Simplify Your Finances with Debt Consolidation Using Your Home's Equity.

Are you juggling multiple debts and struggling to keep up? You're not alone. Many Utah residents face the challenge of rising living costs and mounting debt. But there's a solution—debt consolidation using your home's equity with City Creek Mortgage.

City Creek Mortgage

What are the benefits of debt consolidation?

Simple payments

Convert multiple payments into one.

Lower rates

Get relief from high-interest credit cards.

Improved credit

Raise your credit through one on-time payment each month.

Reduced anxiety

Stop stressing about how to pay off multiple debts.

2,753 people can’t be wrong

2,753 Reviews | Average 5/5

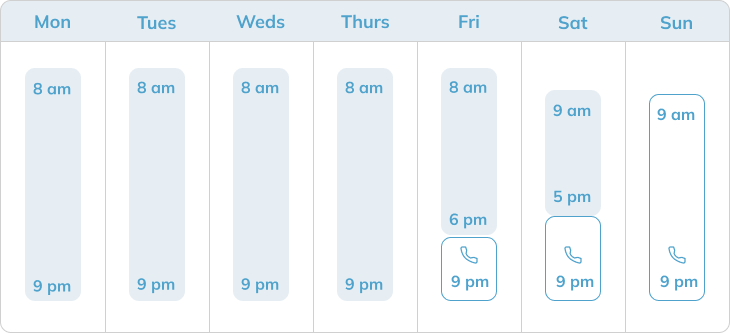

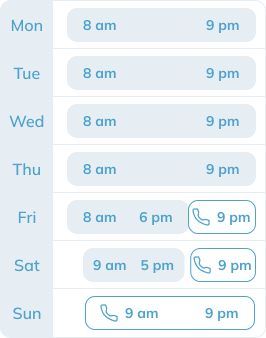

Open early. Working late. 7 days a week.

You are important.

We’ll work around your schedule.

We’re available 7 days a week, 15 hours a day. Our committment to saving you money doesn’t stop at 5pm. Call, chat, or come on in.

Frequently Asked Questions

Our satisfied customers often ask these questions about debt consolidation.

Does debt consolidation hurt my credit?

Does debt consolidation hurt my credit?Debt consolidation loans can enhance credit by providing a single monthly payment and lower interest rates compared to credit cards.

How do I qualify?

How do I qualify?Our consolidation loans require at least $50,000 in debt. Your credit score will also impact the terms you can qualify for.

What are the benefits?

What are the benefits?Debt consolidation loans can enhance credit by providing a single monthly payment and lower interest rates than credit cards.

What are the drawbacks?

What are the drawbacks?A disadvantage of debt consolidation is that it can lead to higher overall costs if you get a loan with a more extended repayment period and higher interest rates.

What is a home equity line of credit (HELOC)?

What is a home equity line of credit (HELOC)?A HELOC lets you borrow money based on your home's equity, acting like a credit card for accessing funds and repaying the balance.

Is it better to consolidate or settle debt?

Is it better to consolidate or settle debt?Consolidating debt is usually preferable to settling as it merges multiple debts into one manageable payment, potentially at lower interest rates, aiding in long-term credit score improvement.