Forbearance to Foreclosure

Forbearance to Foreclosure

The CFPB (pretty much the POTUS of mortgage) expressed its concern about the number of forbearances that could turn into foreclosures if some action isn’t taken. While mortgage forbearances were cut in half from 2020’s peak in May and 25% of people in forbearance are still making their payment, the CFPB is still on edge. Their main concern is the potential rise in foreclosures of communities who were already hit the hardest during the pandemic. So, they are putting in some protections through the end of 2021.

- Before any lender can foreclose, they must contact the homeowner to see if they qualify for a lower interest rate or a different loan program.

The CFPB recognizes the economic progress the country has made since the pandemic. But they know if the stimulus abruptly ends, many communities could fall.

In other news:

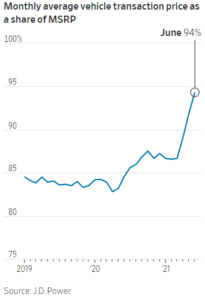

Home price growth just hit its highest level in the last 30 years…(are we bored of home appreciation news yet?) But homes are not the only thing going above asking price. Car salespeople have shifted from sales to auctioneers as car dealerships are pushing sales prices above MSRP.

No longer do you get to walk out of the dealership to see if the salesperson will chase you down and lower the price… you’re now in a bidding war. This is a function of not only increased car demand but the backlog in production during the COVID shutdown and is a clear example of the inflation production backlogs are causing.

The Rates:

Mortgage Backed Securities are down up this morning but continue to climb their upward trendline. We are carefully floating and will lock if they hit their ceiling.