Consumer Price Index report may do little to help calm inflation fears. Based on what the market is currently anticipating, we could see the Core Rate hold at current levels or possibly tick slightly higher.

That would not be good news for the Fed, who has been doing all it can to restrict economic activity and slow the pace of inflation. The good news is that we will see inflationary pressures ease. Just could take more time than originally planned.

Mortgage bonds have once again broken beneath their 200-day moving average. Hope for lower rates to fall in the results of Wednesday’s CPI report. We’ll discuss more about that in tomorrow’s update.

May 5, 2023

This morning’s news is pressuring mortgage rates higher. We will maintain a locking bias.

Labor Markets Still Strong

The labor market continues to flex. The Bureau of Labor Statistics (BLS) shows that there were 253,000 new jobs created in the month of April. Once again, the market significantly underestimated what the report would show. In this case, the market anticipated about 160,000 new jobs in the labor market. In addition, the market anticipated that the Unemployment Rate would rise from 3.5% to 3.6%.

However, the actual Unemployment Rate fell to 3.4%, matching multi-decade lows. Hopefully, economists will get better at predicting labor growth.

But, There Were Some Negative Revisions…

There were a few details in the BLS report that take away some of the shock of the high headline job growth number. There were negative revisions to the prior two estimates that took away a total of 149,000 jobs. When you take April’s strong job number and subtract the job losses of the prior two months, it is a net impact of 104,000 new jobs total. In addition, one of the reasons we saw such strong job gains was because of what is called the Birth/Death model where the BLS estimates the number of new businesses relative to closed businesses.

These nebulas estimates accounted for an additional 378,000 new job creations. Therefore, we could see more downward revisions in the next couple of months.

I Hope The Fed Notices

One of the key reasons the Fed has continued to drive short-term rates higher is due to the strength of the labor market. The Fed wants to see the Unemployment Rate increase to about 4.5% and to see wage growth slow to a monthly pace of about .2% – .3%. In the month of April, average hourly wages increased by .5%, which is well ahead of the Fed’s target. Hopefully, we start to see more slowing in the labor market so that we can hopefully see the Fed cut rates at some point in 2023.

May 4, 2023

Mortgage bonds are right now at an insanely critical level. If tomorrow’s BLS report shows a weaker-than-expected labor market, we could see rates start to tick lower. However, the risk of floating is very high.

The Last Hike?

The Fed raised rates by another .25%. However, they did signal that this may have been the last. The question going forward is how soon they will be forced to cut rates.

Personally, I strongly believe that the banking crisis is far from over and the Fed will be forced to cut prior to the end of 2023. Although the Fed is going to great lengths to assure the market that our banking system is strong, it seems the market no longer believes what the Fed is telling us.

Can Unemployment Actually Rise?

Tomorrow is the release of the Bureau of Labor Statistics (BLS) Jobs Report which will show how many US jobs were created in the month of April. The market is expecting about 180,000 and for the Unemployment Rate to increase from 3.5% to 3.6%.

The Fed is fiercely attacking the labor market, hoping to see more Americans unemployed. So far, they have not been able to tame this savagely unhealthy labor market. Although we could be surprised, I expect tomorrow’s report to show the labor market is still strong.

Here Come More Supply Issues

According to Black Knight, home prices rose .5% in the month of March, which follows an increase of .4% in February. Since we experienced home values declining in the last half of 2022, we are now waiting to see if this upward trend continues, or if this is just a short-term blip higher. Based on market forces, I expect to see housing demand improve as mortgage rates start to fall in the months to come. This will help provide support for home values going forward. Now is the time for buyers to get off the fence and begin the process.

May 2, 2023

Mortgage bonds had a tough day yesterday, with rates increasing by ¼%. The market is clearly nervous about Wednesday’s Fed announcement. The market hopes the Fed will announce that they intend to pause future rate hikes at this time. The fear is that they will signal there is more work to be done in the fight against inflation. Therefore, investors are taking a cautious approach. In the meantime, the safe play remains to lock.

Home Buying is Slower Than We Hoped

We are now in the month of May, which is generally the end of the busy season for mortgage purchase applications. Based on the year-to-date purchase application volume, there’s a lower volume of buyers than we would hope for.

When polled, prospective home buyers cite high-interest rates and elevated home prices as the reason for waiting. Most hope that when rates hit the mid-5% range we will see a flood of buyers hit the market. I think rates need to start with a 4 before we see enough people willing to sell to support buyer demand.

1 Month Away

One of the most accurate indicators of a pending recession is an inverted yield curve. When looking at past recessions, the average time from the 2 and 10-year treasuries inverting and a recession is 11 months.

Well, we are now 10 months out, meaning we are one month away. Although the majority of economists who believe a recession is imminent estimate that it will hit in the 3rd or 4th, consumers will feel it before it is announced.

Down Payment Grant

If you have buyers who need help with their down payment, have them reach out to us. We have:

– a $4k or 2% down payment grant for borrowers with lower income

– a 0% down program in UT

May 1, 2023

Mortgage bonds continue to fight strong ceilings of resistance that are preventing mortgage rates from improving. Unless a decisive move above their 200-day moving average can be made, we will continue to suggest a locking bias.

If Fed Chairman Powell states on Wednesday that they now expect to pause hiking rates, that could provide the market with the momentum needed to break through the aforementioned ceilings. However, my expectations of Chairman Powell are very low at this point.

Where dat money go?

We have experienced the largest drop in overall money supply since this metric started to be tracked in 1959. Given the pace of decline in the amount of money being circulated, there is little chance that inflation will continue to be a problem for much longer.

In fact, we could experience deflation at some point in the months to come, unless the Fed changes direction and begins to loosen monetary policy.

25 BPS

The Federal Reserve is widely expected to announce another 1/4% rate hike on Wednesday. I believe this will be the final hike before the Fed chooses to pause while they give some time for this elevated level of rates to work their way through the system. The key debate at that point will be when they decide they need to cut rates, which I believe will heavily be reliant on how deeply issues are in the banking industry.

Since many banks have been forced to offer higher interest rates on deposits to entice large account holders to keep their money in banks, this will further exacerbate the issue. I expect to see more banks asking the Fed for support in the months to come. This will influence Fed policy, as they seek to provide stability to our financial system.

Trouble in the Commercial Space

We can add Charlie Munger to the growing list of experts warning of trouble ahead for the commercial real estate industry.

First of all, commercial loans are often written on 5 to 10-year terms where the loan must be renegotiated at current market rates when the term expires. That means that someone who took a loan out 5 years ago when commercial lending rates were lower than they are today could be facing a forced rate increase up to today’s market rate – pushing the payment of their loan higher.

Combined with a high probability of the US economy falling into a recession in the months to come, we could see an environment where many businesses are no longer able to keep up on their loan payments. Although not nearly as big of an issue as we faced back in 2008, this could cause downward pressure on the values of commercial space, which will also make it difficult for building owners to increase rents to help them afford the added payment burden.

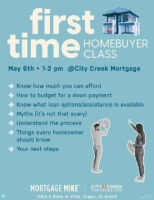

Sign Up Your FTHBs

Everything is just harder when you don’t know. This is why we are hosting a First Time Home Buyer Class on May 6th.

If you have any potential home owners who need a little more education – what loan programs are available, what about assistance, what price range they should be looking in and much more. Please call us for more information and to get signed up 801-501-7950! 😊

April 28, 2023

The bond markets remain in a tough battle over 200 day moving averages. Unless mortgage bond prices break above this critical level, we will maintain a locking bias.

Slowly But Surely

The Fed’s favorite gauge of consumer inflation was reported for the month of March, showing a strong drop. In March, headline inflation rose by just .1%, dropping the annual rate from 5.1% down to 4.2%.

When you strip out food and energy prices, the Core rate fell from 4.7% down to 4.6%. Although we are still well above the Fed’s target rate of 2%, we are seeing inflation slow. In the months to come, we will see this rate drop into the 3’s, at which time we can expect more improvements in mortgage rates.

Another Hike Is Coming

Next Wednesday, the Fed will announce another 1/4% increase, which will push the Fed Funds Rate above 5% for the first time since 2006. We all remember, the US economy fell into a deep recession and the Fed was forced to cut rates starting in 2007. The Fed held rates high for too long and then were slow to respond to the economic crisis that was developing.

We can expect spect to see the Fed once again hold rates high for longer than they should, which means that we may not see cuts until 2024. Although the market is currently pricing in for the Fed to cut in later 2023, I have little faith the Fed will do that. Their history of missing the mark is far too strong.

Sign Up Your FTHBs

Everything is just harder when you don’t know. This is why we are hosting a First Time Home Buyer Class on May 6th.

If you have any potential home owners who need a little more education – what loan programs are available, what about assistance, what price range they should be looking in and much more. Please call us for more information and to get signed up 801-501-7950! 😊

April 27, 2023

After an attempt to break above its 200-day moving average, mortgage bonds have retreated sharply. The market is certainly waiting for tomorrow’s PCE report prior to making any significant bets on the near-term direction of mortgage interest rates. The safe play remains to maintain a locking bias until we see market news that can help push mortgage bond prices above their 200-day moving average.

Misleading Headlines

We’ve all seen the headlines that people with lower credit scores now get better mortgage rates than those with higher credit scores… But that’s all they are, headlines.

It is true that the spread between low credit score borrowers vs. those with high scores will narrow; however, people with lower scores will continue to be charged more.

Regardless, this is a controversial move that seems to have a political bias at its core. Although Fannie and Freddie are under government conservatorship, I do not think either should be used to push any political agenda.

The pool of mortgage loans sold on the open market should be priced based on the default risk of each individual loan. Both political parties have been guilty of using Fannie and Freddie as pawns, and I fear this could be one of those moments. The mortgage and housing industries are hurting enough. This is the wrong time to be charging anyone more for a home mortgage.

Consumers Are Still Swiping

This morning’s GDP showed that although businesses slowed their spending, consumers haven’t. Overall, the report showed that the US economy grew at an annual rate of 1.1% in Q1 of 2023, which was beneath the 2% the market anticipated. A deeper look into the report shows that business inventory declined sharply, meaning that unless consumer spending slows in the second quarter, we could see businesses ramp up manufacturing to keep up with demand.

However, with consumer debt levels rising at unprecedented rates, the current pace of consumer spending is not sustainable long-term.

Unemployment

The labor market remains tight, as shown in this morning’s Unemployment Claims report. Last week, there were 230,000 new claims. This represents a drop of 16,000 from the week prior. Although claims have been increasing, we are a long way from a number the Fed would like to see.

The Fed is intent on breaking the labor market, which would require claims to hit a 4-week average of nearly 320,000. Once that happens, we will likely see the Fed begin the process of reversing course and cutting rates.

Everything is just harder when you don’t know. This is why we are hosting a First Time Home Buyer Class on May 6th.

If you have any potential home owners who need a little more education – what loan programs are available, what about assistance, what price range they should be looking in and much more. Please call us for more information and to get signed up 801-501-7950! 😊

April 25, 2023

Unless mortgage bonds break above their 200 day moving average, the safe play remains to maintain a locking bias.

Gen Z Has Entered the (Housing Market) Chat!

Gen Z is stepping into the housing market, adding to the pool of first time home buyers at a pace faster than what their parents’ generation experienced. Latest reports show that first time homebuyers continue to represent the largest demographic of people buying homes, averaging between 27% to 33% of all new and existing home sales in the US.

This is good news for our long term housing market, as many believed we would see the younger generation prefer a more transitory lifestyle rather than being tied down with a mortgage. Given the impact homeownership has on creating long term wealth, it is good to see young people eager to become homeowners.

Are We Almost at the End of the Rate Hikes?

The 10-Year Treasury Note yield has made a bold move lower, breaking beneath its 200 day moving average. This is the market’s way of stating they believe the Fed should pause and that we are nearing the end of the rate hiking cycle. If the 10-Year can remain beneath its 200 DMA, this will help mortgage bonds as they look to soon face a similar battle.

Although it may take Friday’s PCE report to provide mortgage bonds with the strength needed to win this battle, we will have a better picture of the near term direction of mortgage rates.

Home Values Creeping Back Up

After a few months of weakening home values, Case Schiller reported that home values across the US rose by .2% in the month of February. This is great news for the housing market and could spur some who have been sitting on the sidelines waiting for values to fall to reconsider their decision to delay purchasing. Past history shows that once home values transition from falling to climbing higher, the fear / greed index shifts and more consumers rush to buy.

Let’s hope this move in values continues higher and that we see more sellers willing to list their homes. If we combine this with falling mortgage interest rates, the stars may align and bring much needed life back into the housing market.

Everything is just harder when you don’t know. This is why we are hosting a First Time Home Buyer Class on May 6th.

If you have any potential home owners who need a little more education – what loan programs are available, what about assistance, what price range they should be looking in and much more. Please call us for more information and to get signed up 801-501-7950! 😊

April 24, 2023

The 10-Year Treasury Note yield is now in a battle with its 200-day moving average. A break beneath this level would be great news for mortgage interest rates. However, since breakouts are the exception and not the rule, we will maintain a locking bias as we wait to see how this battle plays out.

$4,000 Down Payment Grant

Eligible first-time homebuyers now have access to a grant that is up to $4,000, or 2% of the price of the home, whichever is less.

Although this new program has income limit requirements, thousands of homebuyers across the US are expected to take advantage of the gifted downpayment while it is available. If you are a real estate agent or a first-time buyer, reach out to one of our team members for details. Since this is an actual gift to homebuyers, it will only last for a limited time.

It’s Time to Pause

The US economy shows overwhelming signs of slowing, adding fears that the Federal Reserve will once again miss the mark and overtighten monetary policy.

In reality, the Fed has a terrible track record of knowing when to move rates and how far to move them. May 3rd will be the next Fed meeting, where they are anticipated to announce another ¼% rate hike.

It is estimated that there is the equivalent of ¾% in unrealized rate hike impact that is still coming down the pike. This is in part because of tightening credit policies as well as the delayed impact of past rate hikes yet to be felt. The hope is that between now and May 3rd, the Fed comes to the realization that the time to pause is now.

Inflation on Friday

On Friday, we will receive an update on the Fed’s favorite gauge of inflation, the Personal Consumption Expenditures (PCE) report. Just like we saw in the recent CPI report, we expect to see a sharp drop in the headline number and a minimal drop in the Core rate (which is what the Fed is most concerned with).

The key point will likely show that inflation is still running hotter than the Fed would like, but is really much closer to 3% than the annualized rate will imply. We do anticipate more meaningful drops to show in the next 90 days, which will be good for mortgage rates as we move into the summer months.

Everything is just harder when you don’t know. This is why we are hosting a First Time Home Buyer Class on May 6th.

If you have any potential home owners who need a little more education – what loan programs are available, what about assistance, what price range they should be looking in and much more. Please call us for more information and to get signed up 801-501-7950! 😊

April 21, 2023

We continue to see upward pressure on mortgage rates. We will maintain our locking bias.

Housing Inventory Problem Once Again Confirmed

To say that we have a housing inventory problem is an understatement. We are now 165,000 away from the lowest housing inventory in history. At a point in the year where we generally see new listing levels climb, active listings actually fell once again last week.

It is not helping that a number of large asset managers and private equity firms are actively buying up single family homes with the intent of converting most into rental homes. Also, after the month of May we generally see new listing activity slow. Given the rough start, hopes of a strong buying season are dwindling quickly.

Buyer Demand Increasing

At the same time we are in an inventory crisis, buyer demand is starting to gain strength. This is good news after we saw buyer demand collapse in 2022. It is anticipated that as mortgage rates fall we will see demand climb even higher, which should add upward pressure to home values.

Experts believe it will take mortgage rates to hit the low 5% range to entice existing homeowners to sell. Personally, I believe we need to see a 4 handle in mortgage rates. Let’s hope this happens, as we need more home choices to avoid bidding wars from once again getting out of control.

Is the Manufacturing Recession Over?

A stronger than expected Purchaser’s Managers Index came in stronger than expected this morning, showing that manufacturing increased from a reading of 50.4 from the previous month’s reading of 49.2. A reading above 50 indicates expansion. This is not good news for mortgage interest rates, as the bond market would like to see both service and manufacturing segments slow.

Everything is just harder when you don’t know.

This is why we are hosting a First Time Home Buyer Class on May 6th.

If you have any potential home owners who need a little more education – what loan programs are available, what about assistance, what price range they should be looking in and much more.

Please call us for more information and to get signed up 801-501-7950! 😊

April 18, 2023

Mortgage bonds are at a critical level. If they bounce higher from here, we could see rates improve a bit. However, there remains great risk in floating.

Active Inventory Continues to Fall

New listing data hit an all-time low in 2023. Restricting potential homebuyers from finding homes; while at the same time providing new home builders the opportunity of a lifetime.

With little competition out there, new home builders are able to charge reasonable prices and continue to make profits in what is most certainly a housing market recession. The housing market has been in a recession now for many months. With no clear indication as to at what point we will see sellers willing to list their properties, many experts are thinking it will take rates starting with a 4 to stimulate much activity.

This is a dangerous position for our economy to be in. We will see industries begin to break if it doesn’t improve soon.

The Rise of “Accidental Landlords”

AKA people who move but do not sell their homes because there is no way they are giving up their low-interest rate!

Now we have a bunch of new landlords and thanks to massive rent increase over the past few years and their low payment, they are netting a pretty penny on their homes. At some point, many of them will decide being a landlord is not for them and they will sell.

Until then, they have a new side hustle.

Car Payments and Cash Out Refis

Everything is just harder when you don’t know. This is why we are hosting a First Time Home Buyer Class on May 6th.

If you have any potential home owners who need a little more education – what loan programs are available, what about assistance, what price range they should be looking in and much more, send them the link below or reply to the email. 😊