Turn your home's equity into cash with a HELOC

Leverage your home’s equity to achieve your financial goals with City Creek Mortgage. Our HELOCs offer the versatility to cover everything from home improvements to personal expenditures, coupled with low interest rates and convenient access to funds, ensuring you have the financial support when it matters most.

City Creek Mortgage

What is a Utah Home Equity Line of Credit?

A Home Equity Line of Credit (HELOC) loan allows you to borrow against the equity in your home. It functions like a credit card, offering access to a low variable interest rate since your home secures the loan. HELOCs are ideal for funding major expenses such as home renovations, educational costs, or consolidating high-interest debt. You can even use a HELOC for large projects and investment opportunities with flexible repayment terms to fit your financial situation.

City Creek Mortgage

Explore the many benefits of a HELOC

Competitive rates

Benefit from lower interest rates compared to unsecured credit lines.

No upfront fees

Enjoy the absence of initial fees, reducing your overall borrowing cost.

Flexible access

Access funds as needed, like a credit line, for any expense or to cover emergencies.

Repayment options

Select from various repayment plans to comfortably manage your finances.

Frequently Asked Questions

Our Utah customers often ask these questions about home equity lines of credit.

How do I qualify for a HELOC?

How do I qualify for a HELOC?Qualification depends on several factors, including your credit score, home equity, and income. Our team can help determine your eligibility and guide you through the process.

Can I use a HELOC for purposes other than home improvements?

Can I use a HELOC for purposes other than home improvements?Yes, while many homeowners use HELOCs for home improvements, the funds can also be used for various needs, such as education expenses, debt consolidation, or emergency expenses.

How much can I borrow with a HELOC?

How much can I borrow with a HELOC?The borrowing limit depends on your home’s equity, creditworthiness, and other lender criteria. Contact us to find out your specific credit limit.

Are there any risks associated with a HELOC?

Are there any risks associated with a HELOC?Like any financial product, a HELOC comes with risks. Understanding the terms and conditions and using credit responsibly is essential. Our experts are here to help you make informed decisions.

What is the interest rate on a HELOC?

What is the interest rate on a HELOC?The interest rate on a HELOC is variable, typically tied to the prime rate. We offer competitive rates tailored to your financial situation.

Can I pay off my HELOC early?

Can I pay off my HELOC early?Yes, you can repay your HELOC early without penalty, allowing you greater flexibility in managing your debt.

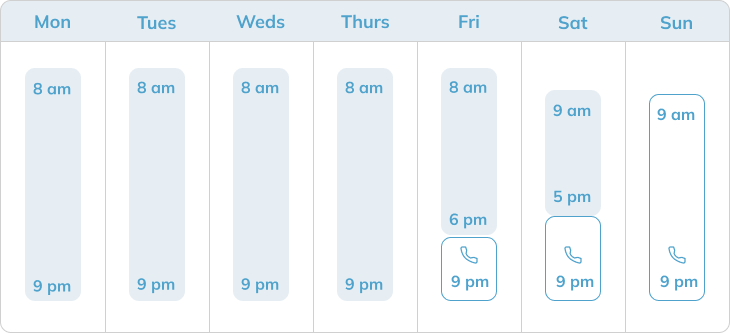

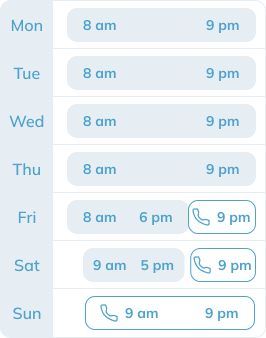

Open early. Working late. 7 days a week.

You are important.

We’ll work around your schedule.

We’re available 7 days a week, 15 hours a day. Our committment to saving you money doesn’t stop at 5pm. Call, chat, or come on in.