How Much Are Closing Costs in Utah? + How To Lower Them

“Fantastic! More fees that I don’t understand why I’m paying!”

This is most people’s reaction to closing costs. However, you’re not just being nickel and dimed. In this article, we’ll explore:

- What you’re actually paying for when you pay closing costs

- How much average closing costs are in Utah

- How you can adjust your loan’s terms for lower closing costs

- Tips and tricks that can potentially lower your closing costs

Use Our Utah Closing Cost Calculator

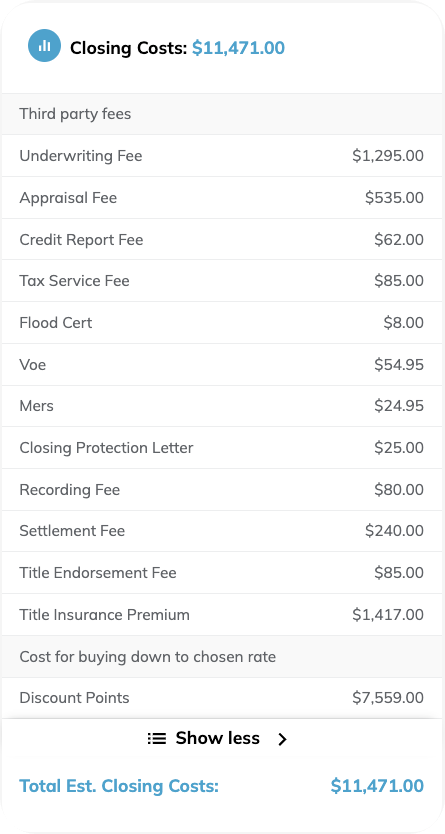

Too often, asking to get your closing costs in advance from your lender is like pulling teeth. Not at City Creek Mortgage. Our goal is transparency and openness, so we readily provide closing cost estimates when you use our rate finder and closing cost estimation tool. It takes less than 2 minutes. While some of these numbers are subject to change before closing, we built this tool to be as transparent, thorough and as accurate as possible.

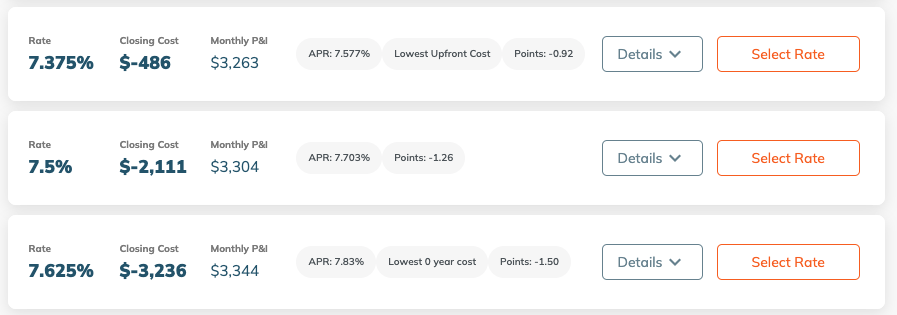

To get an estimate like the one you see in the image above, simply use our rate and closing cost calculator tool by selecting an option below.

“What’s In It For Me?” Why Even Paying Closing Costs?

The average home buyer doesn’t understand why they’re paying closing costs, they just know they have to in order to get their new home.

Unless you understand what you’re paying for, closing costs can feel like you’re being taken advantage of.

So what exactly are you paying for?

Closing costs cover a variety of essential services and fees that facilitate a secure, legally compliant, and efficient home purchase process.

Paying closing costs ensures that the property is accurately valued, the title is clear of any liens or encumbrances, and the transaction is properly documented and recorded with the appropriate authorities.

Without these services, the purchase of a home would be filled with uncertainty, legal risks, and potentially devastating financial losses for both buyers and sellers. In essence, closing costs provide security to you as a home buyer or seller by safeguarding your future or current investment, and ensuring the smooth transfer of property ownership.

What To Expect: What Are Closing Costs in Utah?

According to the most recent national data, in 2021 the average closing costs in Utah are $4,837 with an average home purchase price of $488,644. This is approximately 1% of the purchase price of a home. Utah’s closing costs are lower than the national average.

The national average for closing costs was $6,905, which includes home transfer taxes. However, Utah is one of a minority of states that do not have transfer taxes when completing home transactions, so Utah’s figure does not include taxes. Without transfer taxes, the national average for closing costs in 2021 was $3,860.

In a Nutshell, What Even Are Closing Costs?

Closing costs are fees that buyers and sellers must pay to complete a home transaction. Both homebuyers and sellers pay certain closing costs, and these expenses include fees charged by third parties and the lender.

Nationally, homebuyers can anticipate paying anywhere from 2% to 5% of the purchase price of their homes in closing costs. This means that prospective buyers should prepare by setting aside money for them in addition to their down payments.

According to the Zillow Home Values Index, the average value or price of a single-family home in Utah as of 2023 is $495,920, and homes in certain counties of the state have higher median prices. If you are in the market for a home, this means that you might expect to pay somewhere between $9,900 to $24,790 in closing costs if you buy a home at a purchase price equalling the average home value in the state.

Fortunately, however, you can negotiate the responsibility for paying closing costs with the seller, and closing costs tend to be less than the national average range of 2% to 5% for buyers in Utah.

Adjusting Your Loan Terms For Lower Closing Costs

As a homebuyer, there are several ways to adjust your closing costs. However, there’s a catch.

A good rule of thumb for understanding closing costs is this: the lower your interest rate is, the more you can expect to pay in points (which are often included in you closing costs). The higher your interest rate, the lower your points.

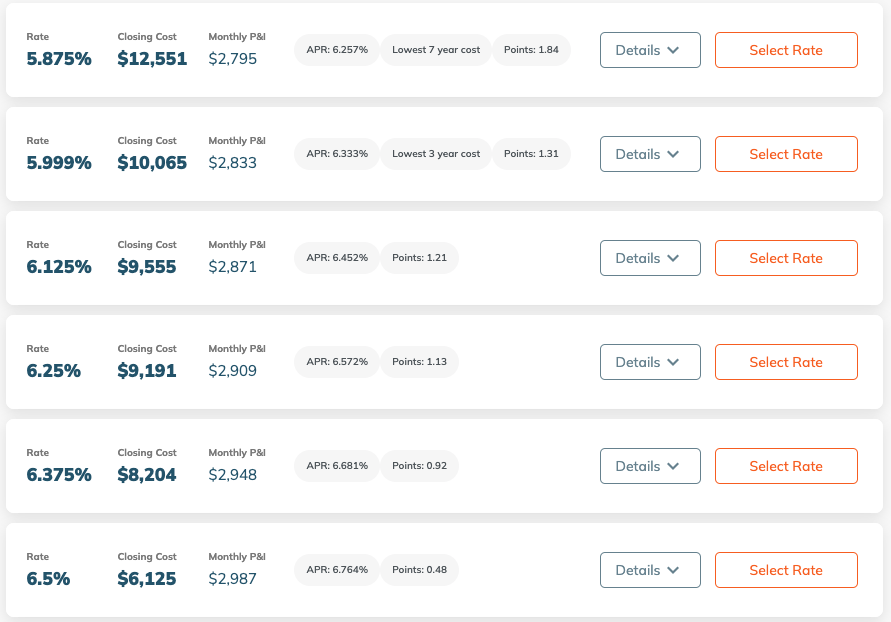

Lower Rate, Higher Closing Costs

At the time of writing, the average Utah mortgage rate is 6.105%. These are *examples of real quotes. You can see the lower the interest rate offered, the higher the closing cost.

*Rates above are an example, and are not representative of today’s rates. Please check today’s rates with our Find Your Best Rate Tool.

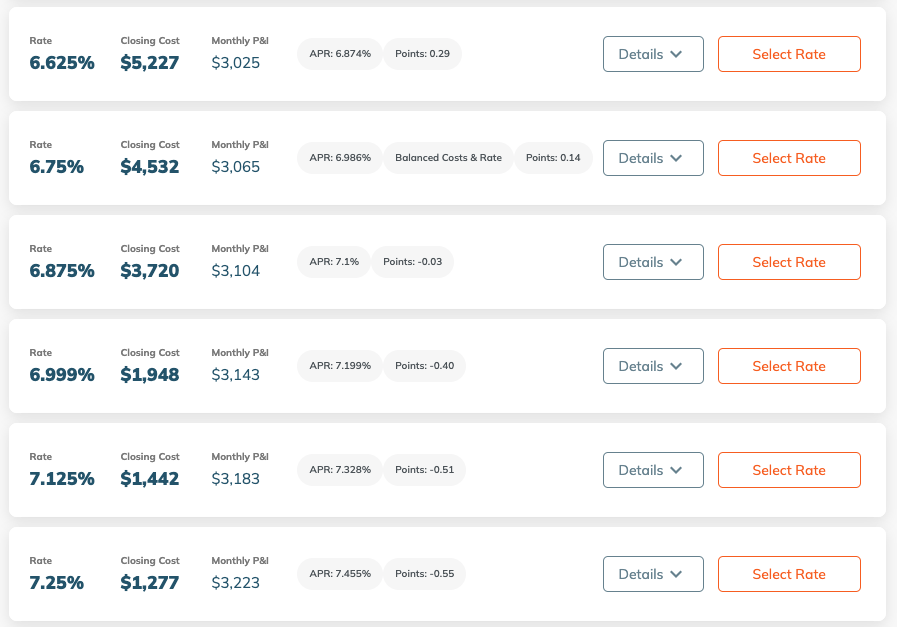

Higher Rate, Lower Closing Costs

On the other end of the spectrum, you can see how closing with a higher rate can dramatically bring your closing costs down.

*Rates above are an example, and are not representative of today’s rates. Please check today’s rates with our Find Your Best Rate Tool.

In some cases, if you agree to a high enough interest rate, you can even have your closing costs paid for you, or work as a credit toward your loan. The downside in these circumstances is a higher rate and monthly payment.

*Rates above are an example, and are not representative of today’s rates. Please check today’s rates with our Find Your Best Rate Tool.

Want To Know Your Exact Closing Costs? Use Our Tool

We don’t estimate closing costs. We tell you exactly what they are going to be when you use our tool.

7 Tips For Negotiating Your Closing Costs

There’s no magical phrase like, “Reducio!” that works to shrink your closing costs. But these tips will help navigate your home buying experience so you know you’re at least getting the best deal possible.

1. Shop around: Obtain multiple loan estimates from different lenders to compare closing costs. This will help you identify which lender offers the best terms and lowest fees. Make sure to compare rates from the same day, and exclude things like escrows & prepaids (as not all lenders include them, and they’ll be the same no matter where you close your loan).

2. Ask “How can you help us out”: Some closing costs have wiggle room. Ask what they can do for you to lower fees, such as loan origination fees, discount points, appraisals, or underwriting fees.

3. Ask the seller for concessions: If you’re buying a home, it can make sense to negotiate with the seller to have them pay for a portion of your closing costs. This is more likely to happen in a buyer’s market. Ask your lender or real estate agent if they would encourage or discourage this based on the situation.

4. Request to close at the end of the month (if possible): By scheduling your closing towards the end of the month, you can reduce the amount of prepaid interest, also known as per diem interest, that is required at closing.

5. Choose a “no-closing-cost” mortgage: Some lenders offer mortgages where you choose a higher rate that covers your closing costs. It’s not really a no-closing cost mortgage, they’re just covered by your credit for the interest rate. You normally choose this option if you think rates will go lower before your break-even point. You are gaining a more ideal situation in the short-term, but you’re trading that for a less favorable financial burden in the long-term, if you don’t refinance to a lower rate.

6. Ask if they offer discounts for bundled services: Some lenders and title companies offer discounts if you use their affiliated services, such as title insurance or escrow services.

7. Ask your lender about local assistance programs: Some states, counties, or cities offer homebuyer assistance programs that can help cover closing costs for eligible buyers. Research your local options and see if you qualify.

All The Variables of Closing Costs in Utah

Below are some common types of closing costs buyers might expect to pay in Utah divided into lender fees and costs associated with the property.

Common Application Fees Included in Buyer’s Closing Costs in Utah

The following closing costs are typically charged by third parties to cover the costs of originating a mortgage:

- Credit report fee – Paid to credit report company

- Loan application fee – Varies by lender and might not be charged by all (we do not charge this)

Common Lender Fees Included in Buyer’s Closing Costs in Utah

The following closing costs are typically charged by third parties to cover the costs of originating a mortgage:

- Discount points – Points that can be paid to reduce your interest rate

- Loan origination fee – Fee for structuring and originating the mortgage loan

- Underwriting fee – Fee charged for the costs of gathering documentation, reviewing the paperwork for approval, and coordinating with other third parties

- Rate lock fee – Charged by some lenders to lock in your interest rate

Property-Related Items Your Might Find In Closing Costs

Some common closing costs related to the property that buyers might expect include the following:

- Title search fee – Fee charged for reviewing historical records to ensure the title is clear

- Appraisal fee – Some lenders require an appraisal and will send an appraiser to look at the home to ensure it meets the lender’s standards

- Lender’s title insurance fee -Fee to pay for the lender’s title insurance to protect its interests in case there are title issues

- Buyer’s title insurance fee – Optional, but this one-time charge protects the homebuyer in case an issue with the title is discovered after the transaction is completed

- Recording fee – Fee paid to the county to update the property records to reflect the transfer

- Prepaid property taxes – Some lenders require buyers to pay property taxes upfront at closing

- Prepaid interest – Charge for the interest that will accrue between the closing date and the date of your first mortgage payment

- Private mortgage insurance (PMI) – Insurance required for buyers who put less than 20% down on a conventional mortgage to protect the lender in case of default

For government-backed loans, navigating closing costs is slightly different. For example:

- FHA Loan upfront insurance – Insurance that must be paid upfront for FHA loans that amount to 1.75% of the mortgage amount

- VA loan funding fee – Some eligible buyers who get VA-backed loans will have to pay a VA funding fee upfront that ranges from 0% to 3.3%, based on the downpayment and whether the buyer has used a VA loan before

People who get VA loans can’t be charged more than 1% in lender’s fees for closing costs, but they might have to pay a VA funding fee upfront that ranges from 0% to 3.3% of the VA mortgage amount.

For FHA-backed mortgages, homebuyers can expect to have closing costs that are similar to those for conventional mortgages. However, they can take advantage of options to reduce them such as closing cost assistance programs for buyers using FHA loans or money from family members or charities.

Buyers using FHA loans can also choose to roll their closing costs into their mortgages by adding them to the loan’s costs or agreeing to an increased interest rate.

The Federal Housing Administration (FHA) also allows sellers to pay closing costs for the buyer of up to 6%, and some sellers will agree to do so to complete the sale.

Lower Closing Costs? Mortgage Brokers Vs Lenders

If you’re a home buyer confused and riddled by all the jargon, going with a mortgage broker is almost always the better decision. Why?

Because mortgage brokers act as intermediaries between borrowers and multiple lenders. Mortgage brokers and home buyers have aligned interests: getting you the best rate and loan possible.

Individual mortgage lenders want to get you the best loan possible, but there’s a catch. It has to be their loan.

By leveraging their knowledge of the entire market and their relationships with different lenders, brokers can help borrowers find the most competitive loan terms and lowest closing costs.

Additionally, mortgage brokers can provide personalized and custom guidance to help borrowers navigate the negotiation process, potentially securing even lower costs. Ultimately, partnering with a mortgage broker increases the likelihood of finding the best mortgage package that aligns with a home buyer’s financial goals, including keeping closing costs to a minimum.

Have a Rate Quote? Use Our Second Opinion Tool

When you use our second opinion tool, we tell you whether or not you already have a great rate, or how much you can save with us! Just give us a few details about your current rate quote and let you know down to the dollar how much you could save.

Talk to City Creek Mortgage

If you are preparing to purchase a home in Utah and are searching for the best mortgage for your needs, you should schedule an appointment with the mortgage experts at City Creek Mortgage. We can help you find the right type of mortgage at the most affordable price and assist you with comparing the closing costs and other terms. Contact us today to schedule an appointment at 801-501-7950.