Tap Into Your Home's Value with a Cash-Out Refinance

Access the equity you've built in your home with a cash-out refinance from City Creek Mortgage. Consolidate debt, fund renovations, or cover major expenses with competitive rates and flexible terms.

City Creek Mortgage

What is a Cash-Out Refinance?

A cash-out refinance replaces your existing mortgage with a new one for a larger amount, allowing you to access the difference in cash. It's a smart way to leverage your home's equity for various financial goals, like home improvements, debt consolidation, or education expenses.

City Creek Mortgage

The Benefits of a Cash-Out Refinance

Investment opportunities

Leverage your home equity to fund investments that could generate additional income or long-term growth.

Debt consolidation

Pay off high-interest debt with a lower-interest cash-out refinance, simplifying your finances.

Home improvements

Fund renovations or upgrades to increase your home's value and enjoyment.

Flexible use of funds

Use the cash for any purpose, from education expenses to unexpected costs.

Frequently Asked Questions

Common Questions About Cash-Out Refinances

How much equity do I need for a cash-out refinance?

How much equity do I need for a cash-out refinance?Lenders typically require a certain amount of equity in your home, often around 20%. We can help you determine your eligibility.

Will a cash-out refinance affect my credit score?

Will a cash-out refinance affect my credit score?Like any loan application, a cash-out refinance involves a credit check, which may temporarily impact your score. However, responsible repayment can improve your credit over time

How long does the cash-out refinance process take?

How long does the cash-out refinance process take?The timeline varies, but it typically takes a few weeks to complete. We strive to make the process as efficient as possible.

What are the closing costs for a cash-out refinance?

What are the closing costs for a cash-out refinance?Closing costs include fees for appraisal, title search, and other services. We provide a transparent breakdown of all costs upfront.

Can I refinance my mortgage if I have bad credit?

Can I refinance my mortgage if I have bad credit?While a good credit score is ideal, options may be available for borrowers with less-than-perfect credit. Contact us to discuss your situation.

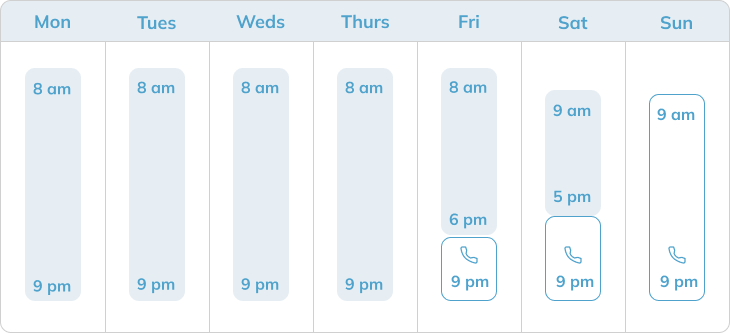

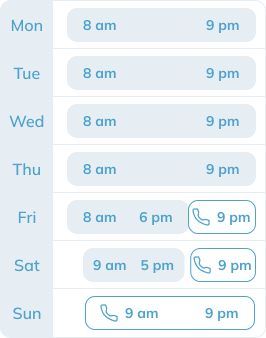

Open early. Working late. 7 days a week.

You are important.

We’ll work around your schedule.

We’re available 7 days a week, 15 hours a day. Our committment to saving you money doesn’t stop at 5pm. Call, chat, or come on in.