Buying Mortgage Points

If you’re buying a house for the first time, you might come across items you’re unfamiliar with. Items like Private Mortgage Insurance, FA vs. Conventional Loans, or what is included in the closing costs. Paying mortgage points (“points”) on your mortgage might not be the first thing you think of when shopping for your mortgage, but knowing what points actually are, is vital to saving money at the closing table.

What Are Mortgage Points?

Mortgage points are a fee you can pay to lower the interest rate on your mortgage. Buyers are always looking for ways to get a lower interest rate (which also means getting a lower monthly payment). With the Fed raising interest rates, buyers’ main tools are waiting for rates to drop, or buying the rate down by paying mortgage points.

Essentially you’re paying the lender money upfront in exchange for a lower interest rate. Mortgage points are sometimes called “Discount Points” or “Rebate Points”

Each mortgage point is 1% of your total loan amount, which can lower your interest rate from 1/8% to 3/4% depending on what the lender is offering.

For example: if the lender is offering you 0.25% off your rate for paying 1 point, for a 30 year, $300,000 loan with a 6.5% interest rate, you could drop your rate to 6.25% by paying $3000, and your monthly payment would drop from 1,896.20 to 1,847.15 saving you $49 a month.

Different Types of Mortgage Points

There are two types of mortgage points: Origination and Discount Points.

Origination Points

Origination points or origination charges are the lender fees that are charged for the closing of a loan. These points are used to cover the overhead costs for the loan. Origination points do not lower the interest rate on the loan and are a one-time fee paid when you close. Origination points are generally between 0.5%-1.5% and are included in your closing costs.

Discount Points

Discount points, aka “points,” are a one-time fee you pay your lender to lower your interest rate. Points are purchased at the sale of a home or when you refinance a home.

Are Buying Mortgage Points A Good Deal?

Your situation will determine if buying mortgage points is a smart move. If you move frequently and might have to sell your home relatively soon after purchasing it, buying points might not be a great option for you. However, it might be a good option if you’re planning to own the home for over five years.

Benefits

When you buy mortgage points, you’re lowering the rate on the loan and the overall cost of the loan. Paying 1 point could end up saving you $10,000’s over the life of a 30-year mortgage, if you keep that exact loan. Which means if you don’t refinance. Mortgage points can be a great option for homebuyers with extra to put towards their purchase, if they are planning on staying in that home with the same loan for a few years.

When to Pay Mortgage Points

There are some instances where buying down your rate is a smart decision. A small upfront cost can save you tens to hundreds of thousands of dollars over the course of your loan.

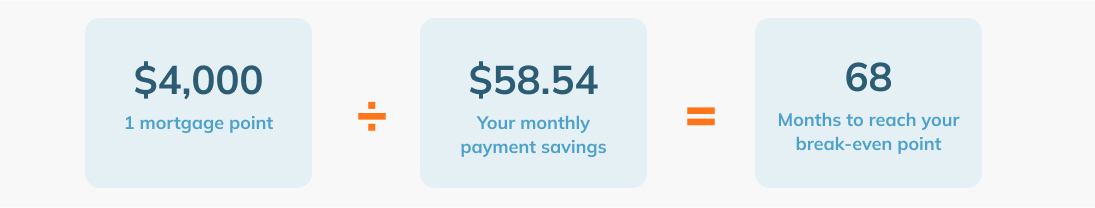

- You plan on staying in the home and not refinance for a long time – Buying points can be a good option for homebuyers that plan to stay in their home for a long time. Because buying mortgage points is an upfront cost, if you sell the house in the first 2-5 years, you generally won’t have had time to see the savings. By staying in your home for 20-30 years, you can save 10’s of thousands of dollars over the life of your loan. This is often called your break-even period and can be calculated by taking the up-front mortgage costs divided by your monthly payment savings. This will give you how many months you’d need to stay at your house before breaking even.

For a full analysis of buying points, you can use our Digital Loan Officer that calculates which amount of points is best for your loan.

- You want a lower monthly payment – If you want a lower monthly payment, buying down your interest rate is an easy way to do that. Depending on the loan amount and interest rates – pre-points vs. post-points – it could save you hundreds of dollars each month. That’s money back into your pocket to use for other things.

- You’re looking to finance a larger amount – You might want a little bit larger of a house, but high mortgage rates are making it difficult to fit into your budget. Buying mortgage points will help lower your monthly payments so you can qualify for a larger loan amount.

- You have enough for the down payment and still want to lower the interest rate – If you have enough for your down payment to be taken care of but still don’t want to pay a ton of money in interest over the life of the loan, then mortgage points are a great option. This path ensures that your basics are covered (3-5% down payment) while helping you save money over the long term (lowering your interest rate).

When Not To Buy Mortgage Points

In general, we recommend not to pay points unless you have to. The major reason to pay points is to reduce the rate and monthly payment. Points are not refundable. So if you pay points, you’re betting upfront money (points) that rates won’t drop in the future. Imagine paying $4,000 to save $60 dollars a month. 6 months later, rates drop to where if you refinanced, you would save $80 a month compared to your original loan. If you refinanced, you paid $4,000 to save $360 dollars during those 6 months.

- Your future with the home is uncertain – If you’re planning to sell your home or are unsure if you’ll be living there in the near future, you won’t get much benefit from buying points. This money might be better spent increasing your down payment to cover PMI, saving for a rainy day, or investing in another property/asset.

- Finances are tight – A lower mortgage rate is great, but it can put a strain on finances if you have to empty out your savings to get it. If paying the least amount in interest is important to you, you could pay extra towards the principal on your mortgage each month or refinance your home when rates start to drop.

- You’re planning on refinancing or taking cash out soon – Many people plan to do remodels, or take cash out of their home to finance things like college. If you’re planning on doing either of these, paying points upfront may not be the best idea. We recommend talking to a loan officer who can help you see why this can cost you thousands.

Is It Better To Buy Points Or Put More Money Down?

Your downpayment is the money you pay upfront to purchase your home. As you look at your finances, you’ll need to ask yourself a few questions to determine what is most important to you. Things like:

- What is the right loan amount for me?

- Will my down payment remove PMI?

- If not, do I want to use my extra funds to buy out my PMI?

- What interest rate am I willing to pay?

- Does this monthly payment fit my budget?

Answering these questions can help guide you on what is best for your situation. That said, buying points will usually save you more money than a larger down payment over the life of your loan. So, depending on how much money you have at closing could be the final factor.

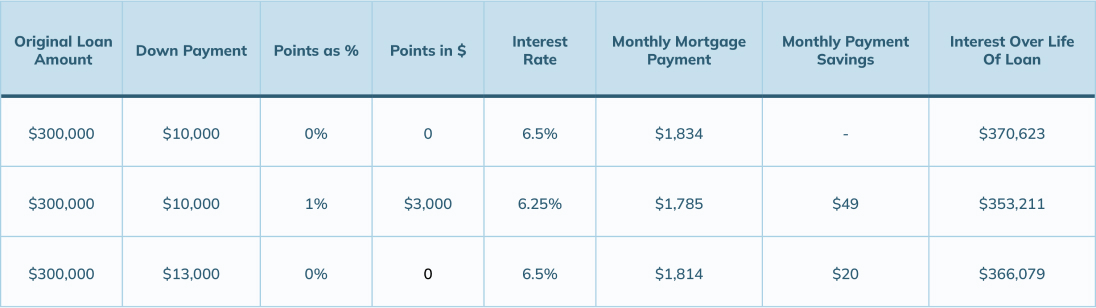

For example, here are the numbers if you had a $300,000 loan and bought down your mortgage rate vs. increasing your downpayment.

Is there a limit to how many mortgage points I can buy?

The limit is different depending on what institution you’re using for your mortgage. The most common types of programs offer a range from paying 0 points or less to up to three points purchase programs. It can vary depending on the institution.

Can you negotiate mortgage points?

The best way to “negotiate” points down is to find a cheaper lender. Shopping lenders to see who has the best zero-point loan offers. Once you know who has the best offer with no points, you can discuss buying points and how that affects your rate.

Are mortgage points tax-deductible?

Yes! Your mortgage points (as well as interest paid on your mortgage) are tax deductible. So when you purchase mortgage points, you are saving money on your interest rate, lowering your monthly payment, and lowering your tax bill if you itemize your deductions. Be sure to talk with a tax expert or refer to the IRS’s guidance on mortgage points to see how it could affect your situation.

Should you pay points?

Paying points is like gambling. You’re betting thousands of dollars upfront, on the guess that rates won’t be any lower later. Because if they were lower, you could refinance. In general we recommend not paying points, however there are cases where paying points to get a lower interest rate which lowers your monthly payment, is a good idea. You can analyze your points with our Digital Loan Officer tool that shows you the total out of pocket costs for your loan after closing (including points).