Today’s Mortgage Rates in April 2023

April 28, 2023

The bond markets remain in a tough battle over 200 day moving averages. Unless mortgage bond prices break above this critical level, we will maintain a locking bias.

Slowly But Surely

The Fed’s favorite gauge of consumer inflation was reported for the month of March, showing a strong drop. In March, headline inflation rose by just .1%, dropping the annual rate from 5.1% down to 4.2%.

When you strip out food and energy prices, the Core rate fell from 4.7% down to 4.6%. Although we are still well above the Fed’s target rate of 2%, we are seeing inflation slow. In the months to come, we will see this rate drop into the 3’s, at which time we can expect more improvements in mortgage rates.

Another Hike Is Coming

Next Wednesday, the Fed will announce another 1/4% increase, which will push the Fed Funds Rate above 5% for the first time since 2006. We all remember, the US economy fell into a deep recession and the Fed was forced to cut rates starting in 2007. The Fed held rates high for too long and then were slow to respond to the economic crisis that was developing.

We can expect spect to see the Fed once again hold rates high for longer than they should, which means that we may not see cuts until 2024. Although the market is currently pricing in for the Fed to cut in later 2023, I have little faith the Fed will do that. Their history of missing the mark is far too strong.

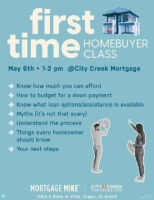

Sign Up Your FTHBs

Everything is just harder when you don’t know. This is why we are hosting a First Time Home Buyer Class on May 6th.

If you have any potential home owners who need a little more education – what loan programs are available, what about assistance, what price range they should be looking in and much more. Please call us for more information and to get signed up 801-501-7950! 😊

April 27, 2023

After an attempt to break above its 200-day moving average, mortgage bonds have retreated sharply. The market is certainly waiting for tomorrow’s PCE report prior to making any significant bets on the near-term direction of mortgage interest rates. The safe play remains to maintain a locking bias until we see market news that can help push mortgage bond prices above their 200-day moving average.

Misleading Headlines

We’ve all seen the headlines that people with lower credit scores now get better mortgage rates than those with higher credit scores… But that’s all they are, headlines.

It is true that the spread between low credit score borrowers vs. those with high scores will narrow; however, people with lower scores will continue to be charged more.

Regardless, this is a controversial move that seems to have a political bias at its core. Although Fannie and Freddie are under government conservatorship, I do not think either should be used to push any political agenda.

The pool of mortgage loans sold on the open market should be priced based on the default risk of each individual loan. Both political parties have been guilty of using Fannie and Freddie as pawns, and I fear this could be one of those moments. The mortgage and housing industries are hurting enough. This is the wrong time to be charging anyone more for a home mortgage.

Consumers Are Still Swiping

This morning’s GDP showed that although businesses slowed their spending, consumers haven’t. Overall, the report showed that the US economy grew at an annual rate of 1.1% in Q1 of 2023, which was beneath the 2% the market anticipated. A deeper look into the report shows that business inventory declined sharply, meaning that unless consumer spending slows in the second quarter, we could see businesses ramp up manufacturing to keep up with demand.

However, with consumer debt levels rising at unprecedented rates, the current pace of consumer spending is not sustainable long-term.

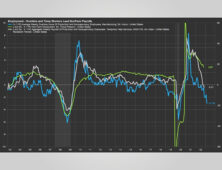

Unemployment

The labor market remains tight, as shown in this morning’s Unemployment Claims report. Last week, there were 230,000 new claims. This represents a drop of 16,000 from the week prior. Although claims have been increasing, we are a long way from a number the Fed would like to see.

The Fed is intent on breaking the labor market, which would require claims to hit a 4-week average of nearly 320,000. Once that happens, we will likely see the Fed begin the process of reversing course and cutting rates.

Everything is just harder when you don’t know. This is why we are hosting a First Time Home Buyer Class on May 6th.

If you have any potential home owners who need a little more education – what loan programs are available, what about assistance, what price range they should be looking in and much more. Please call us for more information and to get signed up 801-501-7950! 😊

April 25, 2023

Unless mortgage bonds break above their 200 day moving average, the safe play remains to maintain a locking bias.

Gen Z Has Entered the (Housing Market) Chat!

Gen Z is stepping into the housing market, adding to the pool of first time home buyers at a pace faster than what their parents’ generation experienced. Latest reports show that first time homebuyers continue to represent the largest demographic of people buying homes, averaging between 27% to 33% of all new and existing home sales in the US.

This is good news for our long term housing market, as many believed we would see the younger generation prefer a more transitory lifestyle rather than being tied down with a mortgage. Given the impact homeownership has on creating long term wealth, it is good to see young people eager to become homeowners.

Are We Almost at the End of the Rate Hikes?

The 10-Year Treasury Note yield has made a bold move lower, breaking beneath its 200 day moving average. This is the market’s way of stating they believe the Fed should pause and that we are nearing the end of the rate hiking cycle. If the 10-Year can remain beneath its 200 DMA, this will help mortgage bonds as they look to soon face a similar battle.

Although it may take Friday’s PCE report to provide mortgage bonds with the strength needed to win this battle, we will have a better picture of the near term direction of mortgage rates.

Home Values Creeping Back Up

After a few months of weakening home values, Case Schiller reported that home values across the US rose by .2% in the month of February. This is great news for the housing market and could spur some who have been sitting on the sidelines waiting for values to fall to reconsider their decision to delay purchasing. Past history shows that once home values transition from falling to climbing higher, the fear / greed index shifts and more consumers rush to buy.

Let’s hope this move in values continues higher and that we see more sellers willing to list their homes. If we combine this with falling mortgage interest rates, the stars may align and bring much needed life back into the housing market.

Everything is just harder when you don’t know. This is why we are hosting a First Time Home Buyer Class on May 6th.

If you have any potential home owners who need a little more education – what loan programs are available, what about assistance, what price range they should be looking in and much more. Please call us for more information and to get signed up 801-501-7950! 😊

April 24, 2023

The 10-Year Treasury Note yield is now in a battle with its 200-day moving average. A break beneath this level would be great news for mortgage interest rates. However, since breakouts are the exception and not the rule, we will maintain a locking bias as we wait to see how this battle plays out.

$4,000 Down Payment Grant

Eligible first-time homebuyers now have access to a grant that is up to $4,000, or 2% of the price of the home, whichever is less.

Although this new program has income limit requirements, thousands of homebuyers across the US are expected to take advantage of the gifted downpayment while it is available. If you are a real estate agent or a first-time buyer, reach out to one of our team members for details. Since this is an actual gift to homebuyers, it will only last for a limited time.

It’s Time to Pause

The US economy shows overwhelming signs of slowing, adding fears that the Federal Reserve will once again miss the mark and overtighten monetary policy.

In reality, the Fed has a terrible track record of knowing when to move rates and how far to move them. May 3rd will be the next Fed meeting, where they are anticipated to announce another ¼% rate hike.

It is estimated that there is the equivalent of ¾% in unrealized rate hike impact that is still coming down the pike. This is in part because of tightening credit policies as well as the delayed impact of past rate hikes yet to be felt. The hope is that between now and May 3rd, the Fed comes to the realization that the time to pause is now.

Inflation on Friday

On Friday, we will receive an update on the Fed’s favorite gauge of inflation, the Personal Consumption Expenditures (PCE) report. Just like we saw in the recent CPI report, we expect to see a sharp drop in the headline number and a minimal drop in the Core rate (which is what the Fed is most concerned with).

The key point will likely show that inflation is still running hotter than the Fed would like, but is really much closer to 3% than the annualized rate will imply. We do anticipate more meaningful drops to show in the next 90 days, which will be good for mortgage rates as we move into the summer months.

Everything is just harder when you don’t know. This is why we are hosting a First Time Home Buyer Class on May 6th.

If you have any potential home owners who need a little more education – what loan programs are available, what about assistance, what price range they should be looking in and much more. Please call us for more information and to get signed up 801-501-7950! 😊

April 21, 2023

We continue to see upward pressure on mortgage rates. We will maintain our locking bias.

Housing Inventory Problem Once Again Confirmed

To say that we have a housing inventory problem is an understatement. We are now 165,000 away from the lowest housing inventory in history. At a point in the year where we generally see new listing levels climb, active listings actually fell once again last week.

It is not helping that a number of large asset managers and private equity firms are actively buying up single family homes with the intent of converting most into rental homes. Also, after the month of May we generally see new listing activity slow. Given the rough start, hopes of a strong buying season are dwindling quickly.

Buyer Demand Increasing

At the same time we are in an inventory crisis, buyer demand is starting to gain strength. This is good news after we saw buyer demand collapse in 2022. It is anticipated that as mortgage rates fall we will see demand climb even higher, which should add upward pressure to home values.

Experts believe it will take mortgage rates to hit the low 5% range to entice existing homeowners to sell. Personally, I believe we need to see a 4 handle in mortgage rates. Let’s hope this happens, as we need more home choices to avoid bidding wars from once again getting out of control.

Is the Manufacturing Recession Over?

A stronger than expected Purchaser’s Managers Index came in stronger than expected this morning, showing that manufacturing increased from a reading of 50.4 from the previous month’s reading of 49.2. A reading above 50 indicates expansion. This is not good news for mortgage interest rates, as the bond market would like to see both service and manufacturing segments slow.

Everything is just harder when you don’t know.

This is why we are hosting a First Time Home Buyer Class on May 6th.

If you have any potential home owners who need a little more education – what loan programs are available, what about assistance, what price range they should be looking in and much more.

Please call us for more information and to get signed up 801-501-7950! 😊

April 18, 2023

Mortgage bonds are at a critical level. If they bounce higher from here, we could see rates improve a bit. However, there remains great risk in floating.

Active Inventory Continues to Fall

New listing data hit an all-time low in 2023. Restricting potential homebuyers from finding homes; while at the same time providing new home builders the opportunity of a lifetime.

With little competition out there, new home builders are able to charge reasonable prices and continue to make profits in what is most certainly a housing market recession. The housing market has been in a recession now for many months. With no clear indication as to at what point we will see sellers willing to list their properties, many experts are thinking it will take rates starting with a 4 to stimulate much activity.

This is a dangerous position for our economy to be in. We will see industries begin to break if it doesn’t improve soon.

The Rise of “Accidental Landlords”

AKA people who move but do not sell their homes because there is no way they are giving up their low-interest rate!

Now we have a bunch of new landlords and thanks to massive rent increase over the past few years and their low payment, they are netting a pretty penny on their homes. At some point, many of them will decide being a landlord is not for them and they will sell.

Until then, they have a new side hustle.

Car Payments and Cash Out Refis

Everything is just harder when you don’t know. This is why we are hosting a First Time Home Buyer Class on May 6th.

If you have any potential home owners who need a little more education – what loan programs are available, what about assistance, what price range they should be looking in and much more, send them the link below or reply to the email. 😊

April 17, 2023

Mortgage interest rates continue to fight a difficult technical move higher. We will maintain our locking bias.

FTHB Class 📖

We are hosting a First Time Home Buyer Seminar on May 6 at 1 pm! We will be going over what programs / down payment assistance is available, myths about buying your first home, what you can qualify for, mistakes to avoid, getting pre-qualified, and a lot more. 😀

Please call us for more information 801-501-7950!

Hiking May Be Comming to an End

The goal of credit tightening in the US banking system is to help the Federal Reserve in its fight against inflation while also slowing the US economy.

Current projections stand at a 68% chance the Fed will do one more ¼% rate hike in May, then odds favor a pause, while the Fed holds rates in the 5% – 5.25% range as they wait to see if inflationary pressures continue to soften. This is good news and means we are almost through the painful rate-hiking process.

Car Payments and Cash Out Refis

With higher rates, come higher car and card payments.

Did you know the average car payment is $800?? Obviously, taking a toll on the budget of many families… and rates are still rising.

Just remember that rates are temporary, but payment stress is ongoing.

Many of those with low mortgage rates but high debt payments could benefit from a debt consolidation loan. And now is the time to act because when rates fall again, you can do a rate and term refi at the market rate which will be lower than the cash-out rate at any given time.

April 13, 2023

There’s not a lot to gain from floating, and because mortgage bonds are up against their 200 DMA, we say lock.

Get a Deal Done With a 203(k)

Home prices aren’t budging much, and interest rates are still high, which has obviously been the biggest hurdle for buyers on a budget. So, everything in their price range may seem… a little less than ideal. So, one option is to include a little bit of reno in their mortgage.

An old kitchen holding the buyer up? Does the front of the house need a facelift? Does the bathroom remind you of ‘The Shining’?

Buyers can use a 203(k) mortgage to buy a house and roll in the cost of some renovations and maybe turn a house they’re on the fence about, to one they love.

Flood Moratorium Lifted

Well, all the predictions of being able to surf down Utah streets seem to be coming true. And because of those predictions, tons of folks called their insurance companies and took out flood insurance policies. Because of the number of policies and the elevated risk because of Utah’s runoff, there was a moratorium placed on Utah flood policies (insurance agents couldn’t write any)…

However, it was lifted a few days ago!

So, if you have not considered it or if you were unable to get a policy, you can now call your agent and see if it makes sense for you. If you don’t have an agent, reply to this email and I can introduce you to one!

It’s Starting To Cost Less To Make Stuff

The Producer Price Index (PPI) looks at inflation on a business-to-business level. Really, the inflation of how much it costs for businesses to make stuff. And it dropped hard to its lowest since Feb 2021!

And over the last year, PPI has gone from 11.7% to 2.7%… No that is not a typo… a 9% drop!

Hopefully, the consumer inflation numbers (what the Fed watches) follow PPI.

April 12, 2023

Mortgage bonds have hit the floor and are bouncing back up, which is taking rates lower. We recommend taking advantage of these lower rates right now.

$4,000 Down Payment Grant

We’ve got ourselves a sweet deal – a $4,000 down payment grant up for grabs for your buyers! But, there are some strings attached. The buyers’ gotta be making 50% or less of the Area Median Income (AMI) for the home they’re eyeing. If they qualify, this is a phenomenal deal! So, if you’re curious to know whether your buyer can cash in on this program based on the home and their income, hit reply and let us know!

Mixed Signals

The Consumer Price Index report came in as expected, with the Headline rate only growing by 0.1% in March. On a year-over-year basis, the rate fell by a whopping 1% from 6% to 5%, which is great news. But hold on, the prices of food and energy took a hit, which is what caused the decrease.

When we take these out, the Core rate increased by 0.4%, and the annualized rate went up from 5.5% to 5.6%, which ain’t the right direction!

It’s Shelter Costs Again

Here’s the deal, the CPI report’s main culprit for the high inflation is shelter costs, accounting for over a third of the whole report. And guess what? Shelter costs went up by 0.6% again!

We all know that rent and housing costs have dropped big time in recent months. But the challenge is that this component is based on a 12-month average. Even when the current month shows a decline, it can still increase the CPI. But don’t worry, the real decrease we’ve experienced will soon bring the CPI report lower, which could happen as soon as June. Then we’ll see the CPI reports go down.

April 11, 2023

Tomorrow’s CPI report is make-or-break for mortgage interest rates in the near-term. If you’re risk adverse, you better consider locking ahead of the report.

Look at the Headline!

Tomorrow’s CPI report is about to drop, and the market’s expecting to see a monthly growth rate of .4% for Core CPI. If that’s the case, brace yourselves for a media and market backlash, driving mortgage interest rates even higher.

On the other hand, the Headline Rate (which includes the volatile food and energy prices that the Core Rate doesn’t) is expected to drop!

Let’s pray the market focuses on the Headline Rate and mortgage rates stay stable.

Think It Into Existence

The Federal Reserve’s been fighting an uphill battle against the consumer inflation mindset. Once folks start thinking prices are going up, they usually do, and a recent study shows consumers are anticipating an annualized increase in prices of 4.75%.

That’s way above the Fed’s target rate, which could encourage them to hold rates higher for longer than expected. Some consumer groups have called for holding back on unnecessary purchases to force businesses to hold prices steady, which could be a quick fix for the Fed’s problem.

Bitcoin is Back

The media and social media influencers have been causing a stir about the US Dollar’s potential crash. Comparisons to Venezuela are floating around, and people are turning to cryptocurrencies to seek refuge. Even traditional alternatives to the US Dollar, such as gold and silver, are experiencing noticeable price hikes. While the value of the has reasons to decline, a complete crash is highly unlikely.

However, jumping on the fear bandwagon could turn out to be quite profitable.

April 10, 2023

With bond prices under pressure, we suggest a locking bias.

Rate is Falling??

The Bureau of Labor Statistics (BLS) report from last Friday showed that 236,000 new jobs were added in March, which is just shy of what the market was expecting. However, the real surprise is that the Unemployment Rate fell from 3.6% to 3.5%. This goes against the Federal Reserve’s plan to make Americans lose their jobs, so rates will likely remain high.

As expected, mortgage rates went up following this news.

The Upside

There’s been a lot of talk about whether the US is headed for a recession. Some folks are trying to deny it, but the evidence is pretty clear. We’re in the midst of the most aggressive rate-hiking cycle the Fed has seen since the 1980s. And history shows that any rate hiking cycle has a recession right around the corner. Unfortunately, history also shows the Fed will keep hiking until the economy breaks.

There is an upside – when the recession hits, we can expect lower mortgage rates.

Are the Rate Hikes Over?

The Fed is likely to raise rates by another ¼% when they meet on May 3rd, but it’s also likely that this will be the last hike for a while. They want to slow down the labor market before they’re done. Fortunately, the signs are pointing to a slowing labor market.

Job growth will slow down, and the Unemployment Rate will rise. That’s when the Fed will stop hiking and eventually cut rates. Most folks think that won’t happen until 2024, but with the current trajectory, it could come sooner.

April 6, 2023

Listen, we know that it’s a bit risky to wait for the BLS report, but there’s a chance that it could be bond-friendly. If you’re feeling brave, you might benefit from holding off on locking in your rate. Just keep in mind that rates are at a risky point right now, so it might be better to lock in while you can.

Some Real Numbers Coming Out

We got some interesting news today about the labor market. As we have been saying, the numbers we were getting before were way off.

The latest report shows that 228,000 people filed for unemployment last week, which is a lot more than the 200,000 that the market was expecting. And if that’s not bad enough, the prior week’s claims got revised upwards by 48,000! The average for the past four weeks is now just under 240,000 new claims per week.

It’s insane how the government was trying to sugarcoat things before, but now everyone can see what’s really going on in the labor market.

Tomorrow’s Jobs Report Could Be Good News

Tomorrow we’re expecting a report from the Bureau of Labor Statistics (BLS) that could shed more light on what’s happening.

A few months ago, when the BLS reported that 517,000 new jobs were created in January, everyone knew there was no way, but interest rates shot up anyway.

Now, the prediction for March is 240,000 new jobs, but we think the real number might fall short of that. That could be good news for mortgage interest rates, as it would show that the economy isn’t as strong as everyone thought it was.

Earnings Are Comming Up

We’ve got another thing to worry about too: earning season is coming up. Companies will be reporting on their performance in Q1 of 2023, and that’s going to be a big deal.

Even though the labor market and consumer demand have been doing well, companies’ profits might not be as impressive. CEOs are already worried about the impact of the recent banking failures and the lending restrictions they’ve caused. Since our economy depends so much on debt, it’s likely that corporate sales will slow down, and we could see profits fall.

April 5, 2023

Given the improvements to mortgage interest rates, we will suggest taking advantage of the lower rate offered today.

The Labor Crack

We are begging to see cracks forming in the labor market. Yesterday’s JOLTS report showed that new job openings dropped below 10,000,000 for the first time in two years last month. Then this morning, ADP reported that there were only 145,000 new job creations in the month of March. Since the market was anticipating 210,000, this is good news for the Federal Reserve as well as the mortgage bond market.

On Friday we will get the more important reading from the Bureau of Labor Statistics. If that further supports a slowdown in new job creation, we could see mortgage rates improve even more.

An Early Pause

According to JP Morgan Chase CEO Jamie Dimon, the banking crisis is not over and will have repercussions that will be felt for years to come. This view is already proving true, as we are starting to see the tightening of financial conditions as lenders become more restrictive in their underwriting guidelines. The good side to this is that it will help slow down the pace of growth in the US economy, which will also help in the fight against inflation. As a result, we can expect the Fed to pause sooner than planned, which will be good news for the housing market.

Rates Continue to Fall

Yields on the 10-Year Treasury Note have fallen to match the lows seen in October 2022 before rates spiked. There are a couple of critical floors of support preventing mortgage rates from falling toward the 5% range that we anticipate seeing in the months to come. Let’s hope we get there sooner than planned.

April 4, 2023

Will Friday be different? I hope so but it is really hard to know. We recommend locking in our gains before the report.

*Millennials* Have Entered the Chat

Over 2/3rds of the world’s wealth is stored in real estate… WILD.

Fortunately, the generation that has so far had probably the hardest time buying property now has over a 50% homeownership rate.

When you break down homeownership by generation, 78% of Baby Boomers own, 70% of Gen-X, and Millennials just crossed the 50% mark. Unfortunately for Gen-Z, the average home price growth continues to rise at a much faster rate than the wages do, so they are not expected to cross the 50% mark until 2038.

Are Home Prices Turning Around?

After some months of dropping home prices, home values are up in February. And up by a decent amount of .8%. So, could this be pointing toward a turnaround?

Well, the people who make the report (CoreLogic) seem to think so as they have revised their following month’s forecast to also show positive growth and for the next year to be up 3.7%.

This is all in the face of tons of negative media regarding housing… We will see!

Where are Mortgage Rates?

Mortgage rates are about as low as they have been in two months.

However, on Friday we get job numbers. Now, we have talked a lot about job numbers and how they can be easily misrepresented by seasonal adjustments and the way they are measured; but it’s important to know that these job reports have thrown mortgage rates into an upward spiral multiple times in the last 6 months.

April 3, 2023

Mortgage bonds remain in a battle over their 200-day moving average. Unless bond prices make a decisive move above this critical level, we will maintain a locking bias.

Oil Whiplash

OPEC is not happy with how low oil prices have fallen.

In response, they recently announced a surprise cut to oil production of I million barrels a day. This comes after oil prices dipped below $70 a barrel, which is truly too low for many producers to earn a profit.

Oil prices immediately surged 8% on the news and are now trading at about $80 a barrel. Although we are still a long way below the $120 a barrel we experienced last June, Bank of America warned that OPEC’s move could add $25 or so to the cost of oil over the next year.

This is not good news for inflation, nor is this good news for the longer-term outlook of mortgage interest rates.

Tighter Laws Means Tighter Budgets

The recent bank crisis has created caused banks to rapidly tighten their lending standards. Surprisingly, the level of tightening is close to what we saw back in the great recession of 2008. This is generally a response to a lack of liquidity in the banking system and default fear. This will in turn leads to forced restrictions on business and consumer lending, as many will no longer qualify based on new standards.

Because growth in an economy is largely dependent upon borrowed money, it becomes very hard for an economy to accelerate in times when credit policies are becoming more restrictive. This will help the Fed in its fight against inflation as it will reduce demand for financed purchases such as cars and any item consumers generally purchase on credit.

Appreciation Is Back

According to Black Knight, after seven consecutive months of falling, home price appreciation accelerated in the month of February.

Although the gains were minimal, it is an optimistic sign that home values are stabilizing and could continue to climb higher as we head into the stronger purchase season. The challenge for the housing market remains to be a lack of available homes for sale. At this time, there are only 563,000 homes available to be purchased. This is roughly ½ of the inventory we had available prior to the pandemic.

If we see mortgage rates continue to fall, we could see listing and purchase activity increase in the second half of 2023.