Primary Residence vs. Investment Property vs. Secondary Home

When you apply for a mortgage, your lender will ask if this property will be your primary residence, a second home, or an investment property. Your answer will determine what mortgage rate you get, who can live there, the amount you can be approved for, and the minimum amount of your downpayment.

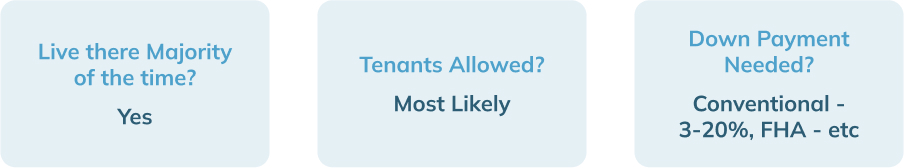

Primary Residence

A primary residence is where you will live and spend most of your time. Your primary residence is viewed as a secure asset for a potential lender, compared to investment properties or secondary homes because if things go south, home owners are more likely to stay current on their payments on where they actually live, in their primary residence.

What qualifies as a primary residence?

To qualify as a primary residence, you must live there the majority of the year. You are also expected to move in within 60 days of closing the loan and not plan to convert the home into a rental property within 12 months of closing.

What kind of loan can I get for a primary residence?

There are several types of loans that may be available for a primary residence, which is a property that is intended to be the borrower’s primary place of residence.

- Conventional Mortgage Loan: This is the most common loan type, but it does have more strict regulations than other types of mortgage loans. Conventional loans have a 3% minimum downpayment, and will have PMI added to their loan with anything less than a 20% down payment.

- FHA Loan: An FHA loan is insured by the Federal Housing Agency. These types of loans are common for first-time home buyers or those that have little savings or credit challenges.

- VA Loan: A VA loan is a Veteran Affairs loan. It was created in 1944 to give back to members of the armed forces and their family members. In 2021, there were over 1.4 million VA loans processed. These loans are only available to military members and generally have 0% down, no PMI, and competitive interest rates.

- USDA Loan: A USDA loan is backed by the United States Department of Agriculture. This loan is designed to help populate rural areas, so it might not be available in all areas.

Each loan has different requirements, and a borrower’s individual circumstances may affect their eligibility for the loan type.

What are mortgage rates for a primary residence?

Mortgage rates can vary and are affected by various factors, such as the lender, the type of mortgage, the borrower’s credit score and financial history, and market conditions. Generally, mortgage rates tend to be lower for a primary residence than for investment properties or vacation homes. This is because lenders view primary residences as less risky. It is important for borrowers to shop around and compare rates from multiple lenders to find the best mortgage rate for their situation. Check out today’s mortgage rates.

How big of a downpayment do I need?

The size of your down payment can vary depending on the type of mortgage and your financial situation. For a conventional mortgage, the down payment is typically between 3-20% of the purchase price of the home. This varies depending on the lender and the borrower’s credit history and financial circumstances. A larger down payment may be required if the borrower has a lower credit score for example.

Some loan programs, such as FHA loans and VA loans, may allow for smaller down payments or may even be available with no down payment at all.

Are tenants allowed?

Generally, you can have tenants at your primary residence as long as you live there. Also, there may be certain restrictions that prevent you from having tenants. Sometimes, the terms of a mortgage or other loan for the property may include provisions about whether the property can be used for rental purposes.

Additionally, there may be local zoning laws or homeowners association rules that regulate whether a property can be used for rental purposes and, if so, under what circumstances. It is important to check with the lender, local authorities, and any relevant homeowners association to determine what the rules and restrictions are for renting out a portion of your primary residence.

Tax Implications

There can be several tax implications regarding a primary residence. One potential tax implication is the mortgage interest deduction. This allows homeowners to deduct the interest paid on a mortgage for their primary residence on their federal income tax return. This can potentially save homeowners a significant amount of money on their taxes.

Another potential tax implication is the capital gains tax, which may be applicable when a homeowner sells their primary residence. Generally, homeowners can exclude up to $250,000 in capital gains from the sale of their primary residence ($500,000 for married couples filing jointly) as long as they have owned and lived in the property as their primary residence for at least two out of the five years before the sale.

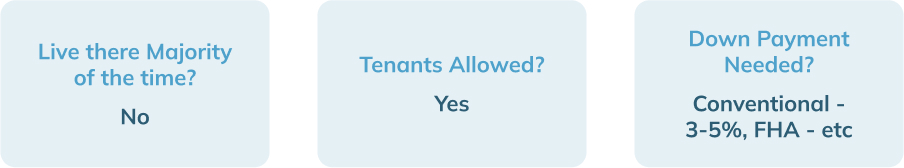

Investment Property

An investment property is a property that is owned to generate income through renting or selling the property. About 70% of rental properties are owned by individual investors.

There are two main types of rental properties: short-term and long-term. Short-term rentals are usually done for the day, weekend, or week-long events. Long-term rentals are rented out in larger chunks of time. Short-term rentals generally have a higher earning potential, while long-term rentals have a more stable cash flow.

What kind of loan can I get on an investment property?

There are several types of mortgage loans that may be available for an investment property. Investment properties could be eligible for a conventional loan, or a non-conventional loan, like a Jumbo Loan. Both of these loan types are usually available as a fixed-rate mortgage, adjustable-rate mortgage, and sometimes as an interest-only mortgage.

- Fixed-rate mortgages have an interest rate fixed for the entire term of the loan, which can be beneficial for borrowers who want the stability of a fixed payment.

- ARMs (Adjustable rate mortgages) have an interest rate that can adjust over time, which can be beneficial for borrowers who expect their income or the value of the property to increase..

- Interest-only mortgages allow borrowers to pay only the interest on the loan for a certain period of time, which can potentially lower their monthly payments but may result in a higher overall cost of borrowing.

Investment properties are not eligible for some loan types. For example, some loan programs, such as FHA and VA loans, may not be available for investment properties because these programs are primarily intended to help first-time homebuyers or eligible military service members and veterans purchase a primary residence. Additionally, some lenders may not offer certain types of mortgage loans, such as jumbo loans or reverse mortgages, for investment properties.

What are mortgage rates for an investment property?

Mortgage rates for investment properties are generally higher than those for primary residences because lenders view investment properties as riskier. Lenders believe they’re riskier because there is a greater potential for default if the property does not generate enough income to cover the mortgage payments.

As a result, lenders usually charge higher mortgage rates for investment properties to compensate for the additional risk.

How big of a downpayment do I need?

The size of the down payment you will need for an investment property will depend on various factors, including the type of property you are purchasing, the terms of your mortgage, and the lender you are working with. Here are a few things to consider:

- Type of property: The type of investment property you are purchasing may affect the size of the down payment required. For example, a single-family home may require a smaller down payment than a multi-unit property.

- Terms of your mortgage: The terms of your mortgage, such as credit score required, will also affect the size of the down payment. A lower credit score may also require a larger down payment.

- Lender requirements: Different lenders may have different down payment requirements for investment properties. Some lenders may require a larger down payment for an investment property than they would for a primary residence.

In general, it is common for lenders to require a down payment of at least 20% for an investment property.

Are tenants allowed?

The purpose of an investment property is to generate income, so it is crucial to have tenants rent it and pay you. As the owner of the investment property, it is your responsibility to find and screen tenants, set the terms of the rental agreement, and collect rent payments.

You’ll need to familiarize yourself with the laws and regulations in your area regarding rental properties and tenants’ rights. Some common legal requirements for landlords include conducting background checks on potential tenants, maintaining the property in a habitable and livable condition, and protecting tenants’ privacy.

It is also a good idea to have a written rental agreement that clearly outlines the terms of the tenancy, such as the length of the lease, the amount of rent, and any other rules or expectations for the tenant.

Tax Implications

Owning an investment property can have significant tax implications, as you will be responsible for paying taxes on any income you generate from the property. Here are a few things to consider:

- Rental income: Any rental income you receive from your investment property is taxable. You will need to report this income on your tax return and pay taxes on it at your marginal tax rate.

- Expenses: You may be able to deduct certain expenses related to your investment property from your taxable income. These include mortgage interest, property taxes, insurance, maintenance and repairs, and property management fees.

- Depreciation: You may also be able to claim a tax deduction for the depreciation of your investment property.

- Capital gains: If you sell your investment property for a profit, you may be subject to capital gains tax on the sale. The amount of tax you owe will depend on your tax bracket and the time you held the property.

- Property Taxes: just like a primary residence or second home, you are required to pay property taxes on an investment property. These usually increase as the value of your property increases.

It is important to consult with a tax professional or refer to IRS guidelines to understand the specific tax implications of owning an investment property. They can help you to determine the tax deductions and credits you may be eligible for and advise you on the best tax strategy for your situation.

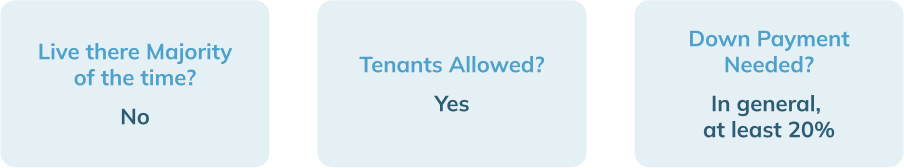

Secondary Residence

A secondary residence, or second home, is a second property where an owner lives for part of the year. Secondary residences also have some other requirements like being suitable for occupancy year-round, and only being one unit. It’s estimated that there are 7.15 million (about 5% of the total housing stock) second homes in the United States.

What kind of loan can I get for a second home?

A second home can qualify for many of the same loan programs as your primary residence, but often comes with a higher rate. The programs available to you will be dependent on your individual situation and your lender. Here are a few common mortgage options for a second home:

- Conventional mortgage: A conventional mortgage is not insured or guaranteed by the government. It is typically available through mortgage companies, banks, credit unions, and other financial institutions. To qualify for a conventional mortgage, you will typically need a good credit score and a down payment of at least 3-5%.

- FHA loan: An FHA loan is a mortgage insured by the Federal Housing Administration (FHA). It is a popular option for first-time homebuyers and those with lower credit scores or limited funds for a down payment. FHA loans typically require a down payment of at least 3.5%.

- VA loan: A VA loan is a mortgage offered by the Department of Veterans Affairs (VA) to eligible military service members, veterans, and their spouses. VA loans are available with no down payment and often have more favorable terms than other mortgage options.

- Jumbo loan: A jumbo loan is a mortgage that exceeds the conforming loan limits set by government-sponsored enterprises such as Fannie Mae and Freddie Mac. Jumbo loans may be available for a second home, but they typically require a larger down payment and may have stricter credit and income requirements.

What are mortgage rates?

Mortgage rates for a second home may be similar to or slightly higher than rates for a primary residence. Mortgage rates will vary depending on market conditions, your credit score, loan type, and other factors.

How big of a downpayment do I need?

Since you’re eligible for the same types of loan programs on a second home as your primary residence, the down payment will be similar as well. Some lenders may require a slightly higher downpayment since secondary homes are sometimes viewed as higher risk than the primary residence.

Are tenants allowed?

Yes! Tenants are allowed in a second home. As the owner of a second home, you have the right to determine how the property will be used within the guidelines set by the lender, including whether or not to allow tenants.

If you decide to allow tenants, you will need to consider whether you hire a property manager to handle the day-to-day tasks of renting out the property. The property manager will need to be available to show the property to potential tenants, collect rent, and handle any maintenance or repair issues that may arise. The owner is required to live at the home for at least 14 days of the year, or 10% of the number of days that the property is rented (whichever is greater), otherwise it would be considered an investment property.

Tax Implications

There are some expenses that you can deduct from your taxes for owning and maintaining a secondary residence. Talk with a tax professional to verify what you can or can’t deduct since deductions can be complex.

Here are a few things to consider regarding the tax implications of a second home:

- Mortgage interest: If you take out a mortgage to purchase a second home, you may be able to deduct the mortgage interest you pay on your tax return. How you use your home will determine if and how much mortgage interest you can deduct.

- Property taxes: You may be able to deduct property taxes you pay on a second home on your tax return.

- Rent: If you rent out your second home, you may need to report the income you receive from the rental on your tax return. You may also be able to deduct certain expenses related to the rental, such as cleaning, repairs, and property management fees.

- Capital gains: If you sell a second home, you may need to pay capital gains tax on any profit you make. The amount of tax you will owe will depend on how long you owned the property, your tax bracket, and other factors.

- Property Taxes: just like a primary residence or investment property, the owner is required to pay property taxes on a second home. These typically increase as the value of your property increases.