After a seemingly coordinated effort to push the “tighten regardless of consequences to the economy” rhetoric, on Friday we heard a couple of Fed members expressed concern that continued rate hikes may soon pause as the Fed waits to access…

`

`

`

The markets are constantly moving! Get Mortgage Mike's daily market updates

Additional Articles

Fed Members Causing Pain

The US federal reserve has been successful at popping the bubbles within the...

Read More

Home Affordability Slowing Existing Home Sales

After just six very hard weeks in office, UK Prime Minister Liz Truss...

Read More

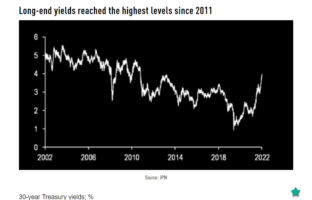

Yields at 11-Year High

If there is one thing the past eleven weeks have taught us, it’s...

Read More

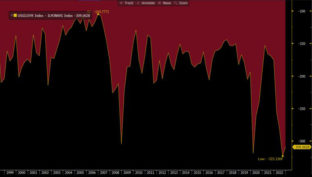

Could This Graph Mean Lower Mortgage Rates on the Horizon?

One of the more fascinating aspects of the recent upward interest rate trends...

Read More

A Lesson from the UK – Not the Right Time to Cut Tax Rates

Mortgage bonds continue to benefit from leadership failures in the UK. Within 45...

Read More

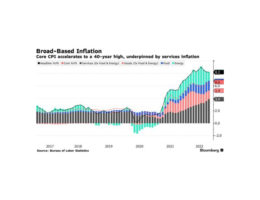

Volatility Remains High for Mortgage Rates

Markets continue to digest the Consumer Price Index (CPI) report released yesterday. In...

Read More

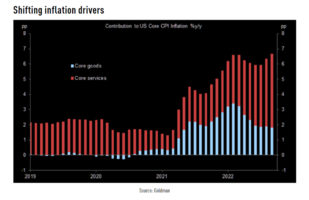

Consumer Inflation Not Backing Down

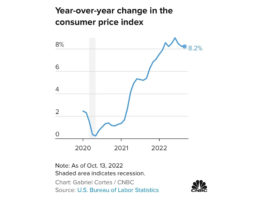

The Consumer Price Index (CPI) report showed prices are moving higher in many...

Read More

A History Lesson from the 80’s

Mortgage interest rates are again under pressure, as markets brace ahead of today’s...

Read More

Nearing a Break in Inflation?

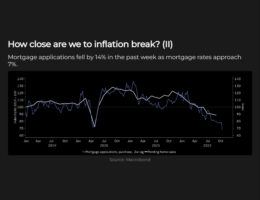

As we move into the final quarter of 2022, the key question on...

Read More

Still Need Help?