Forward This To Your FTHB Friends

If you’re a First Time Home Buyer, there’s a lot going on in today’s market. All the houses in your price range are getting multiple offers so open houses are like Planet Fitness at 6pm – everyone’s flexin’. Now, I know it’s been stressful, and I know how you fell about the people whose offers have beat yours… BUT here’s a couple points that will help you get in your new place and save you some dough!

- What is a “pre-qualification letter”?

Before your real estate agent starts to show you houses, they typically ask for a pre-qualification letter. This is a letter from a mortgage company that states how much of a loan you can qualify for. An agent wants this so they can make sure to show you homes in your price range.

- Rates vs Closing Costs

Everyone is told you want a low rate because that means your monthly payment is low. That is correct. However, the lower the rate, the more money you will have to pay up front. If you are going to keep your loan for a longer time, it makes sense to pay more upfront for a lower rate.

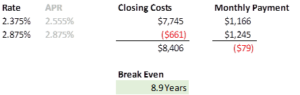

Here’s a simple example with today’s pricing:

Here are two different rates with different closing costs. The lower rate costs $8,406 more. However, it only saves $79 per month. If you take $8,406 / $79 per month, the lower rate only makes sense if you keep the loan for 8.9 years or longer.

Our DIGITAL LOAN OFFICER on our site will decide which loan is best for you based on how long you’ll be in it.

- Shop your mortgage

Not all mortgage companies are created equal – unfortunately, there are many bad eggs who grossly overcharge. City Creek has salaried loan officers instead of high commissioned ones. This allows us to put money back into our client’s pockets.

RED FLAGS WHEN SHOPPING FOR A MORTGAGE COMPANY

– They don’t have their rates online

– They make you finish an application before giving you a quote

– They tell you City Creek’s rates aren’t real (that happens… a lot)